It’s Monday and you’ve just returned to work after the weekend. You open your mail and see that over 50 verification requests are waiting for you. It’ll take you at least 20 minutes to validate each one, consuming time and energy that could be better spent elsewhere.

Traditionally, verifying insurance coverage has been a daunting process, requiring multiple calls to insurance carriers or sending numerous emails or faxes to check the validity, benefits, and coverage extent of the policy. However, this process has been fraught with human errors due to a variety of factors, ranging from the overwhelming number of patients to frequent changes in policies.

This used to be a common scenario in the healthcare and insurance industries where resources and time were spent on repetitive tasks. Recognizing that nobody wants to be stuck in a cycle of long phone calls, back-and-forth emails, or navigating multiple online portals just to validate a policy, the past decade has seen the emergence of insuretech solutions that have simplified the challenge of coverage validation. These solutions not only streamline workflow but also prevent financial loss by optimizing reimbursements and eliminating denials or rejections through proper checks.

What is Modern Insurance Verification?

We’ve come a long way from basic online database portals where you can look up patient or policy coverage. Technological adoption has resulted in the development of software that automates the entire verification process while integrating with insurance core system platforms to enhance claims processing.

Insurance Verification Software is an automation tool that integrates with existing systems or payer databases to determine the validity of coverage, whether the policy covers required services, and if any deductible, prior authorization, secondary insurance, or copayment is applicable. This ensures that patients do not end up paying out of pocket and that medical professionals do not face bad debt due to denials.

Why Should Medical Insurance Verification Software Be a Part of Your Revenue Cycle?

The high cost of manual verification can significantly impact the organization in many ways and affect customer experiences. While these issues might seem minor at first, they can end up costing millions in the long run. Below are some aspects to consider to understand the importance of adopting verification software.

Time-Consuming Process: According to a 2022 CAQH Index report, the redundant task of verifying eligibility for each patient takes at least 14 minutes. In other words, if a claims processor has 20 verification requests, it could take about 4.6 hours to complete the task. Now imagine saving 4.6 hours of productivity simply by automating the verification process.

Administrative Burdens: The tedious process of verification can lead to stress and exhaustion. Human errors are unavoidable in repetitive tasks, a healthcare.gov survey shows that 1 in 5 claims are erroneous leading to denials or appeals. You wouldn’t want your competitors processing claims in seconds while you are stuck in a dreary cycle of eligibility verification, would you? Automating eligibility transactions not only eliminates errors but also prevents burnout and increases job satisfaction.

Financial Burdens: Manual verification will inevitably cause delays, potentially leading to backlogs and cash flow issues. AMA’s survey found that there are delayed or unpaid claims totaling $6.4 billion that are only 6 months or older. Real-time verification provides us with a clear picture of the entire policy coverage, benefit limits, and additional expenses like copays or deductibles. This ensures a smoother revenue cycle management by speeding up response times.

Denial Appeals Cost: Denials on claims can occur for various reasons, from patient registration and eligibility issues to human errors in coding and clinical validations. Research from the Kaiser Family Foundation shows that 90% of denials are actually preventable. While only a moderate percentage of denied claims are appealed, you have to go through the hassle of collecting the amount due. The expensive battle makes it a much-needed win.

Clean Claim Rates: Coverage eligibility validates the plan and benefits from various databases in real-time. This ensures that the required services are covered under the policy, ensuring reimbursement for any claims submitted.

Regulatory Compliance: Traditional verification methods using calls, emails, and spreadsheets, may compromise data or fail to comply with regulations like HIPPA, ACA, or any state-specific insurance compliance laws. Your legal team will have one less issue on their plate as insurance verification software is updated to comply with ever-changing regulations and insurance policies.

For more information on compliance related solutions, read our blog on Insurance Compliance Software.

Fraud Detection and Prevention: Relying solely on insurance identity cards is inadequate, as policies may be updated or canceled, especially with the rise of identity theft. Overworked employees may struggle to detect fraudulent claims amidst the complexity of online portals, emails, and calls. CMS mentioned that $95 billion was spent on improper payments related to abuse or fraudulent claims.

Improved Customer Experience: Only through a good comprehension of the client’s policy coverage information, the client’s finances are protected, ensuring they don’t have to pay out of pocket. The transparency during the verification process prevents any unexpected bills and clarifies financial responsibility.

Evidently the benefits provided by verification software are critical to ensure timely payments, avoid denials, and improve efficiency.

Factors to Consider When Evaluating the Right Software For You

Technical Integration Capabilities: The software should easily integrate with your existing systems, such as a CRM, insurance billing software, or policy management software. Additionally, it should be compatible with core systems and provide flexible database connectivity (including multiple EHR systems and practice management systems).

Automation and Scalability: A good software should require minimal human intervention by offering data extraction features that can handle batch verification. A robust OCR should be included to process various document formats.

Customization: The software should allow for customization and tailoring workflow solutions to meet your organization’s specific needs. Ensuring improved efficiency should be the main goal of any verification

Vendor Support: The software implementation should be smooth with reliable and timely customer support. Evaluate the implementation timeframe, available training resources, and support provided during and after implementation.

Regulatory Compliance: A good software should maintain compliance with HIPAA, ACA, and GDPR, offering proper access control options. Robust advanced encryption methods, such as Advanced Encryption Standard (AES) and Transport Layer Security (TLS), should be in place to ensure the safety and confidentiality of patient information.

Reporting and Analytics: The software should generate reports of policies, indicating any changes or updates. Data-driven analytics should be used to identify trends and patterns that can help optimize workflow.

Interested? Users can also opt for a specialized software, such as an Insurance Analytics Software to gain comprehensive insights into trends and patterns.

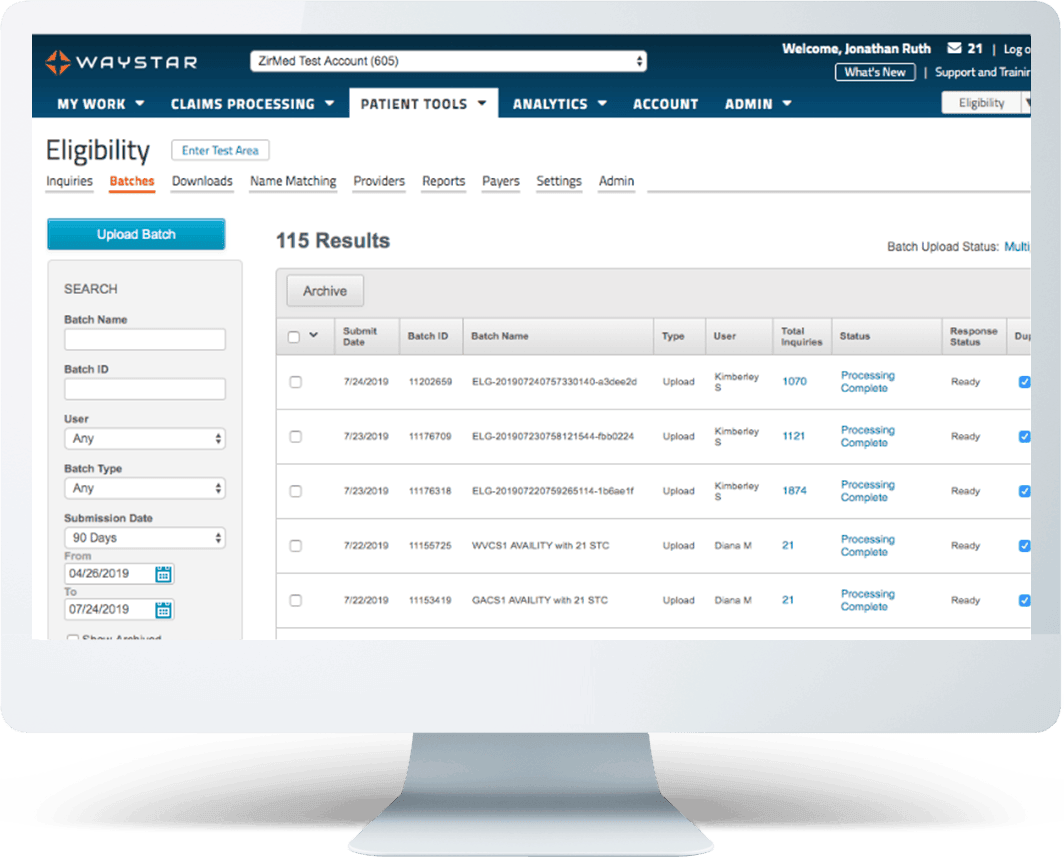

Waystar (formerly known as ZirMed) is a front-runner among verification software with its revenue cycle management (RCM) capabilities. It offers Eligibility Verification as a robust software solution by leveraging techs like AI and RPA to comb through a vast database of payer information to curate accurate and detailed benefits, including patient responsibility estimates.

Key Features:

- Robotic Process Automation (RPA) Electronic Health Record (EHR), and Electronic Data Interchange (EDI) seamlessly work together to automate eligibility, co-payments, and self-pay validation.

- Leverages over 5,000 payer connections and multiple clearing house vendors for the most accurate data. Even in cases without EDI, enriched eligibility data is available.

- Offers real-time claim status with Waystar’s innovative technology, Hubble, which leverages AI, RPA, and a rules engine specific to eligibility verification.

- Any updates to account data automate a recheck of eligibility to ensure the user is presented with the most updated coverage information.

- The denial prediction feature is part of the AI analytics, which helps users prevent claim rejections before they occur.

- Guides users to the next best actions in the workflow and provides intelligent warnings and alerts.

- The platform complies with healthcare security standards and regulations.

| Benefits | Drawbacks |

|---|---|

| User-Friendly Interface: The platform features a simple layout and uses plain language to make navigation easier for users. Benefit information is presented in a normalized way for easier consumption. | Customer Support: Waystar claims to provide 24/7 technical support and dedicated account management, but users report delayed support and subpar customer service. |

| Enriched Benefit Data: By utilizing RPA and EDI connections, the platform provides the best data in the market, helping to minimize claim denials. | Technical Dependency: A robust IT infrastructure, regular maintenance and software updates, and technical expertise for customization are all necessary for optimal performance. |

| Integration and Technology: The platform integrates with multiple EHR and practice management systems and also allows mobile access by users. | Implementation Complexity: The implementation process is complex and requires significant time and resources. |

| Reporting and Analytics: The reporting tool tracks performance metrics and trends to improve workflow. Additionally, it provides intelligent alerts with actionable guidance for staff. | |

| Comprehensive Payer Network: The platform boasts an extensive payer network that supports secondary insurance verifications and multiple plan types. |

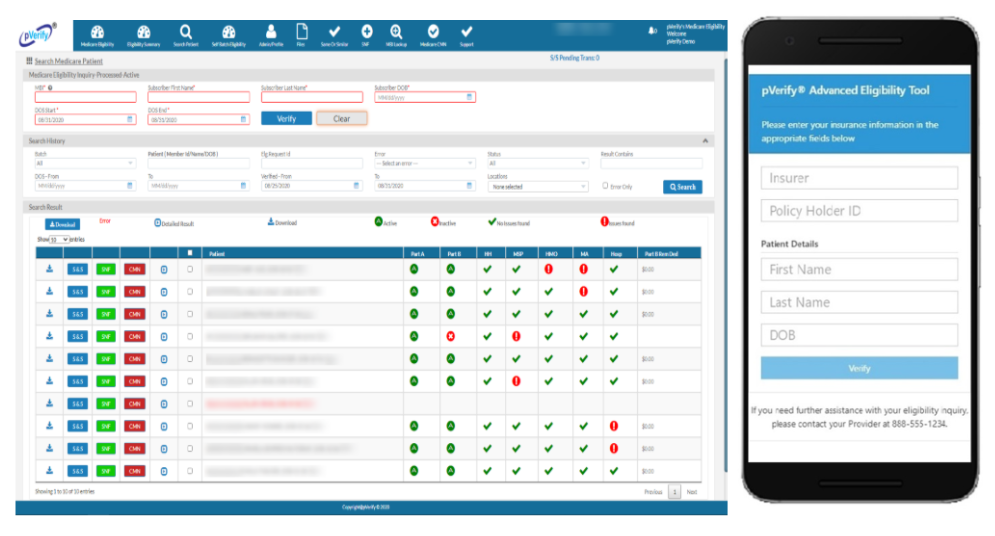

2. pVerify

Key Features:

- Tailored solutions that are available as instant, batch, or API, featuring a patient estimator and patient payments, as well as detailing the patient’s responsibility.

- Notable attributes of this software include Insurance Discovery, Advanced Eligibility, and MBI Lookup (Medicare Beneficiary ID). Users can also combine solutions offered by pVerify to design the perfect software or solution for their business needs.

- Provides real-time eligibility checks on a web-based interface, processing both unlimited batches and real-time, verification requests 24/7 through an automated queue.

- Allows unique eligibility settings for over 1350 payers to refine benefit reporting. Additionally, it allows Secure File Transfer Protocol (SFTP) report extraction and return.

- Connected to eTactics (clearing house) and WebPT (electronic medical record (EMR) system) to expand reach and improve accuracy.

| Benefits | Drawbacks |

|---|---|

| Archival Capabilities: The platform stores and tracks any previous eligibility checks, allowing users to track and refer to coverage changes. | Pricing: Although the plans are affordable, the platform doesn’t allow for long-term contracts, and setup fees are separate. Many users report that the cost is comparatively more expensive than other vendors in the market. |

| Integration Capabilities: A robust set of REST APIs, EHRs, mobile SDKs, and EDI connections to payers provided on a cloud-based unified platform to improve operational efficiency. | |

| Unlimited Support: The software provides support through phone, email, and tickets. | |

| Eligibility Solutions: Available in 4 ways: Individual Patient, Unlimited Batch Processing, EMR/PM Integration, and API Development. | |

| Compliance Certification: The platform is SOC 2 Type 2 and HIPPA Compliant. |

3. Coverage Insight

Coverage insight was designed by Change Healthcare, a robust platform which takes an analytics-driven approach to the verification process. By utlizing Change Healthcare’s expansive payer network and web-based architecture combines with EHR and existing practice management systems assists the solution in discovering undisclosed insurance coverage and copayment requirements, deductible status, and comprehensive benefits information.

Key Features:

- The platform uses advanced data analytics and data mining to identify undisclosed insurance coverage and only reports relevant information through enhanced screening, which suppresses unusable coverage.

- In addition to Change Healthcare’s expansive payer network, it incorporates more than 600 direct and third-party connections to verify a patient’s insurance information.

- It checks multiple Medicare/Medicaid, Disability/SSI, third-party liability, commercial insurance, state and county programs, social programs, and charity to reduce a patient’s financial stress.

- The platform has an automatic retry system that ensures required information is returned in case of payer-driven downtime.

- The software has anti-phishing regulations to allow for a targeted collection approach and complies with healthcare security standards and regulations.

| Benefits | Drawbacks |

|---|---|

| Cost-effective Solution: The software accepts payments for accounts that yield a net gain with a per-person or fixed free, for every benefit unit. | Pricing Challenge: Many add-on features have separate fees and may be difficult for smaller companies. |

| High Accuracy Rate: The platform validates all demographic and insurance profiles to identify risk, and the suppression feature rejects an average of 40% to present reliable data. | Implementation challenges: The implementation process is complex and requires time and resources. Although the UI is easy to use, it may require some training. |

| Technological Capabilities: It has data-mining, machine learning, and predictive analysis to provide the most accurate and comprehensive benefits information and reduce claim denials. | |

| Scalability: It can handle high-volume transactions in many healthcare settings. | |

| Compliance Certification: The platform is HITRUST CSF, HIPAA, SOC 2 Type 2, PCI DSS compliant. |

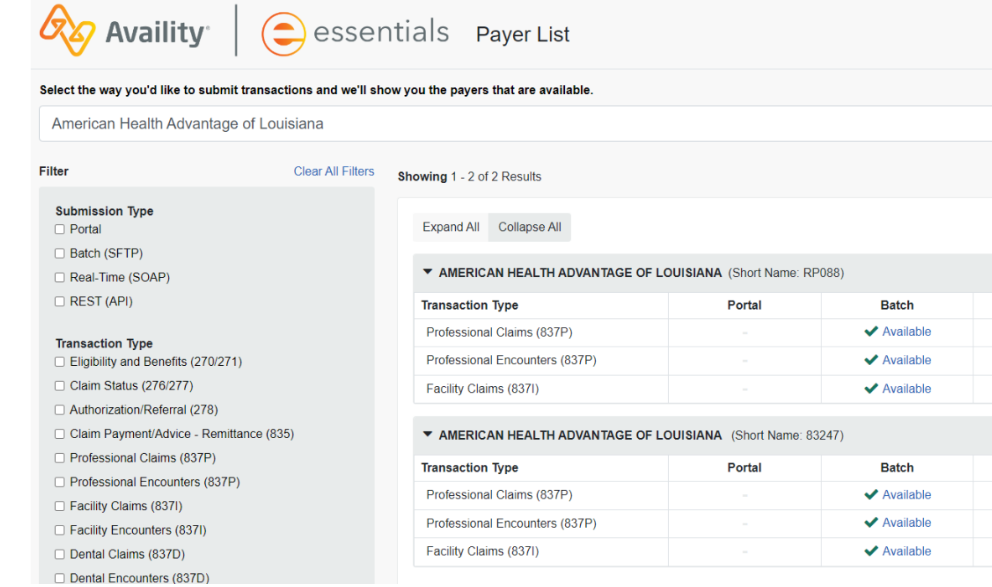

4. Availity Essentials Plus

Key Features:

- Availity Essentials Plus is a middle-tier option that features Essentials Pro’s robust features and the economical benefits that come with Essentials.

- The platform manages verification and billing activities, and its subscription-based pricing makes it more affordable than almost every practice management system.

- It provides ongoing product training and communications and collaborates with peer health plans on best practices.

- With more than 20 years of experience, Essentials solutions are equipped with robust security infrastructure that defends against bad actors.

- The platform complies with healthcare security standards and regulations.

Benefits

- Pricing: As Essential’s is sponsored by many health plans, users are not charged for transactions from those plans. Non-sponsored health plans can be accessed by Essentials Plus.

- Scalability: Offering three tiers of solutions to accommodate different volumes of transactions. Any upgrade will require marginal effort with no learning curve.

- Claim Status: The software also submits institutional and professional claims through intuitive, web-based forms, which can be tracked on the dashboard.

- Compliance Certification: The platform is HITRUST CSF, HIPAA, and Anti-Bribery and Anti-Corruption (ABAC/FCPA) compliant.

Drawbacks

- Technical Challenges:There is a dependency on software updates and a learning curve to adapt to technology.

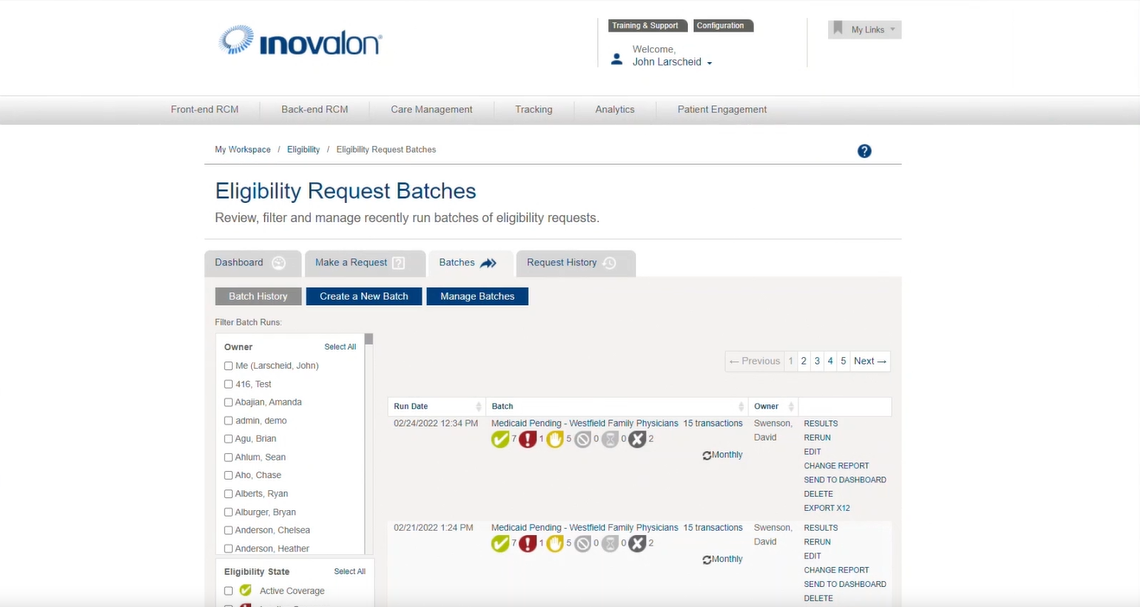

5. Inovalon

Key Features:

- The software features an eligibility workflow that customizes dashboards with batch processing, assigns and prioritizes certain tasks during verification, and monitors changes in patient coverage.

- It verifies multiple facets of the policy simultaneously, such as primary and secondary insurance validation, service-specific coverage details, plan-specific benefits and limitations, and patient responsibility calculations with multiple insurance plans.

- The software also sends alerts of any health maintenance organization (HMO) enrollment, dual eligibility, Medicare as a secondary payer, and other admissions scenarios.

- The comprehensive payer network consists of 1,097 payer connections to automate eligibility lookups.

- The software allows users to set up payer-wise Filter Service Type Code (STC) queries and responses.

| Benefits | Drawbacks |

|---|---|

| User-Friendly Interface: A simple layout allows users to verify eligibility details, including copayments, termination dates, deductibles, and coinsurance with just one sign-in. | Technical Glitches: Users have reported that system updates cause downtime, and it may take a few tries before being able to retrieve requested data. |

| Archival Capabilities: Users can access previous proof of eligibility transactions even if the policy or coverage has changed for a patient, which is helpful when eligibility status is challenged retroactively. | |

| Scalability: The system can handle high-volume transactions and verify across multiple insurance plans and payers. | |

| Compliance Certification: The platform is HIPAA certified, NCQA HEDIS certified, and ENHAC accredited. |

The Top Insurance Verification Software for Small and Medium Insurers

Let’s explore SMBs’ top five eligibility verification solutions, covering everything from features to benefits to help you choose the best software for your insurance business.

➤ Experian

1. eEligibility

Features:

- The 24/7 verification capabilities combined with automation, allow users to schedule verification checks and run them in the background.

- The platform provides daily dashboard summaries of coverage details without the need for the user to access the patient’s chart.

- Seamlessly integrates with the PMS, presenting the insurance tab, patient memo, and summary report under a unified interface.

- Alerts users by sending automatic memos notifying charges not covered by the patient’s policy.

- Apart from traditional verification checks, eEligibility also validates group numbers, dependents coverage, pre-existing condition waiting periods, and Plan limitations and exclusions.

| Benefits | Drawbacks |

|---|---|

| Customizable Parameters: The system allows users to set specific parameters for verification checks to meet business needs. | Add-on Modules Cost: The numerous add-on essential features collectively cost a significant amount. |

| User-Friendly Interface: The platform features a user-friendly design with a unified dashboard. | Lack of Technical Depth: Many users report that the platform has limited advanced features or some features are missing, and it is buggy and needs updates. |

| Scalability: The system can handle high-volume transactions and verify across multiple insurance plans and payers. | |

| Compliance Certification: The platform is HIPAA certified, HITECH certified, and Meaningful Use regulation compliant. |

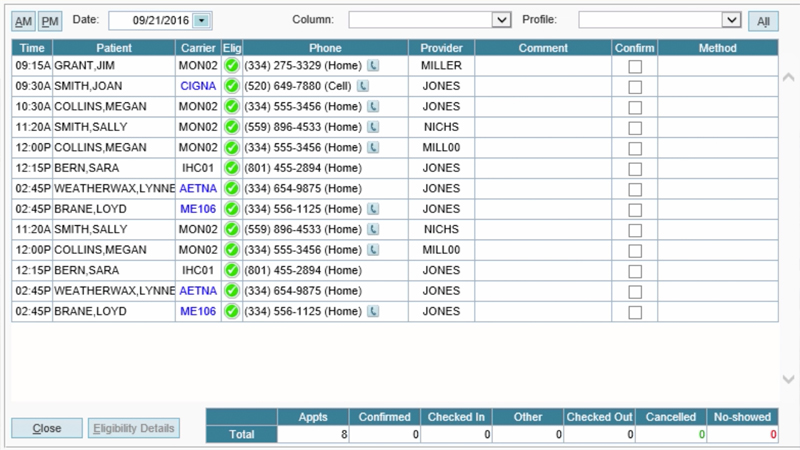

2. eClaim Status

Features:

- A unified interface allows access to more than 900 payers nationwide to ensure real-time eligibility verification, which operates around the clock.

- The platform allows for individual and batch processing, with a batch of 1000 records being verified in 1 to 2 minutes.

- The software offers 24/7 technical support and dedicated account management.

- Reports can be downloaded in Excel format.

The platform has no installation, maintenance overhead costs, lock-in period, or long-term contract while offering monthly subscription plans. The complete setup process can be completed within hours.

| Benefits | Drawbacks |

|---|---|

| Efficiency: Coverage details, such as active, inactive, and specific benefits, can be accessed within 5 seconds. Additionally, the data is color-coded for clarity. | Cost Consideration: While the monthly subscription may be affordable, users ultimately pay for premium features, training, and integration. |

| Customer Service: Critical issues are resolved on a priority basis with a 12-hour TAT for non-critical issues. | Technical Dependencies: Relies on the Internet and the service provider for update management. |

| Training: The platform offers online training to help users make optimum use of the software. | |

| Compliance Certification: The platform is certified by SSAE-16 SOC-1, SOC-2, HIPAA HITECH, PCI-Level 1 DSS, and NIST 800-53 compliant. |

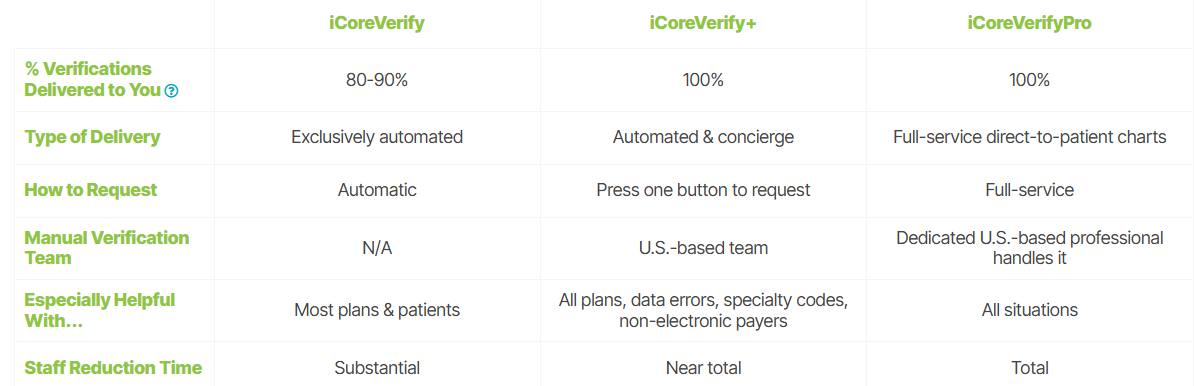

3. iCoreVerify

iCoreVerify is an insurance verification software solution offered by iCoreConnect to combat the challenges of multiple checks. It verifies plans with zero clicks through its automation capabilities. iCoreConnect offers three eligibility verification solutions– iCoreVerify, iCoreVerify +, and iCoreVerify Pro.

Features:

- The multi-payer compatibility makes it a versatile solution not only for dental practices but also verifies different types of insurance carriers.

- Its robust features for dental insurance and integration with Dental PMS, such as Dentric, Eaglesoft, and OpenDental make it an exceptional choice for dental insurance verification.

- Leverages Real-Time Benefit Check (RTBC) technology to verify coverage in a second with the click of a button and sends alerts in case of potential coverage issues.

- For more complex cases where manual intervention is required, iCoveryVerify Plus offers a concierge service that handles data errors, specialty codes, and non-electronic payers.

- iCoreConnect provides free unlimited training and technical support so users make most of the product.

| Benefits | Drawbacks |

|---|---|

| Efficiency: The Benefits column displays coverage information response received from the payer, Additionally, the data is color-coded for clarity and can be understood at a glance. | Cost: The subscription-based pricing model may be expensive for small scale organizations. |

| AI-Powered Tech: AI-driven algorithm provides a detailed breakdown of the insurance coverage with full transparency. | |

| Payer Integration: The platform assesses more than 2,100 insurance databases to provide the most accurate benefits information. | |

| Compliance Certification: The platform is certified by HIPAA, HITECH, HITRUST CSF, GDPR, and PCI DSS. |

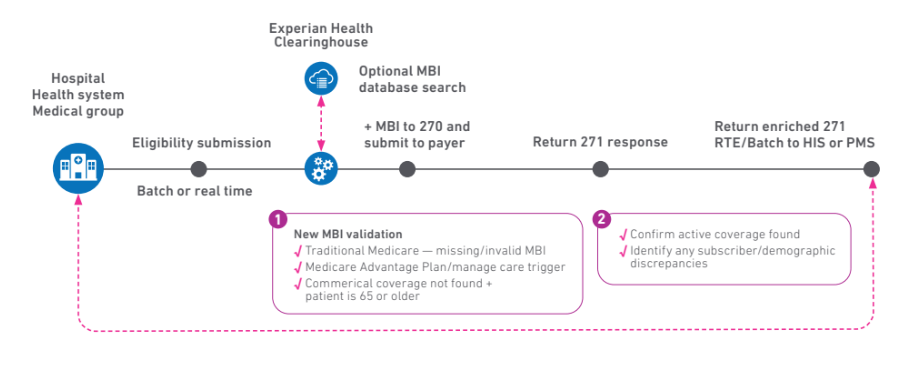

4. Experian

Features:

- A multi-player connectivity ecosystem with over 900 payers and backup connectivity to over 300 additional payers.

- An optional Medicare Beneficiary Identifier (MBI) lookup service so users get the most complete Medicare benefit coverage.

- Utilizes eCare Next’s Bad Plan Code (BPC) detection to send alerts to users in case of any incorrect plan code present on patient accounts.

- Leverages RPA and AI to create work queues with preset or custom alerts, and read eligibility responses in a readable format that alerts you in case any edits or follow-ups are needed.

| Benefits | Drawbacks |

|---|---|

| AI-Powered Tech: An intelligent data-matching algorithm processes multiple insurance plans, exploring all potential payment options to provide accurate benefit information. | Technical Updates: Many users report that new features should be added to the software. |

| Data Integration: The platform uses CAQH COB Smart data to present primacy information to the user of relevant transactions. | |

| Compliance Certification: The platform is certified by HIPAA, IDSP, PCI DSS, EI3PA, and ISO/IEC 27001. |

Conclusion

Insurance verification technology has evolved over time; now equipped with AI, technology-driven solutions are the future of eligibility verification. As healthcare industries face challenges with regulations and increasing complexity in the healthcare landscape, insurance verification software is a strategic necessity to optimize claims processing and enhance workflow.

Key Takeaways:

➤ Insurance Verification Software can save up to 4.6 hours of productivity, allowing staff to prioritize other tasks.

➤ Insurance Verification Software eliminates human errors, prevents denials, increases clean claim rates, and enhances revenue cycle management.

➤ There are various solutions available, and users have to make an informed decision based on their needs.

➤ When selecting insurance verification software, organizations must critically evaluate:

Pro Tip: Develop a scoring matrix based on these factors to evaluate different software options and make a decision tailored to your organization’s needs.

The right solution for your organization depends on its needs, transaction volume, and budget. By assessing this criterion, you can make an informed decision after evaluating the features offered by insuretech solutions to reduce administrative burdens and minimize financial risks.