Underwriting is a crucial aspect of the policy origination cycle. Those interested in purchasing insurance submit their application and await the insurance company’s decision on coverage acceptance. While consumers wait, underwriters face a mountain of work. The underwriting process is an important aspect of the policy origination cycle. Prospective clients start by submitting their application and waiting for the coverage acceptance from the insurance company. During this wait, underwriters working in the background, checking and verifying information.

If underwriters were to manually process every application, just the risk assessment would take forever to complete. Not to mention the growing number of applications, insurance organizations and underwriters are grappling to provide accurate assessment of risks and price of premiums.

This is where insurance underwriting software and tools play a pivotal role in the process. The digitization of insurance processes has revolutionized underwriting methodologies, whether in P&C, life, or other sectors, insurance underwriting tools are designed specifically to help insurers streamline and automate decision-making.

Understanding Insurance Underwriting Software

Insurance underwriting software automates and streamlines the evaluation of insurance applications. Through this, underwriters can perform many tasks simulataneaously, from determining risk levels, settling precise policy pricing, and even establishing coverage terms. Such platforms utilize ML/AI, data integration, robust analytics, and performance metrics to:

- Reduce underwriting errors and biases

- Process applications faster

- Allow a personalized approach to policy writing

- Ensure consistency in risk assessment across all applicationsAllow real-time pricing adjustments based on market conditions

- Integrate with external data sources to enhance data evaluation

The assistance provided by automation for underwriters in risk assessment ultimately leads to more efficient pricing strategies and higher levels of customer satisfaction. Below, we will explore key components and functionalities and benefits related to insurance underwriting software.

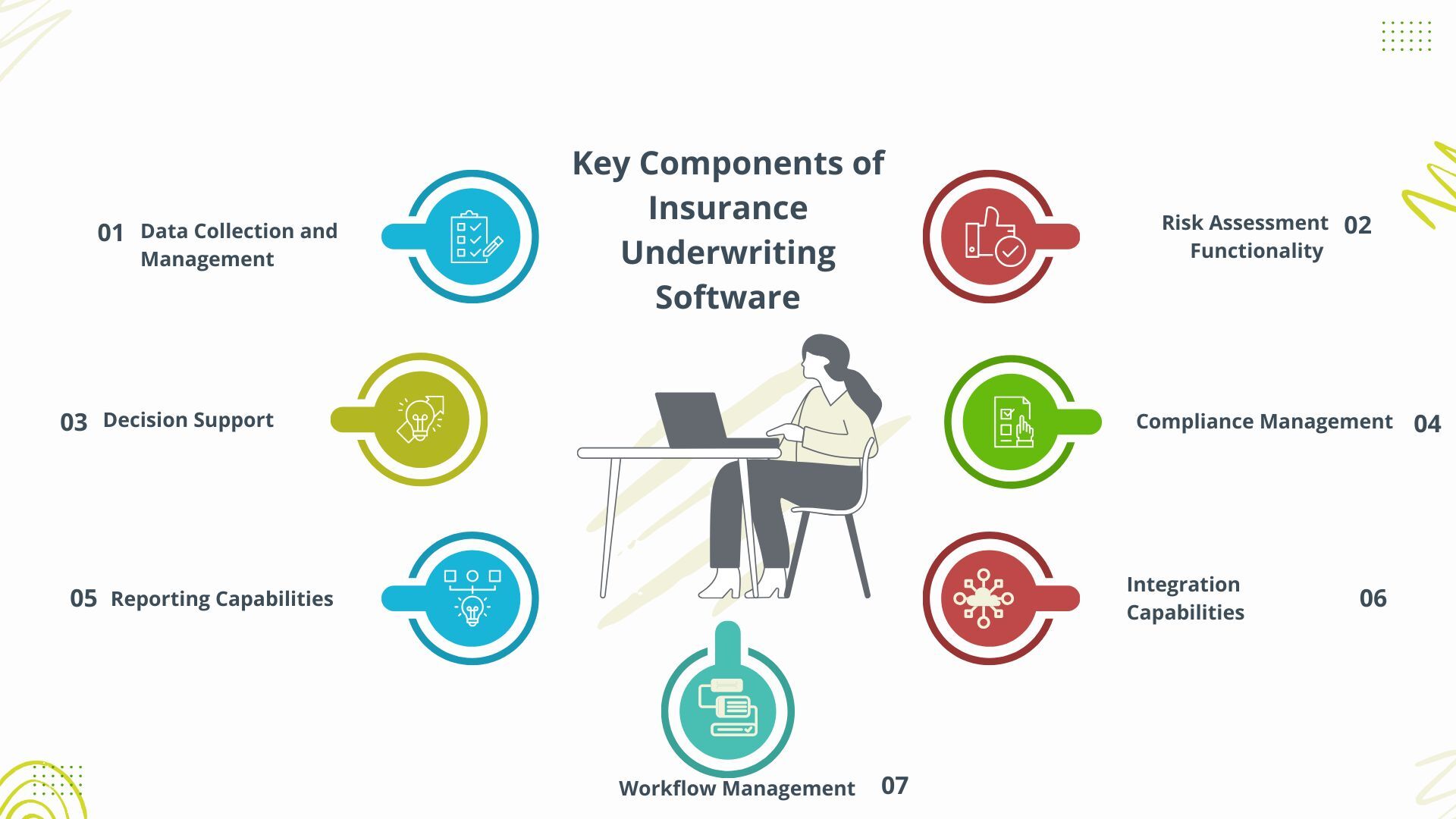

Key Components of Insurance Underwriting Software

1. Data Collection and Management

Digital Input: Modern underwriting platforms use smart forms that adapt to any type of insurance. The data entered on these forms is validated and progressive disclosure techniques are used to present complex insurance applications in an easy-to-read manner.

Data Integration: The platform utilizes its extensive integration capabilities to gather information from credit bureaus, vehicle records, and medical databases instead of manual entry. This helps prevent errors and ensures the use of the most updated information. It also facilitates the storage and retrieval of relevant documents.

2. Risk Assessment Functionality

Predictive Modeling: Underwriting tools employ algorithms to evaluate risk factors associated with the application, helping to make data-driven decisions. Additionally, with the input of new data and available data, they are constantly improving their accuracy.

Data Analysis:The platform uses analytics tools to process large volumes of data (not only current and new data, but also past data) to identify patterns, past losses, trends, and correlations in the data. The analysis helps underwriters compare results across groups to make informed decisions.

Dynamic Scoring: Through competitive intelligence, systems quantify risk factors and changes are made according to real-time analysis.

3. Decision Support

Rules Engine: The system has predefined guidelines and rules to help decide pricing and eligibility based on risk assessment. The rules engine is also highly customizable to meet specific business requirements. Some popular tools in most underwriting software are version control, which tests new rules before implementation, and impact analysis, which reduces the risk of unintended consequences

Knowledge Integration and Automation: Every platform is equipped with underwriting expertise and best practices that are frequently updated. The automation caters to standard risks, while the more complex cases are routed to decision-makers with the necessary expertise by an advanced routing logic.

4. Compliance Management

Regulatory Compliance: Different lines of businesses and insurance types have specific requirements. For instance, any system with a primary focus on Medical insurance would be HIPAA certified. The system is designed in a way where any policy created is automatically compliant with necessary regulations.

Audit Support: The system conducts automatic quality checks of all underwriting decisions to ensure all guidelines and regulations are adhered to.

5. Reporting Capabilities

Business Intelligence: The software can generate reports through the reports and analytics dashboard. Some insights provided are TAT, approval rates, loss ratios, and performance metrics.

Data Visualization: The dashboard transforms complex data in a coherent format to identify and comprehend data quickly and easily.

6. Integration Capabilities

System Connectivity: Most modern software utilizes APIs and microservices architecture to connect to other software or tools.

Future Readiness: The system supports integration with the latest insurtech innovations, such as AI, ML, and fraud detection, to ensure long-term usage and high return on investment (ROI).

7. Workflow Management

Collaboration tools: Underwriting software usually includes communication and collaboration tools. Apart from the automated routing logic, users can also directly assign tasks with higher complexity to another team’s members, such as actuaries.

Task Management: The system handles workflow by assigning tasks, tracking progress, and providing reminders for pending actions.

These key features are essential for underwriters who might want to invest in an underwriting software. Collectively they come together to streamline workflow and increase efficiency while preventing errors and maintaining compliance.

There are many insuretech solutions, offering numerous features and tools, for challenges faced by underwriters, the right solution for your organization should be based on technical considerations, business needs, and operational factors.

Benefits of Using an Underwriting Software

Underwriting Software have become commonplace in the insurance industry with the ubiquity of digitization and insuretech innovations. Below are some benefits that come with the adoption of underwriting software solutions.

Increased Efficiency: Manual underwriting processes are lengthy, and using the software’s automation increases efficiency by reducing the time and energy typically spent on reviewing and documentation and allows underwriters to engage in cases which require their expertise.

Increased Accuracy: The built in rules engine, data algorithms, analytics reduce and in many cases prevents human errors, standardizing underwriting processes by removing human bias.

Regulatory Compliance: All policies which are generated adhere to the domain specific regulatory requirements, moreover, they are constantly adjusted to meet the ever changing regulations.

Data Management and Reporting: Data is consolidated under one platform to access and analyze trends and patterns. Based on the analysis, reports detailing insurance trends and market profiles are presented to the user. This helps make informed decisions and manage risks in the underwriting process.

Customization: Designed with customization in mind, it tailors the rules engine and underwriting judgments to align with client profiles and their previous history.

Top Insurance Underwriting Software

Let us explore a cross-functional analysis of some of the best enterprise-level insurance underwriting software for both medical and P&C insurance, covering everything important to help you choose the best software for your insurance business.

Multi-Line Capabilities

1. Duck Creek Technologies

Duck Creek Rating is a flexible solution which initially started off with a focus on the P&C sector but has grown since then to integrate and manage different insurance products over the years. This cloud-based solution can be used as a standalone solution or be integrated with other tools and software to help carriers and underwriters simplify their underwriting process.

Key Features

- Allows users to flexibly configure the rules engine to meet the requirements of specific lines of businesses (Medical, Life, P&C) and easily launch new products.

- The system provides quoting features and business process management to enhance business opportunities in the insurance market. Through web quoting, users can increase the delivery speed of new products.

- Advanced codeless configuration requires no technical expertise to implement and a single point of change allows updates to be reflected throughout the enterprise.

- ‘What if’ modeling utilizes predictive analysis to mitigate underwriting workloads and evaluate rate changes before live production.

- Provides pre-configured product templates in compliance with ISO, AAIS, NCCI, and other insurance advisories.

- Product inheritance offers customizable inheritance structures with multilevel flexibility across various business lines.

Benefits

Black Box Rating Engine: The engine allows you to remove barriers to market expansion by supporting multi-line service, driving standardization, and accelerating approvals through off-the-shelf functionality.

Test Automation Center: A robust tool that automates test scripts and conducts rapid validation to expedite the delivery of new or updated products with minimal technical knowledge.

Dynamic Product Definition and Configuration tools: Allows users to define and maintain insurance products independent of IT resources.

Integrated Project Management: The system facilitates team collaboration and the management of products, rate changes, and route approvals through customizable workflows, enhanced by wizard features and tools.

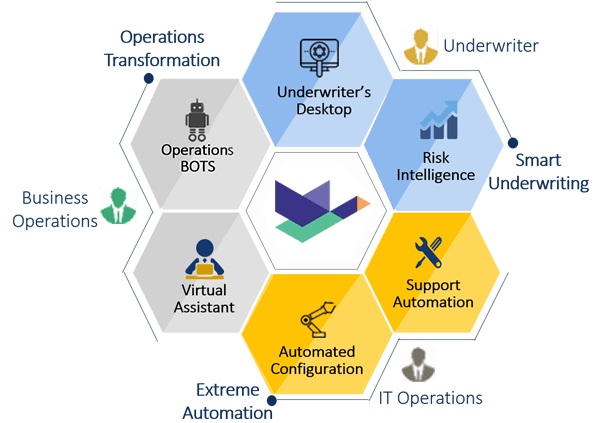

2. Guidewire Underwriting

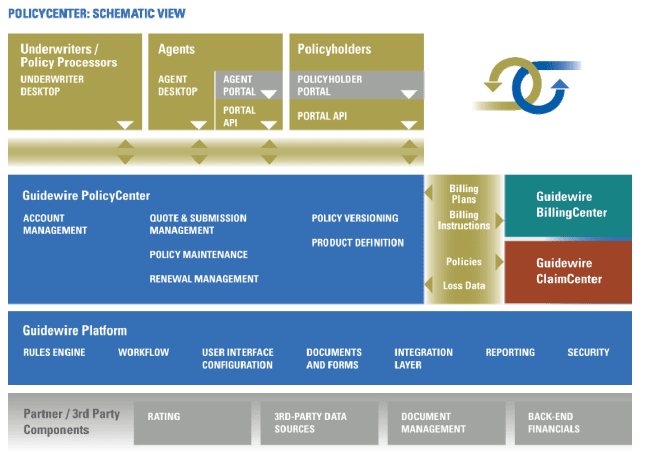

Guidewire offers an add-on application called Guidewire Underwriting Management (UM), a cloud-based solution designed for commercial and specialty line insurers, where automation is the primary focus. This application now includes multi-line functionality (Medical, Life, P&C, and others) to increase profits by streamlining the underwriting process. The feature-rich workstation normally integrates with Guidewire Policy Center, but it also functions seamlessly with other systems as well.

Key Features

- The software features an agent portal to create and monitor policy submission, an administrator portal to manage forms, rules, users, roles, and other system settings, and a system operators’ portal to manage and monitor the UM application.

- Granular risk analysis focusing on price, market segment, and the policy lifecycle to enhance customer lifetime value (CLTV) and improve customer service.

- HazardHub, a real-time property risk analytics platform, analyzes over 1,250 data points and 50 peril scores to proactively identify good risks and minimize adverse selection.

- Predictive analytics helps build, import, tune, deploy, and monitor models.

- The system enhances traditional GLM/GAM pricing to improve ratings and maximize actuarial models while ensuring that transparency and compliance are maintained.

- Uses operational and portfolio intelligence tools to formulate marketing strategies based on data insights.

- The built-in compliance tools undergo regular updates and have audit trail capabilities.

Benefits

Workflow-driven Interface: The UI streamlines moving a submission from the draft stage through rating, quoting, binding of coverage, and issuing a policy.

AppReader: It accurately uploads complex risk information and is capable of converting PDFs or images of ACORD applications and other forms into ACORD XML to easily integrate it into underwriting workflows.

UM Email Add-on Feature: Designed to work with Microsoft Outlook, it helps facilitating email integration.

Scalability: The solution can easily adapt to changing business needs by integrating various workflows, be it a small organization that is just growing or a large scare one expanding its operations.

Underwriters utilize an Insurance Estimating Software to determine the value of insured items, ensuring accurate prices and appropriate coverage terms.

Life Insurance Specialized Systems

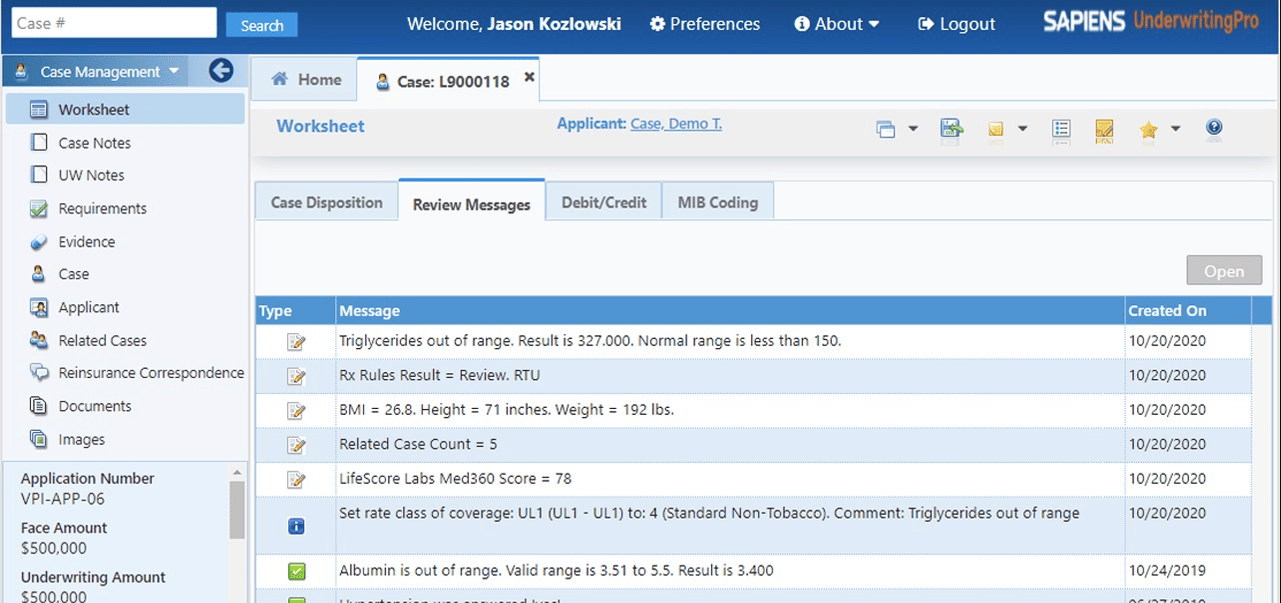

1. Sapiens UnderwritingPro

Sapiens UnderwritingPro is a web-based, cloud-native, award-winning underwriting solution specifically designed for life and annuity insurers. Its core system integrates automation, efficiency, and accuracy while ensuring compliance. The platform’s technology includes AI-based architecture, intuitive user interface, real-time dashboard, sophisticated rules engine, advanced workflow and analytics, and open integrated framework and is continuously updated to align with the industry’s best practices and the latest insurtech innovations.

Key Features

- The software’s automated workflow works with predefined rules to ensure consistency in approvals by eliminating human bias to provide a straight through processing (STP) environment. It also allows underwriters for complex cases that need their expertise.

- Case management and business management are integrated to provide a unified view of case status and requirements. This facilitates communication and collaboration among team members.

- The software seamlessly integrates with other systems, and its interoperability allows the usage of existing tools and numerous data sources (such as Milliman, ExamOne and LexisNexis).

- The software’s configuration capabilities extend to define products and underwriting rules, which accelerate automated decisions and allow for a customizable user interface and business rules.

- The intuitive user interface enhances user experience (UX) by coherently presenting critical information to enhance productivity.

- The solution complies with ACORD XML and other industry-specific standards.

Benefits

Fast Application Entry: The system uses a reflexive data entry tool, suitable for both paper-based and digital applications, to expedite the underwriting process’s initial stages.

Intuitive Interface: The real-time dashboards present the most up-to-date information and critical updates and task assignments are instantly delivered.

Risk Assessment Features: Analyzes data from the Medical Information Bureau (MIB), Motor Vehicle Records (MVR), and Rx (Prescription records), flagging lab results that are outside the normal ranges. This process is rules-driven based on carrier guidelines.

Scalability: The software adapts to changing business demands and integrates with various applications for a seamless workflow.

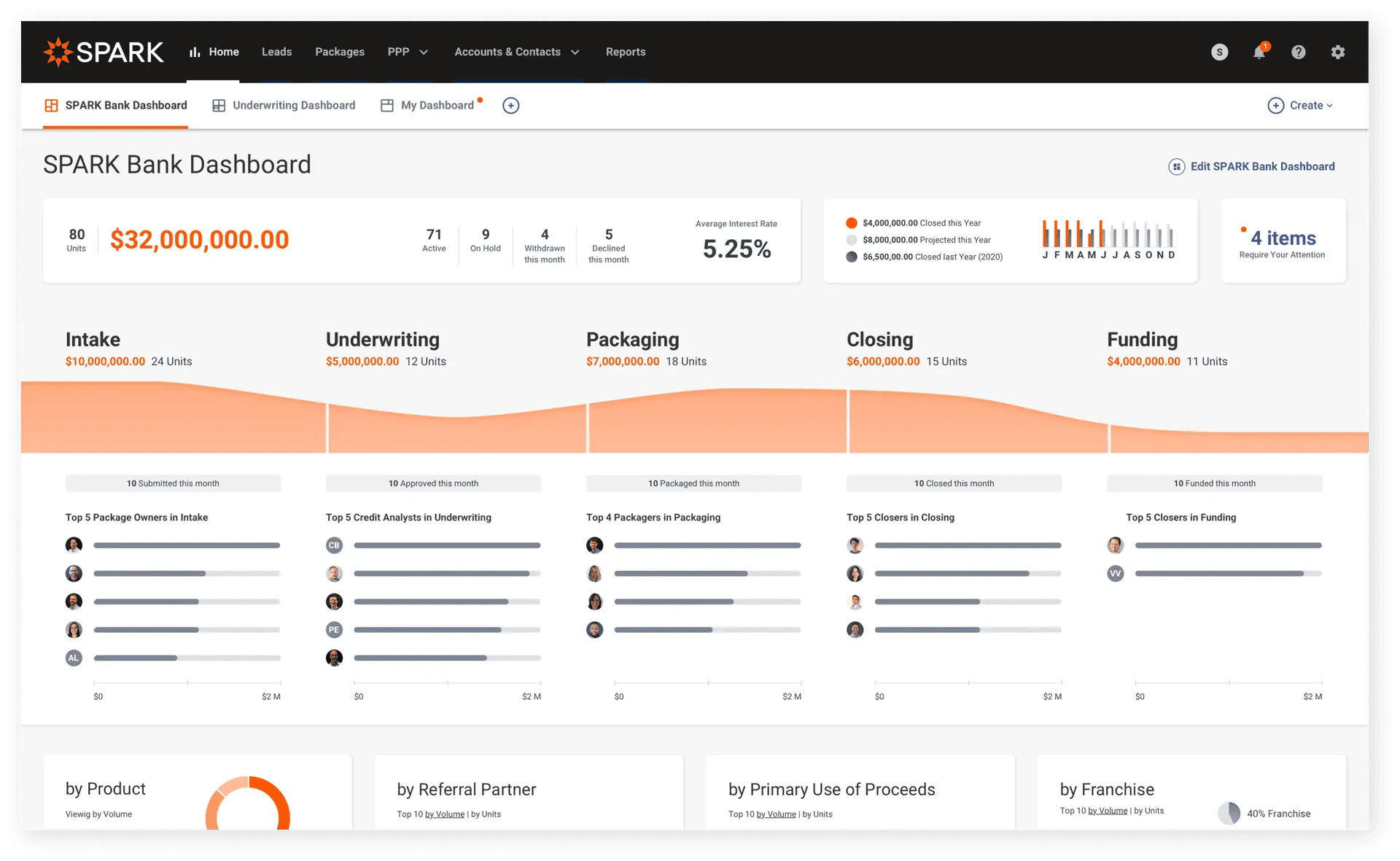

2. Munich Re

ALLFINANZ SPARK is a cloud-based automated underwriting Software as a solution (SAAS) designed by Munich Re Automation Solutions to standardize insurance operations with a specific focus on life insurance. It integrates advanced business capabilities, innovative underwriting processes, and robust analytics into a unified platform to enhance sales and transform CX. As one of the largest global reinsurers in the market, ALLFINANZ SPARK is equipped with state-of-the-art resources and the drive for continuous technological developments.

Key Features

- Pre-configured underwriting rulebook facilitates implementation and allows you to automate decisions. Additionally, the rule design tool can be configured without IT support.

- The rules design and management tools consider shifts in the market and changes in business strategy to leverage industry expertise, evolving rules to reflect the most up-to-date information for seamless operations.

- ALLFINANZ Predictor is an analytics tool that integrates AI and predictive modeling to increase STP rates, expedite decision-making, improve CX, and facilitate continuous model training to ensure optimal performance.

- SPARK provides real-time counter offers for selling, upselling, and cross-selling to increase STP rates, reduce TAT, and transform manual processing into instant decisions.

- The system easily integrates with internal and external third-party databases, while ensuring compliance with industry regulations.

- The solution entails mobile accessibility, meaning users can access it on any device at any time, and supports multiple languages.

Benefits

Rules Designer: The intuitive tool can create and modify the underwriting rules for any risk type, product, channel, language, or geography in real-time without needing vendor or technical support.

Implementation and Support: Munich Re operates offices worldwide and offers extensive guidance during implementation and updates.

Intuitive Interview Experience:The solution improves customer interactions and overall CX by facilitating sales in new markets and attracting dynamic agents.

Security: Although the system is marketed to mid-sized insurers, it includes enterprise-level security features and offers automatic updates.

Scalability: The software adapts to changing business needs and integrates with various applications to ensure a seamless workflow.

Medical Insurance Specialized Systems

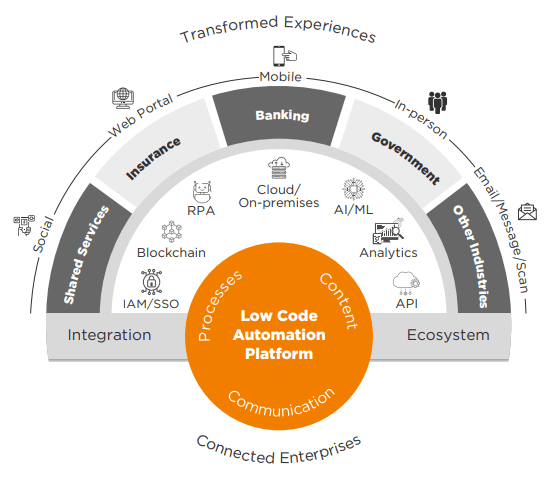

1. Newgen

Newgen has developed industry-specific solutions (life and annuity, health, personal- P&C, and commercial- P&C) to address the challenges faced by underwriters. The end-to-end automation integrates advanced tech to enhance risk assessment, boost productivity, streamline operations, improve security, deliver superior CX, and increase profitability.

Key Features

- The core built-in underwriting engine incorporates dynamic business rules to identify potential concerns, improve STP rates for straightforward submissions, and automatically issue submissions that meet predefined criteria while flagging others for review.

- The dynamic user interface allows for defining data elements that can be customized to meet specific business requirements, ensuring that users can access information in a format that aligns with their workflow.

- The comprehensive risk assessment capabilities encompass health and hazardous occupation assessment, as well as an analysis of educational background. Cases involving narcotics are handled separately.

- The platform supports mobile operations so field agents can work on the go.

- Newgen’s Business rule management system creates simplified rules and rules flow, enabling reusability and extensibility for previously developed rules. It also analyzes rules and any in-flight changes.

- The software has the capability to request additional documents and information based on established parameters.

Benefits

Instant Policy Issuance:The software ensures policies are issued without any underwriting errors.

User Interface: Customizable capabilities to meet organizational needs and specific requirements enhance usability and efficiency.

Collaborative Capabilities:The software enhances collaboration among intermediaries and underwriters, leading to more cohesive and improved outcomes. The integrated communication platform also sends automated alerts during critical stages of the underwriting process.

Seamless Integration: The standard integration architecture ensures integration with existing systems, minimizing any disruptions.

In-Depth Analysis:The intuitive dashboard performs data analysis and generates reports, ensuring that underwriters make data-driven decisions and plan according to trends and patterns.

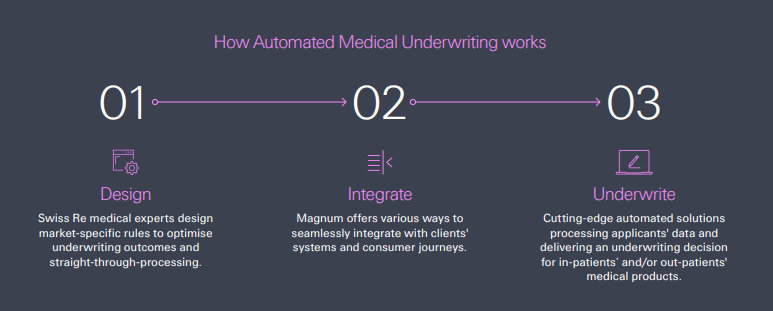

2. Swiss Re

Swiss Re offers numerous underwriting solutions, each designed to meet specific needs, with Magnum being their front runner with its modular platform, data insights capabilities, and innovative edge. Magnum was recognized as an innovative leader among life insurance underwriting engines by the esteemed The Forrester Wave™ Automated Life Insurance Underwriting Engines Q2-2021 report.

Key Features

- Magnum’s solution includes 4 SaaS offering that cater to specific requirements: Magnum Go, Magnum Select, Magnum Pure, and Magnum Medical.

- The experience-based underwriting philosophy accepts the most common chronic conditions and presents a fair rating based on local claims experience. Local claim costs are used to calculate additional premium rating calculations.

- The software enhances portfolio performance and ensures that individuals with impairments receive suitable coverage instead of facing exclusions.

- Magnum Analytics is embedded to present comprehensive analytics, enabling informed decisions and uncovering actionable insights to optimize business strategies.

- The underwriting rules can be tailored to accommodate both voluntary and compulsory insurance markets while complying with state/regional regulations and demographic profiles, promoting operational efficiency across various markets.

Benefits

Inclusive Underwriting Approach: Candidates with chronic conditions and impairments receive equitable ratings based on their medical conditions instead of decline or exclusions.

Automation Capabilities: Slick data collection and processing expedite the underwriting process. With the support of Magnum’s robust analytics, underwriters can make data-driven decisions.

Life Guide: Leverages Swiss Re’s Integrated research– Life Guide which is recognized as the number one underwriting manual worldwide.

Accessibility: The platform is available in over 25 languages and 32 markets. It can be scaled to meet the growing needs of an enterprise or the budding requirements of small-scale insurers.

Alternative Insurance Underwriting Software

- Majesco Underwriting

- Appian Underwriting Workbench

- Insurity Underwriting

- Unqork Underwriting Workbench

- ScienceSoft Underwriting Automation

- WTW’s Radar Live

- Genesis Underwriting

Conclusion

As we conclude our exploration of insurance underwriting software, we have looked over different industry-specific underwriting solutions. Whether you use it as standalone software or integrate it with your existing systems, it is a necessary tool. Through the automation of routine tasks, enriching data, and ensuring compliance, all while assessing risks with unprecedented speed and accuracy. Investing in the right software is crucial in today’s digital world, not only to remain competitive but also to continuously adapt and incorporate emerging technologies in Insuretech. So the question remains: Which software will you choose?

Want to know more about specialized solutions that can help you with operational efficiency? Deep dive into our blogs on Insurance Adjuster Software, Insurance Broker Software and Insurance Verification Software.