Technological adoption has been the talk of the town, more so in 2025. We have witnessed how large-scale organizations have optimized their operations and improved their efficiency; the same cannot be said for all small-scale agencies or even some of the larger ones. Even today, brokers are seen researching several different policies to offer their clients quotes and rate comparisons that would meet a client’s needs. Brokers are, of course, preferred by many policy buyers for the personalized experience and unbiased guidance. This also means that brokers, whether they are part of an agency or provide independent brokerage services, have a significant number of clients.

Today’s insurance brokers or agencies use insurance broker software or solutions that automate their processes and offer a modern set of tools to help manage their day-to-day operations. The primary reason for of insurance broker software is to have a competitive edge in the market and the sheer increase in the number of those interested in a policy. These tools allow brokers to provide perfect coverage to their clients, improving customer experience and retention while also ensuring they can streamline their work.

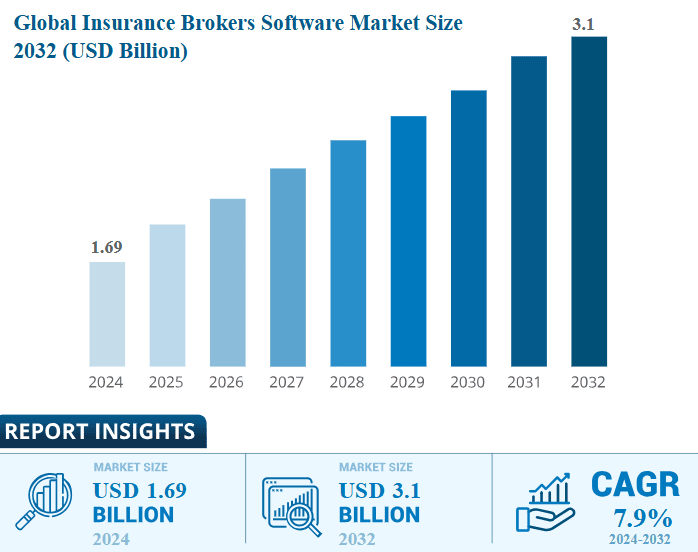

With so many obvious benefits, one would assume that insurance broker software’s usage would be prevalent in the industry. Unfortunately, the resistance to digitization can be due to different factors, the major one being the cost of implementation and maintenance, especially in the cases of small brokerages. Additionally, there is also the threat of data leaks and security concerns while migrating confidential client information. According to Business Market Insights, “The global Insurance Brokers Software Market size is USD 1.69 billion in 2024 and is expected to reach USD 3.1 billion by 2032, growing at a compound annual growth rate (CAGR) of about 7.9% during the forecast period”.

The implementation and investment in an insurance broker software is inevitable. Focusing on the drawbacks of insurance broker software implementation will only hinder the growth and development of an agency.

Running an agency? Read about Agency Software, Estimating Software, and Analytics Software, such tools that would enhance the operational efficiency of your agency.

Why Should Brokers Adopt an Insurance Broker Software?

Brokerage software is the future because of the various challenges brokers face in the industry. The best way to address these challenges is to understand why agencies turn to insurance broker software.

Efficiency: Traditionally, brokers shop around tens if not hundreds of policies to check which one would be ideal for the client’s needs. This time-consuming process can be avoided with a software, not accounting for the fact that brokers can use this time to build better relationships with their clients and close deals instead of tedious administrative work.

Policy Tracking: Insurance broker software would assist in tracking policies from various insurers. They also stay on top of any changes in terms of renewals, claims, and changes in coverage as they have access to policy information in real-time to respond quickly.

Client Relationship Management: An insurance broker software consolidates the required data from various data silos and presents the relevant information. A Client profile functionality accesses contact information, policy details, and past communication just like in a CRM software.

Reporting Tools: Through performance analysis, brokers can make data-driven decisions. In terms of marketing strategies or client retention, reporting tools provide detailed insights on sales, policy performance, and client retention.

Communication tools: Insurance broker software include tools that facilitate communication between the client and the broker. Through notifications, brokers can provide timely responses and improve client satisfaction.

AMS 360 (Vertafore)

AMS 360 is a foundational agency management system designed with large-scale insurance agencies in mind. It caters to multiple lines of business, including specialty lines, with built-in accounting features and role-based permissions. Vertafore has three AMS, namely QQ Catalyst, AMS360, and Sagita. AMS 360 stands out amongst its competition due to its robust integration capabilities and scalability, driving sustainable growth and delivering excellent service.

Key Features

- Client management features include email and text communications through AMS360 Messenger, an around-the-clock self-service portal for clients through InsurLink, and the ability for business users to access client information through AMS360 Mobile.

- The comprehensive policy management features cover carrier downloads (policy data updates, status information, and direct bill commissions) and manage all policy documents.

- The core integrations offered by AMS360 are AMS360 Messenger, PL Rating and its Add-ons, DocuSign, Reference Connect, and InsurLink; apart from that, it has 40+ third-party integrations available.

- The platform utilizes QQ Catalyst for its accounting, manages trust reporting, and segments revenue and expenses by 3 categories: location, business units, and specialty niche.

- Business intelligence provides an analysis of growth patterns, financial reporting, and benchmarking of market trends.

- AMS360 is an integrated accounting solution that automates billing, invoicing, and commission calculations.

Benefits

My Agency Reports: AMS360 provides detailed insights into employee productivity, policy management, and conversions. Additionally, it also allows users to customize reports and includes pre-configured reports.

My Agency Home: The platform helps users service clients through adaptable guided workflows and a customizable dashboard. It also includes built-in regulatory compliance tools.

Vertafore Single Sign-on (SSO): Vertafore enables business users to access all Vertafore solutions without requiring multiple credentials.

TransactNOW: Through TransactNOW, business users can receive eDocs and messages. It also allows real-time transaction workflows and instant sign-on carrier websites.

Financial Capabilities: AMS360 simplifies month-end processes with general ledger functionality. It also ensures adherence to compliance for all financial records and utilizes specialized tools for managing regulated client funds.

Jenesis

Jenesis Insurance Agency Management System is a web-based insurance broker software designed to address the major challenges faced by insurance brokers. Jenesis aims to ease client communication and policy management, as well as the planning and launching of marketing campaigns, by integrating essential tools and capabilities into a unified, user-friendly platform.

Key Features

- Client management features include a 24/7 self-service client portal with access to policy documents and certificates of insurance, notes system capability to search for specific client-related documents, and managing different types of media (logos, certificates, etc.)

- Jenesis has extensive document management and processing capabilities, consisting of ACORD Forms Library, integration with e-signature, and automatically generating insurance certificates.

- The platform supports carrier downloads for both commercial and personal lines from most U.S. insurance carriers and allows single-click access to a carrier’s website.

- Jenesis identifies opportunities for revenue growth through targeted marketing campaigns and cross-selling through client data analysis. It also tracks commissions through the commission manager.

- The suspense feature handles time-sensitive tasks and issuing reminders. For policy renewals, the platform automates reminders as well.

- Jenesis adheres to compliance; it provides documentation of all client communications, audit trails for all transactions, and secures client data.

Benefits

Training and Support: Jenesis’s certification program trains business users to use the platform optimally. The solution also provides dedicated ongoing support from industry experts.

Employee Productivity: The platform monitors employee productivity, transactions, and clock-in and clock-out times.

Communication Integration: The solution integrates two-way email and text so clients can communicate directly from the software’s interface. With VoIP integration, users can also make and receive calls using the software.

Accounting Integration: With QuickBooks’ integration, Jenesis handles invoicing and payment tracking. It is also equipped with credit card functionality and can process credit card payments.

HawkSoft

HawkSoft is a cloud-based Insurance Agency Management System that uses strategic insurtech as its foundation, equipping users with the tools and technologies required to meet clients’ evolving demands. HawkSoft is a system designed by agents, with over 25 years of experience, for other agents and covers both commercial and personal lines.

Key Features

- The solution has cloud-based capabilities that extend to PC, android, iPhone, iPad, laptop, or desktop (full feature access), providing a comprehensive experience by not compromising on essential features.

- HawkSoft automatically downloads carrier policy and coverage updates; it also gives users an opportunity to either update the policy immediately or allow users to review the changes before the update.

- A unified client profile architecture provides access to all the relevant information, and HawkLink helps quickly process changes, payments, and quotes by integrating with carrier websites.

- HawkSoft’s Proprietary Action Menu builds documentation automatically during the execution of workflows. Additionally, the platform automatically documents all client interactions to reduce the chances of errors and omissions.

- HawkSoft’s AMS is integrated with QuickBooks for operational accounting; with built-in accounting workflows, trust accounting, and commission management; it also streamlines commission processing with Excel and CSV import capabilities.

Benefits

Agency Intelligence: The platform’s reporting suite offers one-click reports for Book of Business, retention, sales pipeline, and cross-sell metrics under one platform.

ACORD Forms: The built-in library of ACORD forms with intelligent pre-fill capabilities from HawkSoft data and updates the current versions of P&C ACORD forms.

Virtual Printer: A PDF writer tool captures any website image, screenshot, or document and adds it to the policyholder’s file, simplifying the document attachment process for a broker.

Batch and Email Marketing: The platform helps with scheduling and sending emails to lists generated by Agency Intelligence, giving users the opportunity to either market to the whole book of business or specific groups.

Sales Capabilities: The platform customizes sales proposals that can be edited, captures leads from the website using forms to import data into HawkSoft and provides actionable sales pipeline reports.

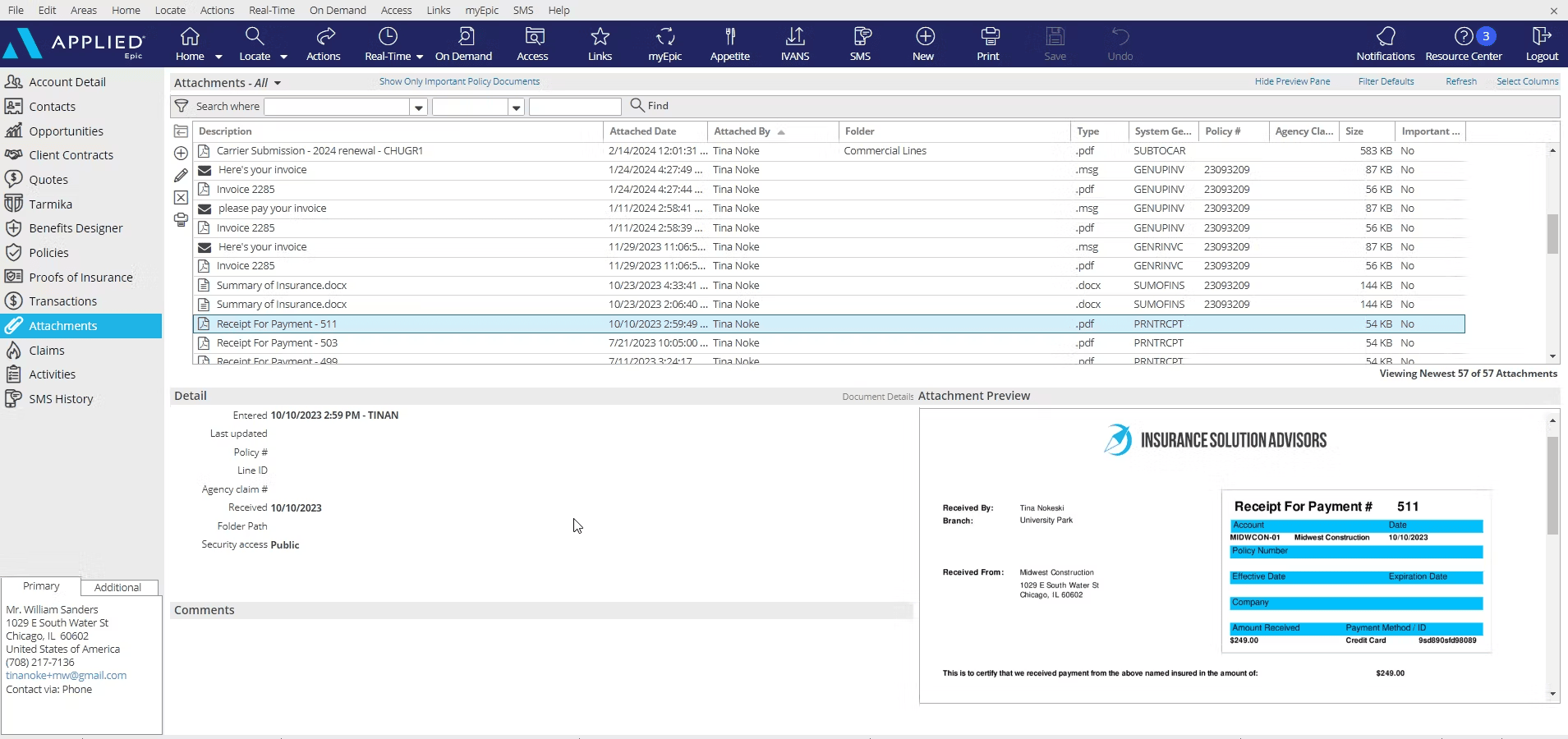

Applied Epic

Applied Epic is an insurance broker software designed as an out-of-the-box management platform that handles policies, customer relationships, documentation, insurer connectivity, and more on a unified system. This browser-native solution is the world’s most widely used insurance broker management platform for its holistic approach to brokerage and the comprehensive functionality it offers.

Key Features

- The platform uses an open, scalable architecture through an API and Data Lake Design, supporting the acquisition and integration of both third-party and applied applications.

- The platform integrates with Salesforce’s CRM technology, monitoring, tracking, and forecasting new business opportunities and renewals. For quotes, it integrates with Epic Quotes for commercial lines.

- Documents are security managed, taking into account the business guidelines or the organization’s customized process by enabling simple or deep folder hierarchies.

- Applied Epic centralizes document management with secure data handling and role-based access controls. The platform reduces security risks through audit trails, version control, and standardized compliance processes.

- Applied Epic provides real-time reports and insights into sales trends, revenue recognition reporting for premium and commission tracking, and analysis of customer portal usage.

- The solution integrates eTrading so brokers can eliminate the data entry process and exchange data directly with insurers.

Benefits

Renewal Management: Applied Epic’s broker system lets you view and track all renewals, including EDI, Manual, and Scheme policies for all lines of business.

Omnichannel Customer Service: The platform offers self-service options for customers through a portal and an around-the-clock mobile application to obtain quotes and look up policy details.

Commission Tracking: The solution processes direct-bill commissions without premium entry requirements and calculates premium-weighted commissions to optimize revenue.

Insurer Connectivity: Automated information exchange ensures users receive the most updated policy-related documents straight to your managing system.

Process Automation: Automated workflows are adapted for commonly used workflows; the system also includes business process management capabilities and pre-built workflows.

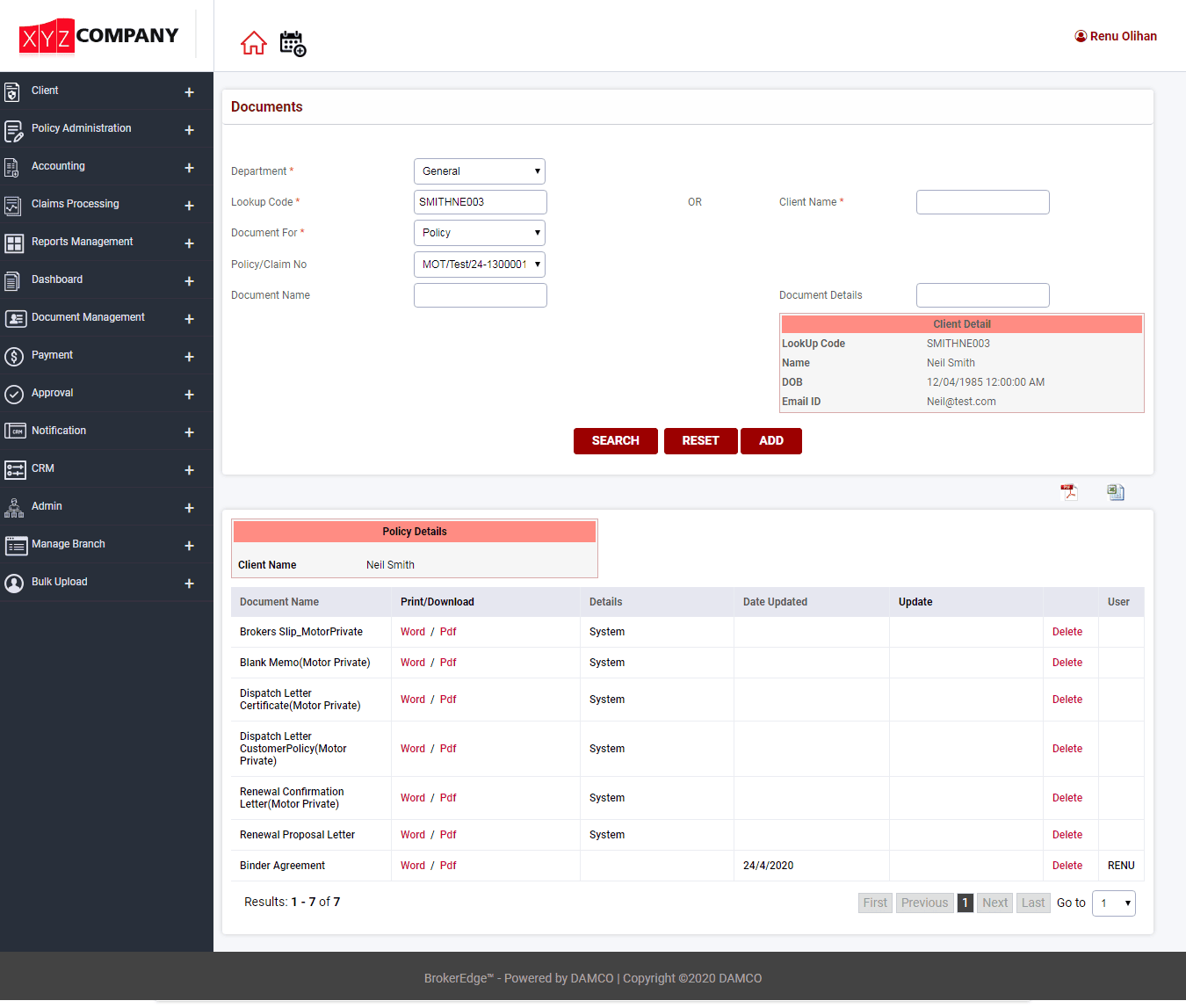

Damco BrokerEdge

BrokerEdge is Damco’s insurance broker software designed with the goal of enhancing productivity without compromising sales and revenue. The solution supports the complete fronting and co-brokering accounting processes, promoting expansion into new or even global markets. By integrating critical brokerage functionalities, the platform helps brokers to manage their operations on a unified platform.

Key Features

- The solution can be configured for various insurance companies and products. It also covers various lines of business, supporting over 38 LoBs across Property & Casualty, Specialty, Liability, Life & Health offerings.

- BrokerEdge’s policy lifecycle includes quoting, endorsements, renewals, and cancellations. With automated renewal notice notifications and automated as well as manual rate management capabilities, brokers can easily manage core operations.

- The platform facilitates real-time data exchange with insurer systems through API or EDI and offers communication channels with multiple carriers.

- A single-view dashboard that can be accessed on both mobile and web platforms to provide access to critical information instantly. The dashboard interface presents all standard and statistical reports.

- Multiple quotes can be compared on the platform through API or Excel uploads and offers digital policy buy out.

Benefits

Sales and CRM: BrokerEdge handles the entire end-to-end processing from head creation to closing. It also promotes cross-selling and upselling.

Producer Portal: The producer portal has business registration capabilities, a commission management system, and configurable agent or producer sections.

Customer Portal: The 27/7 self-service portal helps customers with digital claim submissions that allow for photo and video upload functions. Additionally, the platform has integrated payment processing and profile management capabilities.

Compliance and Security: The platform includes security measures, such as multiple layered access controls, GDPR compliance, and industry-based encryption protocols.

Subscription-Based Model: The platform supports an unlimited number of users and utilizes a pay-as-you-go model that can be scaled.

Worried about compliance? Navigate compliance challenges with insights from our blog Insurance Compliance Software.

Conclusion

There are various benefits of using an insurance broker software, and it’s high time brokers all over the world adopt such insuretech solutions that would aid their jobs. This is crucial as customers prioritize exceptional service; the future of a successful insurance broker isn’t just about the long list of his or her clients but rather how they can leverage technology to provide the best possible coverage options and personal guidance. After all, most people prefer brokers over agents because of their unbiased guidance.

The insurance industry’s primary goal has been to safeguard against uncertainty; with that in mind, investing in an insurance broker software is not just a fleeting trend but an imperative for those committed to long-term success.