The insurance industry is experiencing rapid growth, and with this growth comes the burden of workload that needs to be managed by insurers. Specifically, the overwhelming number of claims submitted on a daily basis requires attention. Insurance professionals overseeing the claim process, such as claim processors, adjusters, agents, appraisers, and others, require specialized tools. Insurance claims management software is one such tool that helps insurance professionals.

An organization may have a CRM or an insurance suite, but a specialized tool that caters to the requirements and needs in that line of business is not just a strategic advantage but rather imperative. As insurers look to optimize operations, they turn to specialized software, such as insurance underwriting software, insurance analytics software, and insurance verification software. Likewise, this has made insurance claims management software vital for insurers and organizations to transform how they evaluate claims.

Why Do Organizations Need an Insurance Claims Management Software?

Traditional claim processing methods are becoming obsolete; insurers need to rise to the occasion with the transition to a more digitally connected world. Conventional methods often rely on paper-based documents, ledgers, and manual processes. Later, there was a shift to using spreadsheets and computer applications. However, these methods are inefficient, leading to delays in claims processing, a spike in operational costs, poor resource management, and, most importantly, increased customer dissatisfaction.

Want to Generate Documents In Bulk ?

With Perfect Doc Studio, you can simplify bulk document generation in over 100 languages with its intuitive drag-and-drop interface. Our advanced features allow businesses to create, customize, and distribute personalized communications across global markets.

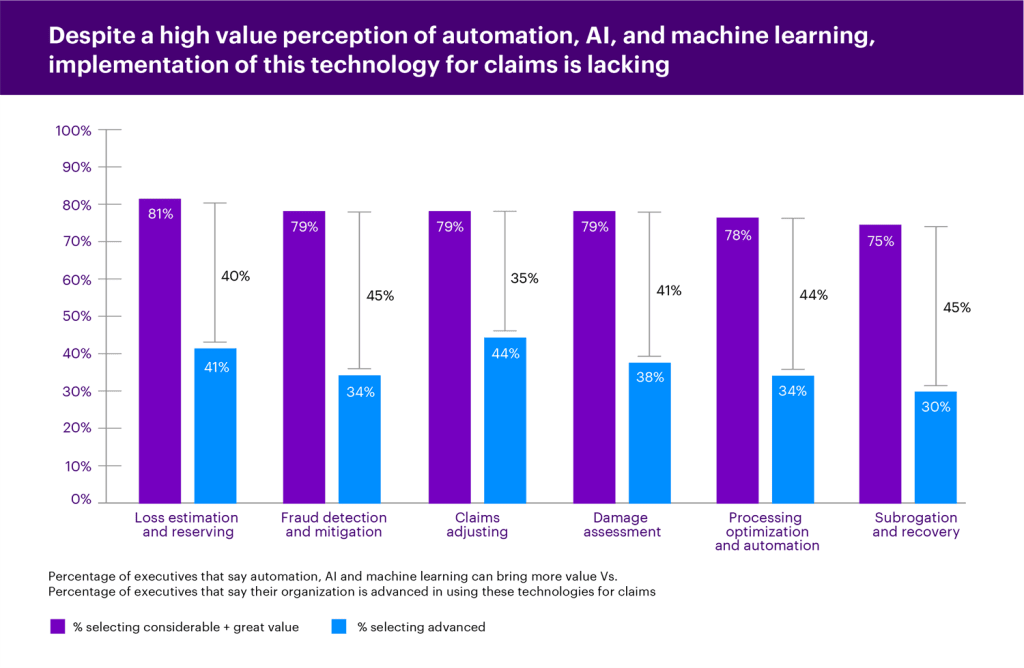

Now, technology is pervasive in the insurance sector, with insurtech innovations leading the way to the insurance industry’s future. Although technological integration and innovation might seem obvious, many organizations are reluctant to embrace these changes. A survey conducted by Accenture reported that a least 75% of insurance executives believed insurtech innovation would benefit the company, but only 44% of them actually use such technology in their claims processes.

This reluctance may be due to the investment required to implement such a complex system, the challenge of training employees, and ongoing costs. Nonetheless, investing in an insurance claims management system is a necessity. Insurers need to move beyond the view that technology is just an expense or a challenge and focus on the various benefits that it provides us.

Insurance Claims Management Software for Multiple Lines of Business

OneShield Claims Solution

OneShield’s insurance claims management software is a robust platform that automates and streamlines every stage of the claim lifecycle. It is hosted on the cloud or delivered as a SaaS model. The software features a customer center, integrated partner management, and journal and task management, extensive reporting capabilities, and a comprehensive user dashboard. The solution supports over 90 lines of business, with pre-built content, collaborative implementations and integrations, and pricing models that make OneShield a market leader in insurance claims management software.

Key Features

- Incident management tracks activities and identifies opportunities before converting claims. This allows users to detect fraud and identify and implement loss control.

- The platform automates coverage identification, by identifying and recommending relevant coverage information, the adjuster can apply for claims accordingly.

- OneShield automates the assignment of claims based on established criteria such as user role, skill set, lines of business, and more. It also assigns work to internal or external parties through notes, tasks, and more.

- Recommendations such as identifying the right reserves for different coverages, loss control measures, addition of new incident types, and more are based on changes in the market or data collected through research or reports and insights.

- The solution provides comprehensive litigation tracking and management and supports different reserving types.

- OneShield’s Management extends to various aspects of the claims process; it includes property/party management, service request management, document management, user administration, and configuration control.

Benefits

Business Intelligence: The platform’s reporting tools provide near real-time data and insights so adjusters and claim processors can make informed decisions.

360-Degree View: The platform offers a holistic view of the claim summary, with BI cubes and canned reports presenting incident and task data.

OneShield Designer: The design tool is a metadata-driven solution with a pre-populated insurance-centric data model that configures workflow, product definition, object model, and interfaces to legacy and third-party systems.

Pre-Built Insurance Content: The solution includes pre-built and pre-defined configurable data models, workflows, incident types, loss types, causes of losses, reserve types, payment categories, and coverage definitions process.

OneShield Solution Add-Ons: The platform offers various add-on services, such as the OneShield Portal, OneShield Partner Relationship Management, and OneShield Reporting.

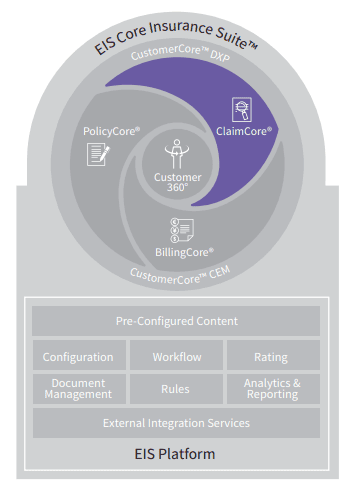

EIS ClaimCore

EIS ClaimCore is an insurance claims management software known for its flexible architecture, intelligent automation, and cross-domain support. The solution supports multiple lines of business. Through proprietary fraud detection, workflow automation, user-centric design, and configured customer experiences, EIS ClaimCore delivers operational efficiency and enhanced user and customer experiences.

Key Features

- The solution intakes claims through multiple channels such as mobile apps, emails, and online forms, data streams, and intelligent automation routes the claims according to the data.

- ClaimCore manages the entire claims lifecycle–from assignment to resolution– through highly configurable workflows that allow for dynamic processing, ensuring that claims only go through the necessary stages.

- The solution supports various lines of business, including health, accident, disability, supplemental health, Life, and P&C insurance.

- Intelligent automation routes claims based on configurable rules to reduce manual intervention enables straight-through processing for low-complexity cases, and supports complex case management scenarios.

- ClaimGuard™ is a fraud detection tool that utilizes algorithms and ML engine scores for every claim to detect fraud patterns, minimize investigator workload, and reduce fraud payouts.

- Leave and absence management integrates with insurance policies to track employee absences, allowing claim initiation and routing based on leave types.

Benefits

Financial Management: The platform’s financial capabilities include accurate claim reserve management, payment processing, detailed financial reporting, and support for multiple payee scenarios.

Data and analytics: The platform’s capabilities provide actionable insights through out-of-the-box, customizable dashboards and reports informing users and facilitating underwriting and risk management strategy adjustment.

Technical Capabilities: The platform supports cloud-based deployment (AWS, AZURE) or on-premise; it is compatible with Chrome, Safari, Edge, and Firefox and supports iOS and Android.

Security: ClaimCore adheres to standard security practices, such as encryption,

authentication, and access control, to protect customer data and ensure compliance with data protection regulations

P&C Insurance Claims Management Software

Guidewire ClaimsCenter

Guidewire ClaimCenter is a modern insurance claims management software that combines advanced functionality, digital engagement, embedded analytics, and a future-ready ecosystem. It was primarily designed for P&C but covers all personal, commercial, and workers’ compensation insurance lines. ClaimCenter is part of the broader Guidewire Insurance Suite but works as a stand-alone solution.

Key Features

- The platform leverages IoT devices to monitor and prevent issues through proactive prevention and notification.

- ClaimCenter handles the entire claim lifecycle, from intake, assignments, evaluation, payments, negotiations, and closure through functional depth.

- The platform offers wizard-based, dynamic, response-driven questions to allow for a quick claims intake process, which integrates with policy search and retrieval.

- The assignment and evaluation of claims are allocated to experts based on the established rules-based segmentation. Additionally, the platform also manages payments, conducts litigation and negotiation tracking, and claims closure with business rules verification.

- Guidewire features embedded analytics and automated triggers and escalations to enhance data-driven decision-making and streamline workflow.

- Embedded analytics transforms any model or data into business value to guide smart decisions across core processes.

Benefits

Guidewire Claims Autopilot: The platform’s AI engine automates the entire claims process, comprising five main areas: Claims Intake Designer, Claims Automation service, Claims Analytics, Claims Integration, and Claims Visibility.

Digital Engagement Platform: Guidewire’s self-service channels allow customers to file and track claims, upload documents, and communicate with adjusters.

Claim Indemnity and Loss Adjustment: The platform offers solutions that include claims triage, severity escalation, subrogation detection, and litigation risk detection.

ClaimCenter’s New Tech: The platform offers over 60 prebuilt apps from leading P&C technology brands to facilitate claim operations. Additionally, users can access Guidewire Marketplace to acquire solutions they are interested in.

Ongoing Innovations: Guidewire has invested in research in the insurtech domain to equip users with the latest technology. Additionally, the software undergoes frequent updates.

Sapiens ClaimsPro

Sapiens ClaimsPro offers end-to-end claims processing capabilities. This solution was designed explicitly as P&C insurance claims management software, and it caters to both commercial and personal insurance lines. It utilizes intelligent automation, rules-driven workflows, robust case management capabilities, and user-friendly interfaces to deliver faster responses while ensuring accuracy, cost reduction, and an enhanced customer experience.

Key Features

- ClaimPro’s intelligent workflow is rules-driven to automate claim assignments, ensuring a balanced workload, rigorous case management, and preventing loss.

- The case management capabilities enable handling complex claim cases, reducing claims leakage, and preventing fraud.

- ClaimsPro gathers and stores all case-related data, documents, communications, and activities in a central repository.

- The platform offers one-click access to key functionalities, personalized dashboards for different roles, and simplified navigation with multitasking capabilities.

- Catastrophic Event Management is a feature that immediately identifies potentially impacted policies, assesses losses, and arranges logistics.

- ClaimPro’s automated decision-making occurs throughout the claims lifecycle, and any task that requires manual review is routed for further assessment.

Benefits

Instant Data Access: The platform’s one-click access instantly retrieves necessary data. This also helps business users to reduce response time in customer support.

Flexibility: The platform is built on a service-oriented architecture and employs a configurable approach (metadata, rules, and more), allowing it to adapt to changing market requirements and customer expectations.

Data Access: Apart from one-click access functionality, the platform has self-service capabilities and integrates with email messaging features.

Claimant and Adjuster Experience: The platform utilizes an intelligent, responsive UI to enhance user experience and configurable dashboards to customize claim rules.

L&AH Insurance Claims Management Software

Majesco ClaimVantage Claims

ClaimVantage is a software solution specializing in L&H insurance claims processes with unique business rules and workflows. By automating claims operations, the platform allows professionals to focus on critical decisions, enhancing operational efficiency. ClaimVantage was acquired by Majesco in 2021 and is now a part of Majesco’s L&H claims solutions. Majesco’s market and financial strength and SaaS expertise, combined with a feature-rich platform like ClaimVantage, make it a market leader among L&H insurance claims management software.

Key Features

- The platform facilitates the management of group and individual life and health claims by overseeing the entire lifecycle, from intake through adjudication to payments.

- The platform automates not only tasks and workflows but also letters, emails, and SMS communications. It is capable of configuring automation to align with operational needs.

- With built-in fraud analytics, the platform proactively identifies and mitigates fraudulent activities to protect the integrity of the claims process

ClaimVantage is hosted on the Salesforce Lightning Platform, featuring an intuitive interface that provides consistent UX across all devices. - The software supports STD, LTD, and Life Insurance (Whole, Term, Universal) and covers AD&D, Critical Illness, Hospital Indemnity, Accident, Cancer, and more.

- The solution can create ad-hoc reports with drag-and-drop capabilities and dashboards to filter and summarize data in real-time, presenting insights and guidance to make data-driven decisions.

Benefits

Majesco’s Copilot: This new-gen AI digital assistant delivers personalized interaction to improve CX. It enhances note-taking, correspondence drafting, and customer inquiries with AI-powered assistance.

Reports: The system offers pre-configured reports, custom reports, shareable reports and dashboards, and data filtration capabilities.

Personalized Service: The platform captures and stores policyholder information, tailoring communication, timely updates, and proactive support.

Continuous Updates: The platform offers regular updates aligned with salesforce and a dedicated QA team to ensure continuous testing.

Remote Access: The platform is available on various devices with its cloud-based platform.

FINEOS Claims

INEOS Claims is more than a claims software; by integrating automation, case management capabilities, a user-friendly platform, and a flexible technology framework, the solution ensures business users have a competitive advantage. FINEOS Claims is the leading customer-centric, web-based insurance claims management software for Life, Accident, and Health Insurance needs, all on a single platform. It has a proven track record of facilitating claims processing for carriers of all sizes.

Key Features

- The platform offers end-to-end automation, from the initial notification to payments and reserves management.

- The solution addresses various aspects of a total claims solution: fully automated claims and case management, integrated customer management, comprehensive financial management, optimal provider management, and a flexible, modern, rules-driven technology platform that prepares you for growth.

- FINEOS offers a total claims management solution that includes fully automated claims and case management, customer management, financial management, and provider management.

- FINEOS Claims’ L&H offerings include Income Protection, Individual and group Disability, Long-term Disability (LTD) Short Term Disability (STD) Long long-term care (LTC) Life Insurance, Waiver of Premium, and Dental

- FINEOS Claims broadly has three crucial roles: Claims Manager (handles assignment, audit trails, compliance, and more), Claims Administrator (handles notification, coverage information, payments & reserves, and more), and Enterprise Architect (handles SOA, Security, Scalability, and more).

Benefits

Compliance: FINEOS claims streamlines reporting, including HIPAA, ERISA, and Unfair Claim Practice Statutes, reducing costs and enhancing efficiency.

Customer Management: The unified platform stores all customer data and allows users to access data in real-time through secure connections—internet, branch, phone, PDA, and more—while ensuring compliance.

Financial Management: The platform manages complex payments, including administering backdated or out-of-sequence payments, invoicing, and reserving processes. It also handles recovery calculations, overpayment cases, subrogation, and alternate liabilities cases.

Provider Management: The platform thoroughly manages provider networks, including service agreements and performance monitoring. Additionally, providers can access the platform through a secure portal to view claims and payments.

Risk Management: With data visibility and forecasting, the platform enhances fraud detection and risk assessment and provides audit trails.

Automotive Insurance Claims Management Software

Mitchell Automotive Insurance Solutions SuiteM

Mitchell auto insurance solution is a comprehensive suite of features that aim to enhance the claim process, elevate CX, streamline operations, and reduce cycle times. Equipped with a suite of tools catering to simplify automotive insurance, the platform is used by over 300 insurers, a vast network of collision repairers, vehicle manufacturers, parts suppliers, and other industry partners.

Key Features

- The platform’s intelligent First Notice of Loss (FNOL) functionality enables consumer-driven claims initiation through mobile devices, allows reporting of loss details, and captures photos of damage.

- With flexibility in reporting methods, including mobile or telephones, the platform also instantly assesses vehicle repairability.

- Mitchell WorkCenter dispatch reduces cycle times, and resource allocation is based on intelligent algorithms, location, skillset, and priority with configurable workflows to match business standards.

- The platform’s AI integration automates appraisal workflows, enhances estimate accuracy, streamlines review processes, and identifies damage severity through photo recognition.

- Mitchell Connect facilitates communication between insurers, repair partners, and customers; with real-time repair status tracking, supplement processing, and collaboration tools, Mitchell offers complete repair management.

Benefits

Mitchell TechAdvisor: The platform provides complete OEM repair data, diagnostic trouble codes, parts and labor look-up, and other repair resources.

Mitchell Cloud Glass: Mitchell cloud glass parts look-up allows access to real-time glass repair and replacement data. It also has access to Mitchell’s National Auto Glass Specification (NAGS) catalogs, calculators, and windshield hardware guide.

Analytics and Reporting: The platform streamlines the data aggregation process offering actionable insights through performance analytics tools like miScore, miTrends, visualization services, and synthetic peer benchmarking.

Photo-Based Estimation: The platform offers guided photo capture applications, a unique link-based photo submission process, and remote estimate writing capabilities, reducing the appraisers’ travel time and workload.

Snapsheet Claims Management Solution

Snapsheet is digital claims management software with a customer-first approach, the platform utilizes intelligent automation to streamline claim management. Snapsheet states the software is a “claims org in a box,” managing the entire claims process from FNOL to settlement. Designed specifically for auto insurance, the platform removes friction from auto injury and collision claims to enhance CX.

Key Features

- The platform’s no code configuration tools allow users to customize claims processes without needing IT expertise.

- Snapsheet includes a built-in engagement feature for proactive communication through various channels, including text, emails, and web portals.

- The dynamic rules engine automates workforce distribution and assigns claims. Claim routing streamlines claim triage and adjuster allocation.

- Snapsheet’s virtual insurance appraisal software has remote appraisers nationwide (U.S.A.) to provide virtual appraisals preventing any delay in time.

- The established workflow routes claims to the right adjuster in the first attempt to eliminate wasted time and effort.

Benefits

API Integrations: The platform is capable of integrating (with over 70 different vendors) with various technologies, such as legacy systems, AI, telematics, IoT data, and more.

Regular Updates: The solution strives for continuous improvement by providing frequent enhancements to the platform so users can benefit from the latest insurtech innovations.

Implementation: Snapsheet’s typical setup time is anywhere from 5 to 10 weeks.

Other Notable Insurance Claims Management Software

- Duck Creek Technologies

- Insurity Claims

- 360Gloablnet

- Claimable

- Majesco Claims

- BriteCore

- Diamond Claims

- Pega Claims Management

- Ventiv Claims Enterprise

- InsureEdge (Damco)

Want to improve your insurance operations? Check out our blogs on insurance policy management software and insurance billing software to learn how these tools can work together with claims management software.

Conclusion

The year 2025 will witness the adoption of insurtech, attributed to the growing demand, workload, sustainability goals, and customer satisfaction. By investing in tailor-made software or specialized tools, insurers propel themselves to the forefront of the industry. This blog explored various software solutions tailored to different lines of business; with so many options available, insurers should make an informed choice on the right tool that meets their business requirements.

For instance, a P&C insurer would look for a tool that offers advanced analytics for damage assessments. In contrast, a health insurer would benefit from a solution prioritizing quick and easy claims and document submission. It is pivotal to select the right software, as the right claims management software can enhance both claimant and business user experience. Through scrupulous evaluation of needs and selection of the right software, insurers can gain a competitive advantage!