As we step into 2025, we must acknowledge that we have indeed entered a digital era. The past two decades have experienced the insurance industry’s transformation through insuretech innovations. As carriers and organizations grapple with abundant data sets, complex regulatory requirements, and evolving customer needs, gone are the days of insurance books, manual processes, or even spreadsheets. An insurance policy management software is paramount to meet these business requirements, not only to stay competitive but also to increase profitability and efficiency.

So what exactly is an Insurance Policy Management Software?

An Insurance Policy Management System (IPMS) automates and streamlines the entire policy lifecycle, from quoting, rating, and underwriting to processing and renewing claims. By implementing it, business users can manage policy life cycles, track claims in real time, utilize various data structures to make more informed decisions, automate manual processes that reduce errors, offer better customer service, ensure regulatory compliance, and more to improve overall performance.

Traditional To Modern Insurance Policy Management Software

Over the past few decades, we saw the transformation of insurance operations from ledgers and insurance books to a gradual shift to spreadsheets with the rise of computers; from there, computer and software program utilization skyrocketed in the insurance industry. The gradual change in policy-making operations addressed the problems created by manual processes, which increased workload. Apart from being time-consuming, its increased risk of errors, limited visibility, difficulty in compliance, and paper usage made it unsustainable.

Want to Generate Documents In Bulk ?

With Perfect Doc Studio, you can simplify bulk document generation in over 100 languages with its intuitive drag-and-drop interface. Our advanced features allow businesses to create, customize, and distribute personalized communications across global markets.

Modern insurance policy management software emerged as the obvious solution, offering end-to-end software services to meet the demands of customers and business users alike, facilitating insurers in creating, distributing, and managing policies.

Policy management goes hand in hand with Billing management and Claims management. Read our blogs on both for a deeper understanding!

Core Components of Modern Insurance Policy Management Software

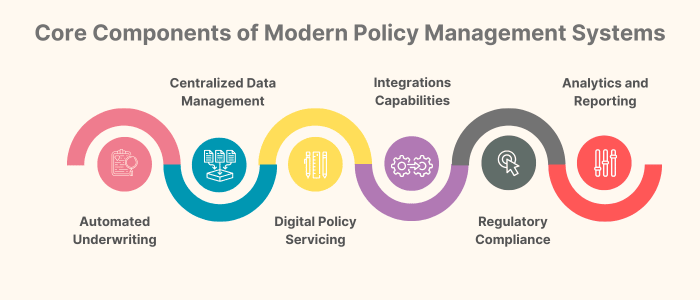

While basic policy administration systems have been in existence since the 90s, an IPMS offers capabilities that far surpass those found in basic administration systems. An Insurance Policy Management Software includes the following components.

Automated Underwriting: With the various sources of data available, underwriters need tools to harness them and optimize their underwriting process with the help of complex algorithms that facilitate risk assessments and policy pricing while reducing errors.

Centralized Data Management: A unified platform that allows different levels of users and stakeholders to access information which encourages collaboration and enhances visibility and customer experience.

Digital Policy Servicing: In this digital era, customers expect mobile accessibility to view, modify, and manage policies through self-service portals or mobile applications.

Integrations Capabilities: The IMPS is a centralized system, but it also needs to integrate with other complementary systems like billing, verification, and other third-party vendors and systems for seamless operations.

Regulatory Compliance: The solutions have built-in compliance checks and automated updates to ensure insurers are up-to-speed on the latest changes in compliance requirements. There are also specialized systems that help with niche domains.

Analytics and Reporting: Analytics tools are crucial to understanding customer behavior, analyzing risk exposure, and improving risk portfolios.

There are specialized tools, such as Insurance Compliance Software, Insurance Underwriting Software, and Insurance Analytics Software; these tools will complement your existing systems and enhance the overall performance.

Top Insurance Policy Management Software in The Market

Guidewire PolicyCenter

PolicyCenter is Guidewire’s insurance policy administration system and part of its broader suite offerings. It is renowned for its speed to market, superior policyholder experience, and ongoing innovations. PolicyCenter provides insurers with tools that are required in this day and age to stay competitive by designing, deploying, managing, and iterating on the insurance experience efficiently.

Key Features

- Guidewire’s Advanced Product Designer uses an intuitive mind-mapping interface to visualize products before deployment, test policy transactions in real-time, make changes without coding and allow rapid product development.

- The solution includes embedded data and analytics for more accurate risk analysis and decision-making.

- The comprehensive policy lifecycle management streamlines processing with automates ISO forms processing.

- The solution includes a cloud-based rating engine that allows underwriters a holistic view of each account and submission.

- Automates quoting, binding, and policy issuance based on business needs and integrates with preferred services.

- PolicyCenter integrates with other related systems to streamline and make informed renewal decisions.

Benefits

Speed to Market: With rapid product design capabilities, the solution can reduce the launch of new products from weeks to days.

Omnichannel Experiences: The solution offers functionality across various channels like phone, in-person support, and digital channels.

User Experiences: The customizable user interface, third-party partnerships and guidewire marketplace, and personalized offers to policyholders using marketing logic and predictive analysis enhance user experience.

Data Management: PolicyCenter consolidates data from various sources and improves the data quality, integrity, completeness, and consistency. Through operational data and models, users can solve specific business issues.

Ongoing Innovations: Guidewire has invested in research in the insurtech domain to equip users with the latest technology. Additionally, the software undergoes frequent updates.

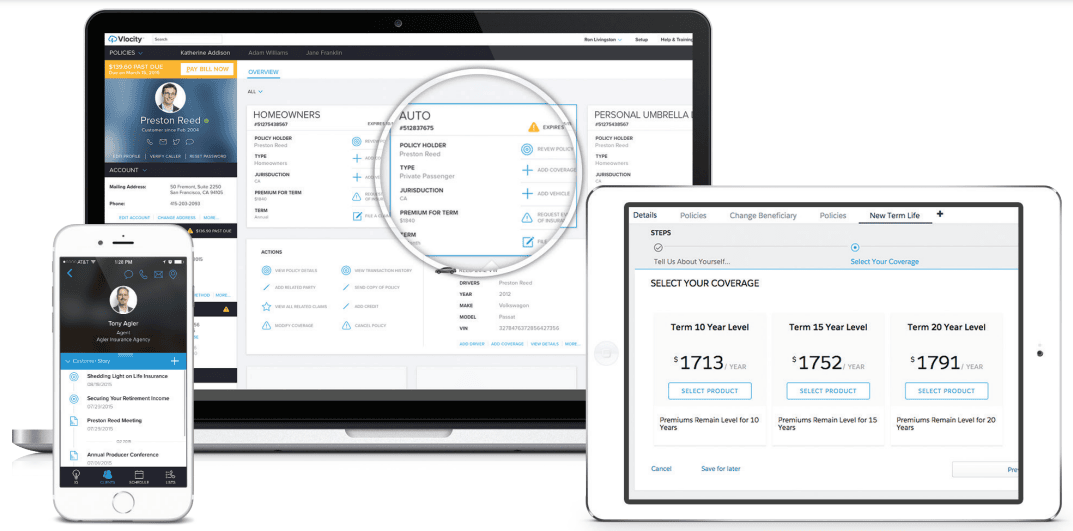

Vlocity Insurance Solutions

Vlocity Insurance (Salesforce Industries) is a pre-built solution on the Salesforce platform. Vlocity leverages cloud and mobile applications to deliver digital, omni-channel processes through industry-specific expertise, service management, and developer experience. The insurance policy management software streamlines the complete policy lifecycle and equips insurers with tools to meet customer demands and identify and profit from growth opportunities.

Key Features

- The quote-to-bind process is cloud-native, allowing customers and insurers to access self-service on all devices. It also includes AI-powered add-ons for improved functionality.

- Vlocity’s policy administration extends to various policy transactions, including coverage verification, automated renewals, out-of-sequence endorsements, and premium tracking of a policy from issuance to termination.

- Vlocity ensures policyholders experience quick and transparent claims processing, providing a dynamic first notice of loss (FNOL) experience. Users can enhance their claims management experience by integrating with customer relationship management.

- The solution allows users to visualize complete household and business networks, from individual policyholders, corporate accounts and households to agents/brokers, insurance carriers, and service partners.

- The software delivers guided service through proactive renewals and identifying cross-selling opportunities to maximize customer retention and satisfaction.

Benefits

Omni-Channel Delivery: Vlocity delivers targeted functionality through optimized mobile apps, customer portals, producer portals, and sales or service solutions.

Speed to Market: Built on Salesforce, insurers can adapt to changing regulations and market standards to launch new products quickly.

Business Growth: Apart from the obvious increase in productivity, Vlocity enhances pipeline management and cross-selling opportunities, improves renewal rates, and manages risk portfolios.

Agile Middle Office: The system integrates front, middle, and back offices; moreover, it includes product definition, industry object model, intelligence, rating, rules, and documents & forms.

AI-Powered Insights: By leveraging intelligence, it gives users insights on whitespace opportunities and integrates abandoned quote requests into nurture campaigns.

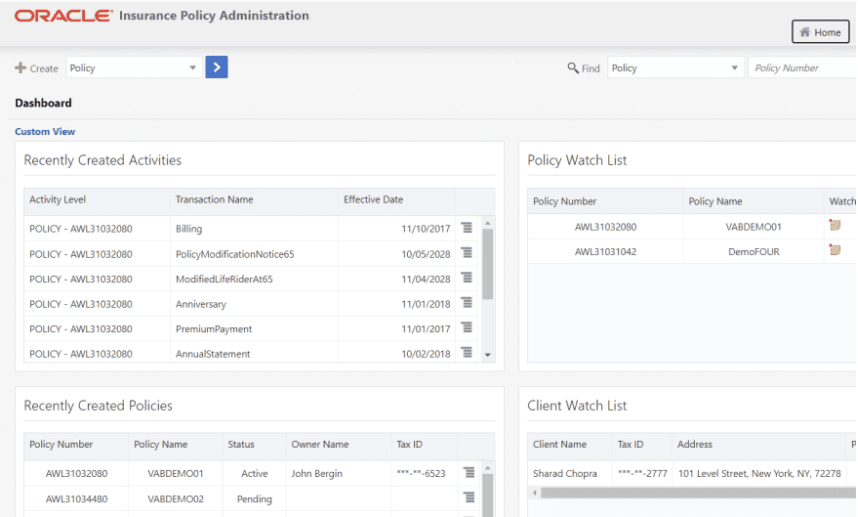

Oracle Insurance Policy Administration (OIPA)

Oracle Insurance Policy Administration is specially designed for individual life and annuity and group insurance on a unified platform. This modern, rules-based open architecture supports straight-through processing across the complete policy lifecycle, including underwriting, policy issuance, billing, claims management, and more. It supports new business underwriting, policy issuance, billing, collections, policy processing, and claims for individual life and annuity and group insurance—all on a single platform.

Key Features

- The solution can rapidly configure, adjust, manage, and bring life insurance products to market through a highly flexible, rules-driven engine, even without programming knowledge.

- OIPA utilizes prebuilt templates and components to ease the development and deployment of standard insurance products, while reusable templates are utilized for product updates.

- The rules palette can define and customize business rules through an intuitive drag-and-drop interface, which also includes a data dictionary, a debugger, consistent naming conventions, and validates calculations.

- OIPA is known for its scalability, supporting up to 100 million policies while integrating with existing systems for large-scale operations.

- Group functionality offers different products to different classes of group members, and it supports group billing and group census, defines group customer relationships, and facilitates product cloning.

- OIPA enhances audit and compliance by maintaining a detailed audit trail, and storing transactions, including reversals, with complete data flexibility while ensuring compliance.

- The new business underwriting enables the creation of hybrid products across retail and group businesses on OIPA’s platform.

Benefits

Product Configuration: Insurers can share business rules across the product lifecycle, clone products, and copy plans.

Multilanguage and Multicurrency Support: The system supports multilanguage and multicurrency functionality to comply with localization requirements.

Tax Compliance: OIPA transactions and business rules are generated based on DEFRA and TAMRA actuarial formulas and share a common data set.

Workflow Task Management: The solution organizes and streamlines workflow policy activities, allowing user roles and controls to access tasks and work on activities, policies, applications, and clients.

Business Insights: OIPA uses analytics to mitigate risks and present company-specific insights with prebuilt dashboards that consolidate policy and claim data.

Majesco Policy for P&C

Majesco Policy for P&C is designed for personal, commercial, specialty, worker’s compensation, and new innovative products. The platform caters to customers’ evolving needs and tailors products accordingly. Its robust features, cloud deployment options, API-driven architecture, ecosystem partner integration, and regular software updates make Majesco an emerging competitor in the market.

Key Features

- The solution supports personal, commercial, and specialty lines of business with extensive ready-to-use Bureau Lines content, including over 4,000 forms, 14,000 data fields, and 40,000 rules.

- Majesco streamlines the complete lifecycle of a policy from quoting to issuance and renewal.

- The system performs automated monthly updates for Bureau Lines rates, rules, and forms and conducts software updates.

- The solution includes pre-loaded templates and ready-to-use configurable content to meet market needs with customizable insurance products.

- Majesco’s built-in rating engine manually creates or changes rates for new and existing products, and it can also integrate with other rating content.

- Majesco’s underwriting workbench includes automated decision-making processes, intelligent work routing, evidence gathering and assessment, built-in self-learning engine for similar cases.

- The software is integrated with Majesco Business Analytics, Majesco Enterprise Data Model, and Majesco Enterprise Data Warehouse to make better underwriting decisions.

Benefits

Partner Ecosystem: The system allows integration with the partner ecosystem that provides access to technologies like AI, ML, chatbots, IoT, Virtual Reality, and much more.

Configuration Toolset: Majesco Content Developer offers business users and IT developers an intuitive, web-based user experience for configuring rules, rates, and forms.

Data and Analytics: The built-in reporting and analytics capabilities include pre-configured mapping of metadata, standard reports, and dashboards to present actional insights and better risk assessments.

Speed to Market: The platform rapidly develops and deploys new products through pre-defined products for all US states and Jurisdictions and ready-to-use content.

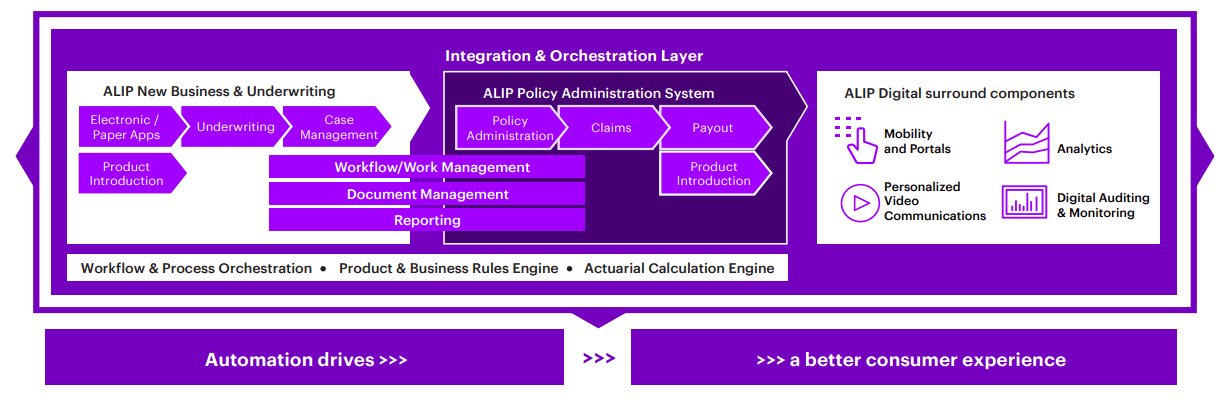

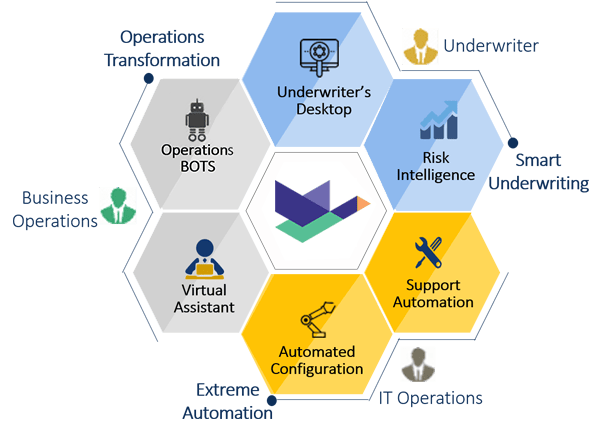

Accenture Life Insurance & Annuity Platform (ALIP) Policy Administration

Accenture Life Insurance & Annuity Platform (ALIP) is a policy administration system that delivers products quickly through industry-leading tools that automate, configure, test, and integrate to launch more products, reduce operation costs, and provide superior customer service. Built on a fully configurable, angular-based platform, ALIP is a rules-driven insurance policy management software with various deployment options.

Key Features

- ALIP’s extensive library of ready-to-use life and annuity products includes Traditional life products, Non-traditional offerings, and Diverse annuity products.

- Product configuration can be done through a modern workbench and workflow, actuarial calculation engine, transactions and fund components, and Product Testing Workbench and Debugger.

- The platform’s architectural design features a single and continuously improved code base through Kubernetes to reduce IT maintenance and low-/no-code applications simplified maintenance updates.

- The actuarial calculation engine can support complex formulas and product tables.

- The out-of-the-box product templates are preconfigured and tested to expedite product launch. Additionally, preconfigured rules are applied to new product features, riders, and benefits to product structures and calculations.

- ALIP’s Base First Approach, Continuous Upgrade Program, Client Advisory Board, ALIP University consolidate best practices and latest enhancements, aiming to reduce customization needs and expedite time to market.

Benefits

Deployment Options: The design offers flexible and cost-effective Software as a Service (SaaS) and Platform as a Service (PaaS) models.

Compliance Features: ALIP includes built-in compliance functionality for U.S. tax processing and can configure rules and calculations for the global market.

360° Customer Visibility: The platform allows a holistic real-time view of customer interactions, policy information, and more.

User-Centric Interface: The platform features drag-and-drop capabilities for easy configuration without needing IT expertise.

Transaction Management: The platform handles cash management, claims processing, billing, and more with integrated transactional capabilities.

Duck Creek Policy

Duck Creek Policy is a comprehensive cloud-native solution, combining advanced features with user-friendly configuration, security and compliance measures, and excellent customer service capabilities. It can be deployed as a standalone solution or part of Duck Creek’s broader suite. It manages the entire policy lifecycle, from quote to bind to issue. Duck Creek Policy was named ‘Luminary’ in the 2023 Celent Report of P&C PAS.

Key Features

- Duck Creek Policy facilitates the configuration and customization of insurance products with over 6,000 unique combinations of commercial line templates.

- Duck Creek’s test automation center builds automated test scripts, validates them, and accelerates the delivery of new or changed products.

- The platform includes an advanced rating solution and forms engine, which was purpose-built into the configuration tools.

- Duck Creek Anywhere Technology framework allows third-party systems to access product definitions and pre-integrates with Duck Creek’s global alliance partner’s systems.

- The dynamic insurance product definition and configuration toolset allows business users to define and maintain insurance products without IT expertise.

- Duck Creek Policy tailors workflows to specific user roles with persona-based models and low-code, drag-and-drop configuration for people-centric UX.

Benefits

Single Point of Change: Product deployments are streamlined with a single point of change for rating, rule, form, and page modifications.

Omnichannel Support: The platform offers self-service capabilities and multi-channel support for customers, agents, brokers, and third-party entities.

Underwriting Capabilities: The underwriting rules engine flags common issues, configures rules based on underwriting experience, and autogenerates follow-up tasks. It redirects only non-routine cases to underwriters for review.

Regulatory Compliance: The platform pre-configures ISO, AAIS, and NCCI product definitions with a comprehensive library of product content.

Resources and Support: The platform offers a dedicated customer service team, training resources— Duck Creek University- and a partner ecosystem for easy integration and implementation.

Instanda Manage

Instanda Manage is a cloud-native policy administration solution with a unique approach o product development and management. With a primary goal of reducing the time to market from months to just weeks, Instanda’s Manage is considered a technology standout among policy administration software. Insurers and MGAs can create, manage, and deliver insurance products through a no-code innovative platform with extensive features and benefits.

Key Features

- The platform facilitates rapid deployment with no-code product configuration that quickly designs and customizes insurance products without needing IT expertise.

- Instanda includes advanced analytics and reporting capabilities that provide detailed insights which allow users to make informed decisions and product offerings.

- The drag-and-drop interface extends to designing customer user experiences, configuring complex rating rules and workflows, and facilitating rapid product launches.

- Instanda allows policyholders self-service through a web app that enables users to manage their payments, update information, and view policy documents.

- Group Policy Management enables users to configure and iterate products and offers tailored employee and member portals.

- Instanda performs real-time modifications to existing products and allows insurers to rapidly test and integrate new offerings, enabling them to respond quickly to market opportunities.

Benefits

Bulk Upload: The platforms simplified the onboarding process for corporate clients through bulk upload capabilities.

Unlimited Integrations: The platform offers unlimited API and Webhook integrations such as HazardHub, DocuSign, Salesforce, Hyperscience, and more.

Multi-Channel Distribution: The diverse distribution strategies on this platform include consumer-facing portals, broker interfaces, internal staff portals, corporate administration dashboards, and employee self-service portals.

Flexibility: The product can easily change products to meet market demands, test them, and adjust based on customer feedback through no-code configuration.

FIS Policy Administration Suite

FIS Policy Administration Suite (formerly Compass) is an enterprise-level rule-based solution supporting multiple lines of business, such as traditional life, whole life, and variable interest-sensitive policy administration globally. Known for its high service quality, customer experience, and scalability level, the FIS Policy Administration Suite streamlines the entire policy lifecycle while responding quickly to market changes.

Key Features

- Due to its configurable nature, the accelerated market response allows insurers rapid development, adaption to regulatory changes, and expansions into new markets.

- The platform provides a holistic view of all policies with self-service capabilities on the web and mobile.

- The platform can quickly construct any type of product and supports many lines of business, including pension, savings, life, variable life, critical illness, annuity, disability, AD&D, dental, vision, and health.

- The solution can be deployed on-premises or hosted won FIS’ mission-critical facilities. It would be deployed through web-based J2EE client applications for users with UNIX or Linux servers.

- The platform’s insurance-in-a-box core administration capabilities utilize flexible business rules and workflows across underwriting, issuance, claims, billing, commissions, and actuarial.

Benefits

Global Capabilities: The platform supports multiple currencies and languages and offers global implementation support.

Implementation Support: FIS’ team of experienced business and technical professionals use time-tested project management methodologies to accelerate implementation. They also provide advisory services from industry experts and ongoing support.

Information Management: The solution monitors and tracks process flows; business users or decision-makers receive notifications of reports.

Business Process Management and Workflow Tools: These tools automate and reduce manual processes while validating and monitoring decisions.

Equisoft Manage

Equisoft Manage is a SaaS policy administration system designed for life, group, and annuity insurance products; it streamlines the complete policy lifecycle through its modular design digital modules, workflow, CCM & document management and API-driven architecture. By providing off-the-shelf innovations, Equisoft aims to enhance flexibility and improve efficiency. Equisoft has been refining its insurance policy management software, with the advanced analytics update expected shortly.

Key Features

- The platform’s modular design activates a web of accelerators and tools, including e-applications, illustrations, document generation, management, workflow, and claims processing.

- Equisoft offers business-driven APIs that integrate with other applications in the ecosystem and even third-party applications, including application capture systems (eApp, Tele-App), automated underwriting tools, premium collection services, and more.

- Equisoft assures self-sufficiency with its low-code IDE and carrier self-service tools, allowing insurers to manage development and administrative tasks independently, control product updates, release safely to production, and other innovations across the lifecycle.

- The platform’s plug-and-play design reduces implementation costs and timelines.

- The solution utilizes AI-augmented dashboards with business insights and oversight equipped with automated triggers to improve loss ratios and portfolio growth and an advanced configurable alerting system.

- The OOTB data staging solution allows insurers to control their data strategy to optimize data management.

Benefits

Security and Compliance: The platform’s advanced measures include strict access controls, audit trails, disaster recovery protocols, SOC, ISO, and Enterprise Risk Management (ERM) certification.

Actionable Insights: Although an analytics update is yet to be added, the platform does include actionable insights through advanced analytics integrated with AI, predictive & prescriptive analysis.

Document Management: The platform handling features include a scalable repository for high data volumes, automated information governance, email integration, custom template creation, and the ability to digitize, store, assign, track, and follow up on all content.

Pre-Built Templates: The solution includes cost- and time-saving templates for individual and group life, annuities, and individual and group health to quickly launch complex insurance offerings.

Solartis Insure

Solartis is a cloud-native, microservices-based platform that supports the entire policy lifecycle across all P&C, commercial, and personal lines. With a flexible and scalable API-centric platform, Solartis Insure can facilitate both established insurance organizations and insurtech startups. The solution supports multiple companies, products, and sublines in a single insurance product; Moreover, the solution’s pricing is based on usage for both startups and businesses.

Key Features

- The platform, built on microservice technology, has 100 specialized policy lifecycle microservices and runs on Oracle Cloud, Azure, or Google Cloud.

- Solartis Insure has a built-in ISO Electronic Rating Content (ERC), pre-configured pure ISO commercial lines versions, and automated updates for the latest ISO circulars.

- The platform is equipped with out-of-the-box or custom user interface screens.

- Solartis Builder toolkit allows rapid product setup and low-code configuration allows for self-service maintenance, testing, and deployment.

- Solartis Insurer generates dynamic document generation, supporting proposals, worksheets, policy packets, endorsements, and version control with effective dating.

- The platform’s headless architecture completely separates frontend and backend services.

- The platform improves compliance through automated ISO updates, built-in version control, comprehensive audit trails, and multi-state support.

Benefits

Customer Support: The platform provides expert-led customer support and ongoing maintenance and updates.

Modern Tech Stack: The platform’s foundation is built on Java EE, RESTful services, Kubernetes, and Oracle Cloud.

Cost Considerations: The platform’s usage-based pricing model is beneficial and cost-effective for organizations. With lower upfront costs, this is a suitable solution for small and medium-scale insurers.

Implementation Support: Through an agile methodology, thorough testing and quality assurance, and regular updates, the dedicated implementation teams provide support and ongoing maintenance.

Conclusion

The insurance industry has been revitalized through insurtech innovation, and its importance cannot be overstated. The solutions highlighted above present some of the best options in the market for organizations of various sizes. Each insurance policy management software comes with its unique features and tools; there is a lot of overlap in the features, but boiling it down, business users need to find a insurance policy management software best suited for their organization’s needs.

What is the next step?

1. Assess and define your requirements based on the size and specific needs.

2. Create a detailed document with a finalized list with specific requirements for the software.

3. Research available insurance policy management software; look for options that align with your needs.

4. Request trials and demonstrations from a few vendors to better understand the product.

5. Engage stakeholders from various departments like underwriting, claims, and more to evaluate shortlisted insurance policy management software.

6. Speak with reference clients of similar size to truly comprehend the benefits and drawbacks, if any.

7. Prepare well for implementation, as it may take longer than the estimated timeframe.

Successful implementation of an insurance policy management software is where proper planning, change management, and ongoing support are involved to make the implementation efficient and effective. Users should choose a solution based not only on their present needs but should also consider the future growth of the organization.