We live in an era where digitization has become the norm. From the most minor purchases to the largest, customers now expect everything at their fingertips. The increasing demands and expectations of clients in the insurance sector are not to be underestimated. Clients are gravitating towards organizations that provide excellent customer service. This shift has emphasized a need for a sophisticated software solution, not only to enhance customer satisfaction, but also to ease the administrative burden of insurance professionals.

The automotive industry is growing, and there are more people buying vehicles. With a rise in automobile sales comes an increase in auto insurance customers. According to a recent report on motor vehicle insurance, ‘this growth trajectory is expected to drive the market volume to reach an impressive US$997.74 billion by 2029’. The significance of the adoption of auto insurance software cannot be overstated. The various market changes, regulatory requirements, consumer preferences, and the need for operational efficiency have made a specialized software a pressing priority. When a software offers telematics, data analytics, insights into driver behaviour and risk assessment, usage-based issuance, and so much more, how can organizations pass up on the opportunity to lead the market with competitive advantages?

Let’s Dive into What is an Auto Insurance Software

An auto insurance software consists of various digital tools designed specifically to target the pain points of those in the auto insurance domain. Auto and motor insurance software streamlines complex processes, including policy management, claims management, underwriting, customer relationship management, advanced analytics, and many other functionalities. It encompasses everything an auto insurance professional needs under one platform to provide a seamless user experience.

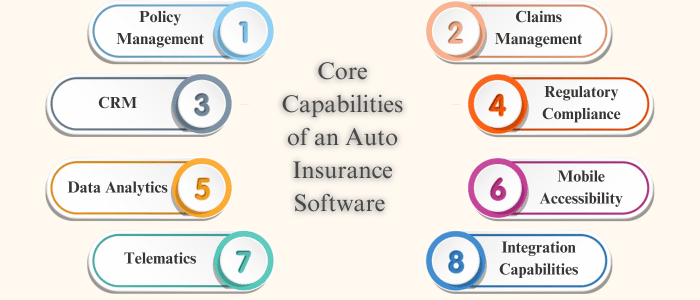

Core Capabilities of an Auto Insurance Software

Technology today isn’t just basic policy management; the functionality offered by a modern auto insurance software goes beyond rudimentary capabilities. These modern systems are equipped with different tools and even have the option of third-party integration to transform the entire insurance lifecycle.

Policy Management: Any auto insurance software would cover the entire policy management process: creating, managing, and tracking auto insurance policies. Some of its key functionality includes policy issuance, renewals, cancellations, and modifications.

Claims Management: Claims processing is handled through automated workflows (reviewing, verifying, and settling claims), intelligent document processing, and ML algorithms that detect potentially fraudulent claims.

Customer Relationship Management: Auto insurance software’s CRM doesn’t simply focus on better customer service, but also increases productivity. A complete view of the customer’s information would present opportunities to cross-sell to the client.

Regulatory Compliance: It incorporates various dedicated compliance modules for auto insurance. Advanced technology automatically tracks regulatory changes, ensures that business users are updated, and adjusts policies, documentation, and standard protocols.

Data Analytics: Auto insurance software enables users to analyze data, including but not limited to employee performance, market trends, risk assessment and fraud detection, and client analysis, allowing you to make data-driven decisions.

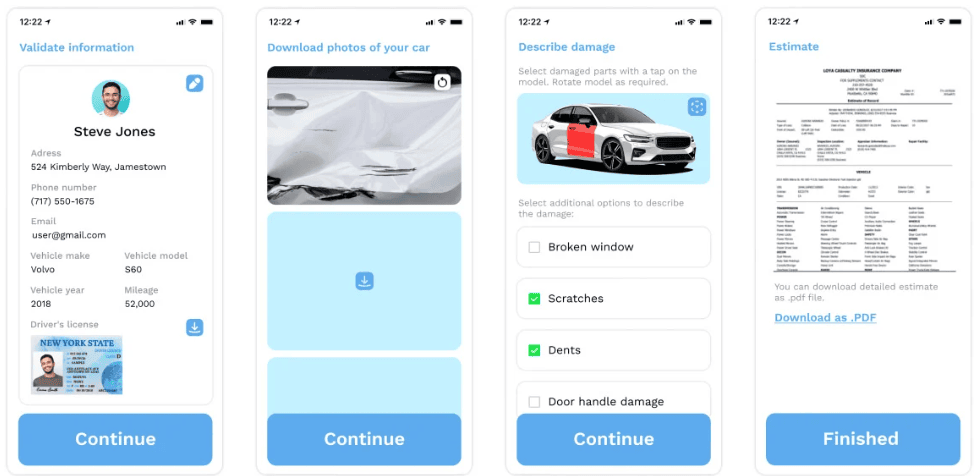

Mobile Accessibility: Modern auto insurance software supports mobile service, not only that, but also provides self-service functionality to customers. Users can file claims, access policy information, and much more through self-service interfaces.

Telematics: Usage-based insurance (UBI) has become a crucial aspect of auto insurance software; It analyzes driver behavior, so business users can offer personalized premiums based on usage, enhancing risk assessment and promoting safer driving behavior.

Integration Capabilities: The platform should offer a robust API framework. The integration of repair shop networks, telematics, document management, third-party data providers, and other complementary applications is pivotal to an auto insurance software.

Top Auto Insurance Software in The Market

There are many new solutions emerging in the auto insurance industry, with so many new ones, we have compiled a list of top software, and its key features and benefits for business users to make an informed decision.

NewgenONE

The NewgenONE Platform for Fast-Track Motor Insurance is a comprehensive solution that automates the entire claims lifecycle process. Its foundation is intelligent automation and AI-driven processes. NewgenONE platform addresses some of the most common challenges such as lengthy settlement times, manual errors, fraud, and gaps in operations with its robust system and advanced technologies.

Key Features

- The platform’s various channels help with communicaton, including web portals, mobile apps, branch walk-ins, and scanning solutions for claim intimation. Additionally, a unified dashboard captures and uploads all documents (vehicle videos and images) into the system; it also tracks the claim in real time throughout the claim journey.

- The claim registration process covers checks and validation, such as verification on duplicity, anti-money laundering (AML) detection, blacklisted entries, and others. After which, a successful claim registration will trigger an acknowledgement letter to the client.

- The platform provides a list of repairers based on the location and auto allocates repairers and surveyors based on various factors including user workload, ratings, claim amount, and geolocation.

- Surveyor mobile app portal, with offline functionality, comes with easy forms to capture estimates provided by surveyors. Additionally, it also has a collaborative portal is available for repairers to provide estimates and upload invoices.

- With intelligent allocation and auto-prioritization, claim assessment cases are allocated to claim handlers at different steps of the process. The detailed assessments also provide recommendations for the next decision and action.

- The intelligent business workflow showcases both the surveyor’s and the repairer’s estimate for business users to review and use the decision support system to select the best estimate.

- Claim settlements can be partial or full payments and utilize AI/ML models to accurately calculate the final payments. Any documents related to the claim settlement and debit notes are also system generated.

Benefits

Monitoring and Analytics: Performance dashboards provide comprehensive KPIs and monitoring reports. It uses AI algorithms for pattern identification and to detect fraud, and tracks the claim throughout its journey.

Fraud Assessments: The platform’s fraud assessment model helps identify potential fraud and default probability. It also includes tailored prevention strategies through AI and data analytics.

Estimation Capabilities: Estimation is accurate and precise covering the amount, discount percentage, and net amount for spare parts, materials, and more.

Customer Experience: Customer can get updates in real-time and access a easy-to-use interface for claim-related information.

ScienceSoft

ScienceSoft’s Custom Auto and Motor Insurance Software is an advanced platform with AI/ML technologies, blockchain-based recordkeeping, and IoT-enabled pricing models to cater to the demands and needs in the auto insurance sector. The platform aims to simplify the insurance process by using technology to automate customer onboarding, underwriting, claims resolution, fraud detection, compliance, and many other functions.

Key Features

- The solution’s application processing abilities automatically convert paper applications using intelligent OCR technology and capture multi-format applications from various channels in real time.

- The platform validates customer data against third-party sources and includes KYC/AML integrated verification for new customers, and in case of discrepancies, the platform would send alerts.

- The platform has extensive term management capabilities, for instance, insurance terms with flexible coverage thresholds, flexible loss type coverage (accidents, theft, vandalism) and custom mileage plans and deductible options.

- ScienceSoft’s AI-driven recommends optimal coverage terms by customer segment and provides flexible total loss settlement options be it stated value or the agreed value.

- The underwriting capabilities include generation of LLM-supported underwriting files, rule-based and AI-powered customer risk scoring mechanisms, automated vehicle evaluation and risk estimation, statistical and AI analysis of customer data points, and risk-based segmentation of customers through approval workflows.

- Preventative analytics is equipped with multi-channel notifications for loss prevention, AI powered preventive action recommendations, and real-time AIoT monitoring of vehicle condition and driver behaviour.

- Policy administration covers automated policy creation and customer submission through customizable templates for insurance documentation. With rule-based policy lifecycle management, renewals, cancellations, and updates are easily managed.

- Claims are processed through automated FNOL capture and multi-format document processing. It also supports AI-loss valuation and computer vision integration for damage assessments.

Benefits

Billing Infrastructure: With Multi-currency support (diverse payment methods and gateways) and multi-language generation, digital signature integration for documents, invoice tracking and management, the solution is provides many functionalities for to ease the billing process.

Business Intelligence: The software offers forecasting for strategic planning, premiums, claims, business demands, actionable analytics, and performance benchmarking against industry standards.

Compliance and Security: The platform conducts audit trails for regulatory examinations (KYC/AML, NAIC, IFRS17, GDPR, etc), utilizes multi-layered protocols for sensitive information, and offers optional blockchain technology for record-keeping.

Customer Experience: ScienceSoft’s AI analysis recommends personalised coverage; the platform provides intuitive 24/7 self-service options with AI virtual assistants, multi-channel communication, and helps clients register, manage accounts, file, submit, and track their claim’s journey.

Mitchell Auto Physical Damage Solutions

Mitchell Auto Claims & Insurance Management Software is built on the foundation of over 75 years of expertise to cater to the needs and requirements of the evolving needs of the auto insurance market. It handles the entire claim lifecycle from FNOL to settlement. Mitchell’s cloud-based ecosystems and technological framework is robust and can enhance operations.

Key Features

- Mitchell’s auto insurance software connects over 300 insurance carriers with 20,000 collision repair facilities.

- With advanced loss profiling capabilities, it offers customizable loss profiling questionnaires with a 92% accuracy in total loss prediction.

- Assignment dispatch automates workload management for field and virtual resources, and intelligent task assignment based on resource territories and expertise.

- Mitchell’s multi-device estimating capabilities consists of specialized tools for passenger, commercial, and specialty vehicles, automated appraisal technologies for touchless claims delivery, and integrated audit functionalities to ensure business rule compliance.

- The OEM Repair integration provides instant access to OEM repair procedures, parts and labour data, and diagnostic trouble code information, and it supports Advanced Driver Assistance Systems (ADAS) calibration.

- The Total Loss management capabilities include market-driven valuation tools for loss vehicles, centralized management of salvage related activities, and settlement workflows.

- The solution’s intelligent claim automation happens through AI-powered appraisals and claims workflows, and customizable automation solutions that can be adapted to unique business needs.

- The platform conducts performance monitoring for staff, independent appraisers, and repair facilities; it also tracks customer satisfaction and analyzes the feedback.

Benefits

Glass Repair Solutions: An end-to-end glass claims experience, from FNOL to coverage verification, with partner connectivity and payment settlement integration.

Mitchell Work Center: A Centralized platform for loss profiling, FNOL, and assignment dispatch.

Reporting Suite: Multilevel reporting capabilities and data driven insights for operational improvement.

Customer Experience: The platform allows policyholders to report claims through mobile devices for an easy experience.

Duck Creek

Duck Creek Personal Auto Insurance Software is a SaaS solution built on the Duck Creek Suite. The platform consists of auto insurance-specific tools, applications, and integration to be able to adapt to the evolving market. With its various capabilities, its supports launching products quickly, automates complex processes, and fulfills customer expectations.

Key Features

- The platform covers end-to-end auto lifecyle, encompassing personal auto line of business kits with low-code tools for development of coverages, rules, rates, and forms quickly, and reusable components from base auto products for expansion.

- The platform can configure rules for telematics data collection and premium re-rating that are based on the driver’s behavior. Additionally, it has integration capabilities for historical rating variables, usage-based data, and behavioural data that support configuration of rules.

- Touchless claims processing ensures the automation of the claims lifecycle from FNOL to payment, while allowing for transparent customer engagement throughout the process, by integrating embedded data and predictive analytics to make informed decisions.

- Duck Creek extends your distribution network by integrating with leading comparative raters and offers expansive producer portal capabilities. There is a single point of change architecture for maintaining multiple user portals.

- Data sources are consolidated across internal systems, external feeds, and other Duck Creek solutions. It provides a holistic view of driver information, motor vehicle reports, accident history, and telematics data.

- The policy management covers from quoting to the renewal process, and provides rating results quicker than most websites and agency management software.

- Duck Creek’s customer-centric billing offers customizable payment plans, discounts, and installment options, while supporting various payment methods including eCheck and auto pay services.

Benefits

Third-Party Services: Duck Creek’s partner ecosystem features various integrations, namely telematics, chatbot, photo submission tools, predictive fraud analytics, payment providers and more.

Cloud-Based Infrastructure: The SaaS deployment model has integration capabilities and a secure system architecture and is regularly updated.

Omnichannel Communications: The platform offers interactions across the web, mobile, email, and text so that customers can receive timely support and information.

Zendrive Auto Insurance Software

Zendrive auto insurance software is an innovative solution targeting the major pain points of the insurance industry with features like Insurance Qualifications Lens, Usage-Based Insurance, Claims Automation, and more, Zendrive aims for organizations to not only enhance their operations but also acquire safe drivers. It utilizes advanced risk modelling and real-time data insights to protect the company’s bottom line while simultaneously improving customer experience.

Key Features

- The Insurance Qualification Lens (IQL) uses behavioral risk signals to offer personalized insurance quotes. It analyzes actual driving data, route risk, and other risk factors to determine fair pricing, boosts NPS scores and retention, and benefits the company by lowering customer acquisition costs.

- Usage-Based Insurance (UBI) functionality creates digital insurance products, offering personalized experiences and discounts based on IQL’s analysis. The user experience can be made consistent through gamification, rewards, and family safety notifications.

- The Platform can detect collisions and has the capabilities to dispatch help and provide an automated claims experience. It provides instant FNOL and triggers automated workflows for rapid claim resolution.

- Claims automation lowers claim costs, minimizes fraud, and shortens cycle times by processing actionable insights and making data-driven decisions.

- The smartphone-centric collision detection notifies within 20 seconds of impact even at speeds as low as 10 MPH through an extensive collision analysis database (100,000+ analyzed collisions). It also provides contextual collision insights including location, time, g-force, road type, and more.

- The scoring algorithm includes normally distributed versus self-selected data, provides highly accurate event and trip detection capabilities, assesses the volume and accuracy of the collision data, accounts for normal geographic distribution of the data, and considers seasonality and regional differences.

Benefits

Risk Modelling: Zendrive’s Mobility Risk Intelligence (MRI) platform builds custom risk scores and proprietary models with multiple scoring options.

Flexible Targeting Criteria: By targeting customers based on location, mileage, and driver scores, Zendrive helps lower customer acquisition costs and get the best potential customers.

Compliance: With privacy-compliance user identification systems that come with GDPR compliance, ensuring that driver IDs are confidential and anonymized.

Conclusion

The strategic advantages of investing in auto insurance technology are apparent; the ROI includes Risk Portfolio optimization, better fraud detection and prevention, and not to mention how it reduces costs and protects insurers’ profit margins. Choosing the right software is not an easy task. Business users have to first evaluate their current and future requirements, assess the implementation plan, and determine any other additional costs. All these are important factors in deciding the software that can maximize ROI and scale with your organization. Take a step towards digital transformation!

To learn more about enhancing your organization’s performance, our blogs on Insurance Compliance Software, Insurance Quoting Software, and Insurance Accounting Software for valuable insights.