“Insurers must embrace digital tools not just to keep pace, but to lead in a landscape where agility and customer focus are non-negotiable.”

Today’s Property and Casualty (P&C) insurers are finding themselves at a crossroads, where traditional methods meet cutting-edge technology, and new challenges demand agile solutions.

With advanced software solutions at their fingertips, insurers can improve everything from policy making and underwriting to verification, claims processing, accounting, customer experience, and operational efficiency. But understanding which innovations truly offer value—and how to integrate them effectively—is another matter entirely. In this blog, we’ll explore the role of P&C insurance software, and the best software tailored for SMB and Enterprise businesses.

Want to Generate Documents In Bulk ?

With Perfect Doc Studio, you can simplify bulk document generation in over 100 languages with its intuitive drag-and-drop interface. Our advanced features allow businesses to create, customize, and distribute personalized communications across global markets.

What Does P&C Stand For in Insurance?

Property and Casualty (P&C) insurance plays a vital role in safeguarding your valuable assets, including your home, vehicle, and even pets. This broad category of insurance encompasses policies designed to protect personal property while providing liability coverage tailored to individual needs.

For business owners, property insurance is particularly crucial. It offers vital protection for both the business premises and the assets within, shielding against losses from theft or vandalism. This type of coverage enables business owners to recover costs associated with damaged or stolen goods, allowing them to maintain operational continuity.

Casualty insurance, on the other hand, addresses the legal responsibilities that arise from accidents causing harm or damage to individuals or their property. Business owners rely on casualty coverage to protect themselves from liability related to workplace incidents, ensuring that they can manage unforeseen circumstances without jeopardizing their financial stability.

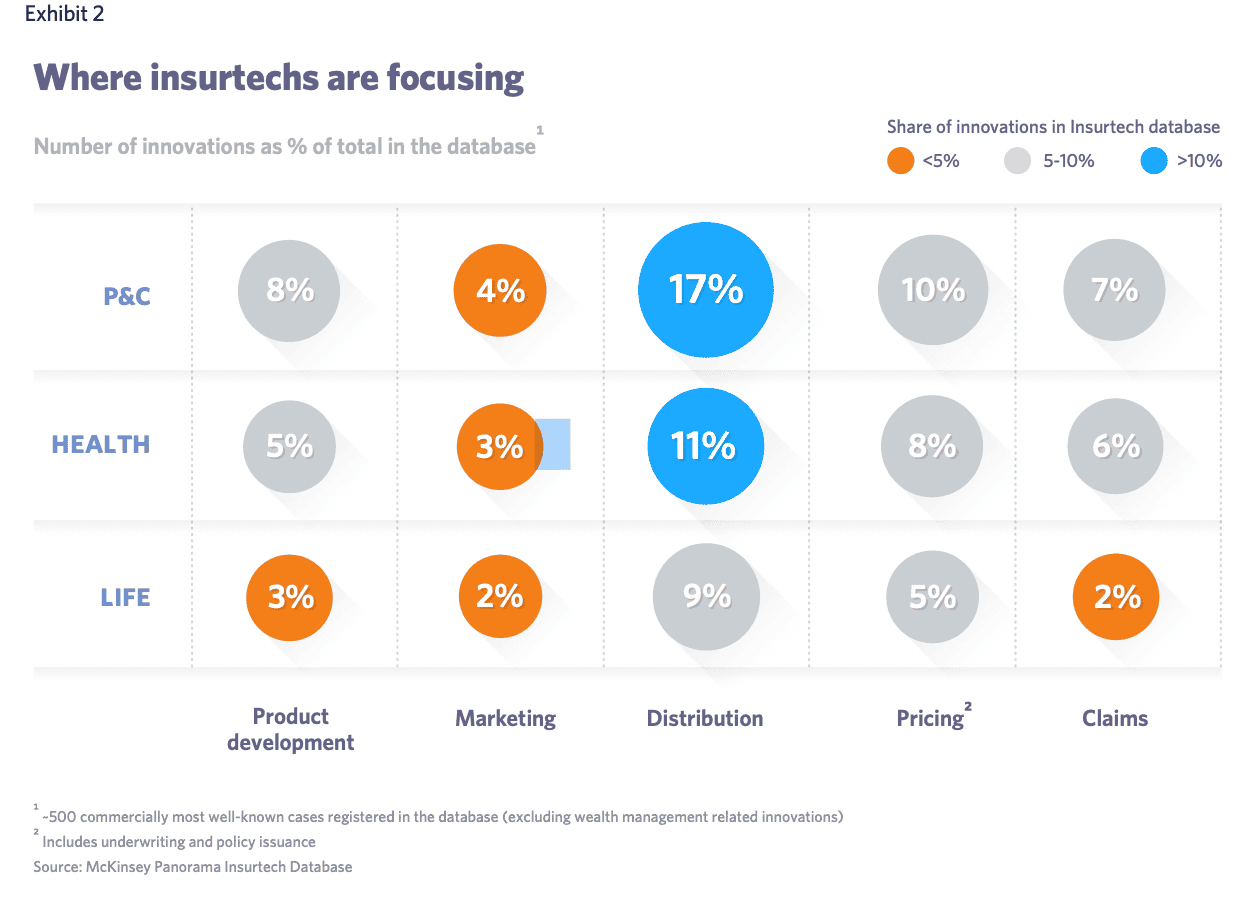

According to a report from McKinsey, P&C insurance has particulalry focused on certain aspects.

The Role of P&C Insurance Software

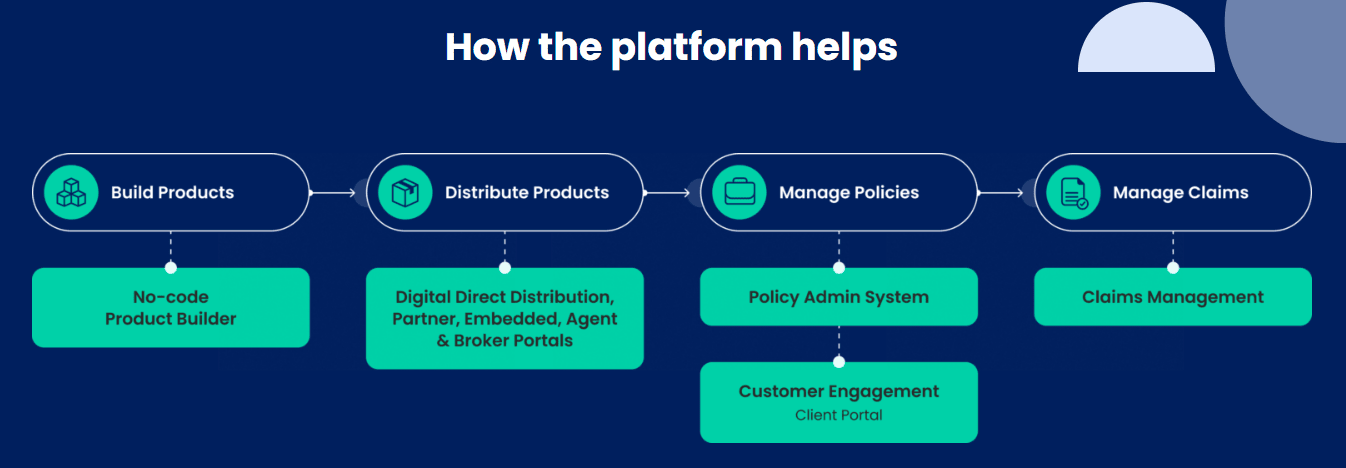

Property and Casualty (P&C) insurance software automates key processes involved in the insurance lifecycle for property and casualty insurance providers. P&C insurance software encompasses specialized solutions designed to improve various aspects of the insurance process, such as underwriting tools, policy management, claims processing, and customer service.

These platforms are essential in modernizing the insurance industry, enabling insurers to respond to evolving customer expectations and market demands .But how does Property and Casualty (P&C) insurance software stand out from other software solutions? There are unique functionalities that enable insurers to operate more efficiently, making P&C software essential for success in the insurance sector.

The Best P&C Insurance Software for SMB And Enterprises

Small to Medium Business

Enterprise Business

Small to Medium Business

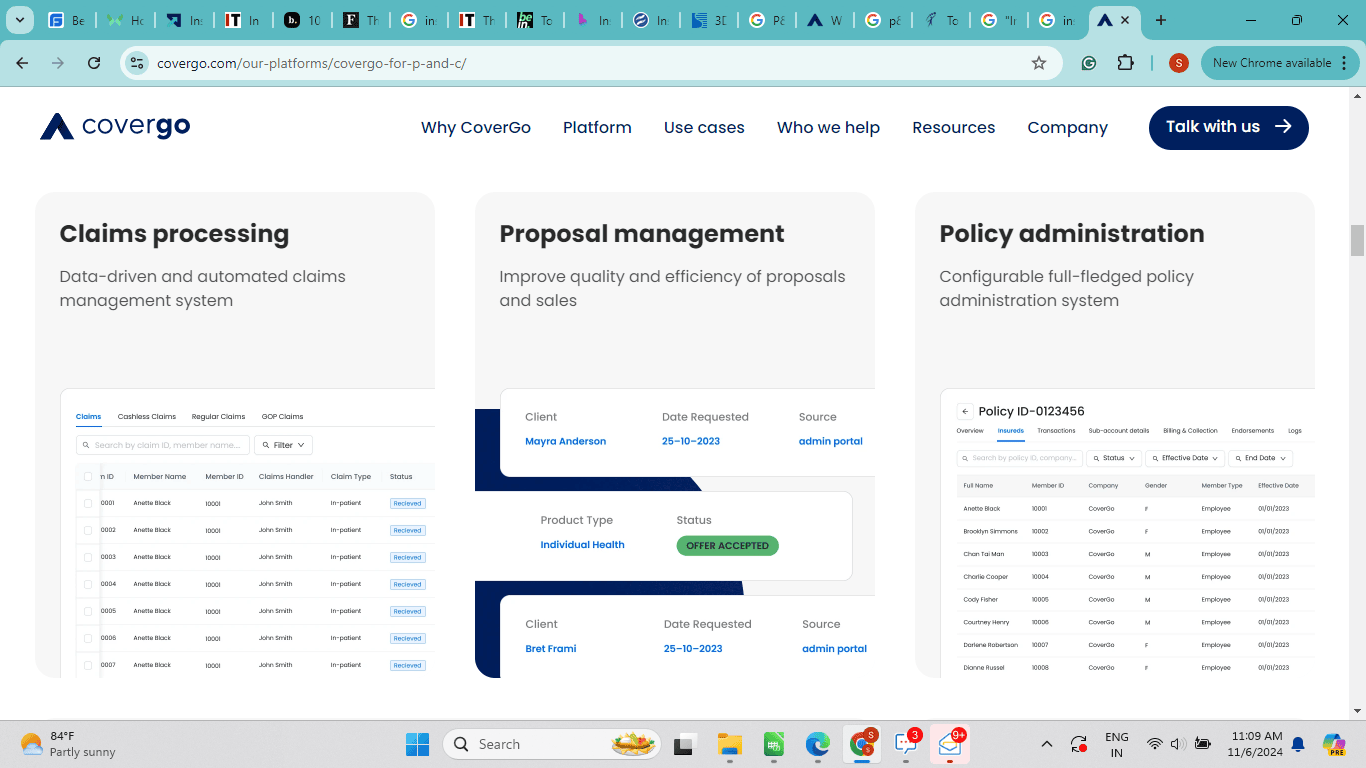

CoverGo

Key Features

- CoverGo uses its patented no-code configuration tools to help insurers improve customer conversion rates, reduce turnaround times, and lower operational costs, ultimately elevating both efficiency and customer experience.

- The software offers customizable portals for clients, employers, health providers, and brokers. This streamlines and facilitates policy and claim management.

- CoverGo is ISO 27001 certified, ensuring security and preventing any data leaks.

- CoverGo’s distribution platform is a part of the insurance suite; it provides omnichannel distribution across direct distribution, brokers and agents, bancassurance distributions, embedded insurance, and affinity partnerships.

- The advanced technical infrastructures allow for multi-cloud deployment and support integration with AI and ML, while Microservices architecture ensures enterprise-level scalability and flexibility at a nominal fee.

| Starting price | Free Trail | Free Version |

|---|---|---|

| CoverGo pricing is available upon request. | Not Specified | Not Available |

Benefits

No-Code Builder: CoverGo’s no-code platform allows insurers to build products quickly without needing technical support.

Open Gateway: The platform provides over 500 APIs, ensuring smooth integration with existing systems and external services.

Modular Design: This enables insurers to adopt specific features or perform a full system upgrade based on needs. It also facilitates quick implementation.

99.9% Uptime Commitment: The software assures users of 99.9% uptime and 24/7 global support.

Implementation Approach: CoverGo’s team of service experts facilitates the implementation process through a step-by-step MVP (minimum viable product) delivery methodology, which warrants success within the promised budget and timeline.

Insuresoft’s Diamond Platform remains a leading software solution for Property and Casualty (P&C) insurers. The platform leverages its 30+ years of industry experience, allowing insurers the flexibility to implement it as a complete suite or as individual modules, depending on business needs. With a focus on innovation and custom implementations, Insuresoft streamlines the entire product lifecycle by utilizing real-time analytics, fraud detection using AI and ML, commitment to security and compliance, and self-service options for policyholders.

Key Features

- The solution offers over 140 pre-built third-party integrations; with its API-first design with a low/no-code toolkit making integration with existing and external systems easy.

- The core system also has a built-in document and workflow management functionality, supporting insurance carriers MGAs, and TPAs.

- The software conducts bi-monthly updates to ensure the system runs on the latest tech.

- The solution is equipped with a unified code base that supports all user types. It also offers flexible portal access for agents and clients.

- Insuresoft boasts a 100% success rate in deploying its solutions, with all implementations reportedly going live without major issues.

| Starting price | Free Trail | Free Version |

|---|---|---|

| Starts at $1,500/month | Not Available | Not Available |

CoverGo’s P&C insurance software, known for its innovative no-code platform, continues to gain traction in the insurance industry as of 2024. Its core solution supports rapid, end-to-end digital insurance processes for both property and casualty (P&C) insurers. Built with an API-first architecture, CoverGo integrates easily with existing systems, making it ideal for insurers who want to modernize without complexities. This platform allows users to create, customize, and manage insurance products with speed and flexibility, enabling insurers to develop and launch new offerings in days rather than months.

BriteCore is a cloud-based software designed specifically for property and casualty (P&C) insurance providers, catering to small and mid-sized companies. BriteCore stands out with its suite of core functionalities, including policy administration, claims management, billing, and customer engagement tools. It stands out in the market with its comprehensive functionality and flexibility in configuration and integration.

Key Features

- The digital interface allows for a web-based agent portal to quote, manage policies, and file claims; a policyholder portal and mobile app with self-service capabilities; and an insurer portal with custom access controls.

- The solution’s flexibility extends to underwriting, where rules and guidelines for underwriting can be modified, user-friendly tools that allow pricing changes across all lines of business, and easily add new lines and ancillary products.

- BriteCore provides customizable reporting and analytics, and configuration-based customization adjusts reporting tools to accommodate changing business needs and improve strategic planning.

- The software’s data encryption entails TLS (Transport Layer Security) and HTTPS, AES-256. Additionally, it includes RBAC, MFA, private key access, and key rotation.

- By relying on AWS hosting, BriteCore ensures continuity even during outages. It uses Amazon’s multiple availability zones for disaster recovery.

| Starting price | Free Trail | Free Version |

|---|---|---|

| BriteCore pricing is available upon request | Not Available | Not Available |

Benefits

Reporting and Analytics: The solution leverages analytics powered by AI and ML, real-time reporting through in-memory database technology, and built-in financial and regulatory reporting.

Risk Mitigation: The software helps insurers track and manage risk-related data; it can detect fraud, facilitate improved underwriting decisions, and monitor claims.

Custom Document Generations: Business users can preview, generate, and print any policy deliverables, including custom and stock deliverables; These documents can also be attached to emails.

Security: Apart from the standard data encryption, the software conducts regular security audits and penetration testing.

WaterStreet is a cloud-based insurance software solution built primarily for the property and casualty (P&C) insurance sector, focusing on simplifying processes across the quote-to-claim lifecycle on a single platform. Hosted on Microsoft Azure, it offers excellent security and compliance. It uses BI, AI, and ML to improve customer experience, all while optimizing cost and enhancing market agility.

Key Features

- The software is hosted on Microsoft Azure; WaterStreet uses Azure Data Factory for scale-out serverless data integration, Azure Data Lake to store data that can be processed and analyzed across multiple platforms and languages, and Azure Analytics Service (Data cube) – a no-limits analytics job service.

- The software offers self-service tools with no code configuration for users to modify offerings based on business requirements.

- The solution’s built-in business intelligence (BI) data model entails AI-powered anomaly detection and natural language exploration capabilities.

- WaterStreet’s fully branded and white-labeled portal allows policyholders to access and update policy details, make online payments, eSignature, PCI Payment options, and omnichannel engagement options such as text, social media, and email communication.

- The solution utilizes a monthly SaaS subscription that includes software, service, and support.

| Starting price | Free Trail | Free Version |

|---|---|---|

| WaterStreet pricing is available upon request. | Not Available | Not Available |

Benefits

Back Office Support and Services: WaterStreet offers services such as accounting support, print & finish distribution, policy support, and a customer service call center.

BI Reporting Capabilities: The software’s BI allows for more than 50 standard reports and customizable dashboards. It also offers drill-through capabilities, a wide range of visualization options, and a report builder with a drag-and-drop report editor.

Billing and Accounting: The built-in billing automates the entire billing cycle with configurable workflows and multiple payment methods and integrates financial reporting. It also manages compensation for agents.

Expert Support: WaterStreet’s team of experts provides dedicated support for users. BI also offers in-app help articles and interactive walkthroughs.

Claims Management: It handles end-to-end claims processing from the first notice of loss (FNOL) to settlement. It also detects fraud and manages loss reserves.

Enterprise Business

Guidewire

InsuranceSuite is an insurance management solution designed to assist insurers in simplifying their operations. This versatile solution can be deployed in both cloud and on-premise environments through platforms such as Amazon Web Services and Microsoft Azure. Guidewire has over 300 P&C insurance customers in over 40 countries. It has also invested more than $600 million in R&D since 2016 and typically rolls out 3 versions of its software every year with the latest insuretech innovations.

Key Features

- Guidewire’s Insurance Suite integrates ClaimCenter, PolicyCenter, and BillingCenter to provide end-to-end insurance processes.

- The solution is built on the Guidewire Cloud Platform (GWCP) and includes automatic updates and maintenance. More than 140 customers use GWCP.

- Guidewire uses embedded analytics within core processes; it runs operational monitoring through Guidewire Explore and utilizes predictive analyses for claims and underwriting processes.

- The software has advanced business agility: Guidewire’s product designer develops products rapidly, quick quote-and-buy experiences are autogenerated digitally, and many other features that propel its position in the market.

- Guidewire’s digital capabilities are extensive, with omnichannel customer communication and an Experience Manager who creates and optimizes digital experiences.

| Starting price | Free Trail | Free Version |

|---|---|---|

| Contact Guidewire for the prices. | Not Available | Not Available |

Benefits

Integration Capabilities: InsuranceSuite entails an API-driven architecture that integrates easily with third-party applications like DocuSign, Hubio, Polonious, CoreLogic, LexisNexis, and many other applications.

Security and Compliance: The solution uses a comprehensive set of compliance certifications and attestations, including SOC 1,2,3, ISO 27001, PCI DSS, and more.

Support and Training: Guidewire provides training, documentation, and a partnership network that helps users make optimum usage of the products. Technology & Services Industry Association (TSIA) recognizes Guidewire Education with a 2023 star award.

Guidewire Marketplace: This platform allows insurers to buy apps, content, and pre-built product models to enhance policyholder experiences.

Key Features

- The solution was built for the global market and was equipped with various models required to manage core operations. The product offers a detailed future road map and a unique global service delivery model.

- The solution includes a reinsurance module that configures and integrates reinsurance treaties with policy and claim management. With its multi-level treaty setup model, it also supports Facultive (FAC) inward and outward business.

- InsureEdge is IFRS 17 compliant; it uses data points for IFRS reporting. Additionally, it uses ready reports, multi-level escalations, alerts, and reminders.

- The interactive dashboards act as easy data access points to push data into Data Lake or Data Warehouse for further reporting and improved monitoring.

- The system comes with interconnected portals for agents and customers– a feature-rich customer self-service portal, on both web and mobile platforms and an agency portal to manage agents and commission structures.

| Starting price | Free Trail | Free Version |

|---|---|---|

| Starts at $400/month | Not Available | Not Available |

Benefits

Business Intelligence: The system can provide over 200 pre-built standard and statistical reports. Through mobile-friendly dashboards, it presents real-time business insights. It also integrates with the CRM system to present a consolidated view of customer interactions.

Digital Document Repository: Physical documents related to claims, policies, or litigations can be linked to their digital counterparts through the store-keeping module to monitor physical file movements.

Operational Accounting: It clearly shows income and expenditures and allows for integrations with Microsoft NAV or other third-party accounting software.

Implementation Process: InsureEdge applies a quick and simplified 4-stage implementation process; moreover, the system architecture allows for customization.

CRM: InsureEdge offers an integrated CRM system with a holistic of customer interactions, sales activity, and lead details on a unified dashboard that extracts data from multiple sources.

Sapiens P&C general insurance software is a cloud-based insurance management solution that complies with General Data Protection Regulation (GDPR) standards, tailored for medium and large organizations in the non-life property and casualty and general insurance sectors, supporting direct-to-consumer and agent/broker distribution. Sapiens offers multilingual and multi-currency support. The vendor provides standard maintenance, 24/7 online assistance, and on-site customer training and support.

Key Features

- The software supports traditional and digital channels; It manages direct insurance, bancassurance, and digital channels.

- A modular design with low-code configuration is a standout aspect of the IDIT suite which reduces time to market by 75%. The product and pricing configuration engine allows users to create, amend, price, and test products.

- IDIT is a cloud-ready solution that supports hybrid AWS and Azure platforms, and with always-on cloud delivery, it ensures consistency.

- The solution offers a 360-degree view of customers and agents with detailed data analysis.

- Sapiens’s collaboration with Munich Re allows the former to leverage the latter’s global expertise and share risk to facilitate user expansion and provide a foundation for growth.

- The solution incorporates differential rating, allowing users to evaluate the performance of an investment or fund based on various parameters. It also supports comparative quoting and proposal creation, and users can organize policy components in a shopping cart.

| Starting price | Free Trail | Free Version |

|---|---|---|

| Sapiens (IDITSuite) pricing is available upon request. | Not Available | Not Available |

Benefits

Varied Functions: The solution has multi-company, multi-branding, multi-currency, omnichannel, and multi-lingual capabilities.

Complementary Products: Sapiens offers complementary products that automate and enhance the insurance process– ClaimsMaster, PolicyMaster, BillingMaster, DigitalSuite.

Intelligence Embedded: IDIT’s advanced analytics automates low-value tasks and maximizes BI with decision-ready data by converting data into actionable insights.

ML and AI: ML and AI analyze performance and suggest the next actions. It also manages all elements of the value chain from one core system.

Insurity stands as the largest cloud-based provider of P&C insurance software, with over 400 of its 500 clients already utilizing its cloud solutions. Ranked among the top two core system providers in the P&C industry, Insurity’s ascent to this leading position is credited to its high-quality, configurable cloud solutions, advanced data management and analytics capabilities, strategic acquisitions, deep industry knowledge, and keen insight into evolving market opportunities. The suite includes core policy features, rating, underwriter workbench, document creation, agent portal, business intelligence, reinsurance, billing, and claims.

Key Features

- The solution features a cloud-first platform for rapid product launches and scalability while ensuring compliance with regulations.

- Insurity billing features configurable billing workflows with various payment methods, and real-time automated processes with accurate payment tracking and cash flow.

- Insurity claims features AI-enabled claims processing for claims resolution by faster reporting times and predictive analytics. It also handles catastrophic events.

- The platform’s predictive models anticipate client needs, market trends, and growth opportunities, supporting informed decision-making.

- Insurity policy features smart configuration (intuitive, no-code tools), embedded analytics, and bureau content.

- The software utilizes ready-to-use out-of-the-box bureau lines, which support more than 3000 annual changes, facilitating quick adaption to market changes.

| Starting price | Free Trail | Free Version |

|---|---|---|

| Insurity pricing is available upon request. | Not Available | Not Available |

Benefits

CX: Policyholders have access to self-service capabilities, various payment methods, billing options, including digital payment solutions, and personalized interactions.

Market Presence: Insurity has the largest customer base (more than 400 cloud customers) and has partnered with more than 25 system integrators.

Configuration: Configuration for insurance products, workflows, rules, and document authoring is via tools for BAs and non-IT staff, while screens and integration to third-party service calls are through developer tools, XML manipulation, or a scripting language.

Compliance: It also ensures compliance with ISO, AAIS, and NCCI standards for policy processing, claims management, and billing.

Powered by the low-code, the NewgenONE platform is designed to simplify claims management, underwriting, and policy servicing and automate workflows for policy binding and quotation management, all while accelerating claims processing. These advanced P&C solutions boost operational efficiency, reduce processing times, and enhance customer satisfaction across the board. Key features include provider management, personalized product setup, and easy billing and finance operations, helping you stay competitive in the insurance industry.

Key Features

- The solution is built on a low-code framework which allows for rapid product development and quick adaption to market changes

- Omnichannel customer engagement for personalized and consistent communication across numerous channels.

- Newgen’s unified content management facility centralizes document management and allows for information to be shared among stakeholders.

- AI-driven cloud solutions for data-backed and proactive autonomous decision-making. Using AI and predictive analytics, users can assess risks, detect fraud, and increase efficiency.

- The software automates the entire underwriting process, from risk assessment to policy binding.

| Starting price | Free Trail | Free Version |

|---|---|---|

| NewgenONE pricing is available upon request. | Not Available | Not Available |

Benefits

Compliance and Reporting: The software features wealth management reporting, FATCA compliance, and common reporting standards. It ensures end-to-end compliance to bridge operational silos and increase data security.

Role-based Portals: The system grants specific rights to external partners, intermediaries, and employees based on the roles.

Salvage & Subrogation: Implement a dedicated sub-process to effectively handle salvage and subrogation scenarios

Leading the Way with the Right P&C Insurance Software

As technology advances, the capabilities of P&C insurance software will continue to grow, transforming the industry and enabling insurers to stay competitive. Emerging trends point to greater integration with technologies like blockchain, IoT, and telematics for enhanced risk assessment and fraud prevention. Insurers can look forward to more personalized policies, improved cybersecurity measures, and the further automation of underwriting, claims processing, and customer service.

Additionally, adopting modern P&C insurance software for document generation is also crucial to simplifying processes and improving customer experiences. Effective document generation can improve accuracy and compliance, helping businesses stay competitive in a fast-paced environment.

With Perfect Doc Studio, you can ease bulk document generation in over 100 languages through an intuitive drag-and-drop interface. Our advanced features empower businesses to create, customize, and distribute personalized communications seamlessly across global markets. Take your document management to the next level, ensure precision, and stay ahead with our powerful solutions designed to meet the needs of the insurance sector.

Hence, by adopting these evolving software solutions, insurers can modernize their operations, exceed customer expectations, and adapt to an ever-changing insurance landscape. Those who embrace these tools will be well-equipped to lead in the future of insurance.