The Allied Market Research stated that the health insurance market is expected to soar past $4.15 trillion by 2028. There are so many people relying on health insurance, at the end of the day, it is more crucial than ever for companies to keep up with the growing demand and high expectations of their customers.

Managing health insurance can often feel like trying to find your way through a bureaucratic labyrinth filled with endless paperwork, frustrating delays, and a lot of stress. For years, tasks like enrolling new members, processing claims, checking eligibility, and handling billing were done manually. However, things are changing; the insurance landscape has evolved from outsourcing these jobs to utilizing health insurance software to do the same job at a fraction of the cost. Insuretech innovations now leverage advanced technology to automate most manual processes, analyze mountains of data, and create digital experiences, all to meet the demands of today’s market and the expectations of the clients.

What is a Health Insurance Software?

A Health insurance software is a specialized administrative system designed for operational excellence, better customer experiences, stringent adherence to regulations, and facilitating various processes in health insurance companies. The software would typically come with the latest insuretech trends, such as AI/ML, telemedicine, and more, that are being used to address the most prevalent pain points in this domain.

Below are some of the key features of health insurance software:

Core Components of Health Insurance Software

Claims Processing Automation: Today’s modern solutions use AI to validate claims based on policy terms, recognize patterns to identify fraudulent activities, and track claims in real-time for both the insurers and the clients. Additionally, it also reduced administrative work and costs.

Policy Management: Health insurance software goes beyond basic policy administration functionalities; it offers comprehensive capabilities, including Automated Underwriting, dynamic policy configuration, and regulatory compliance monitoring are necessary features in light of the various healthcare policy adjustments.

Customer Relationship Management: We’re heading towards a more customer-centric market, meaning a good health insurance software must have omnichannel communication options, member portals, and engagement tools. Through this, we can enhance CX and reduce service-related queries.

Analytics and Reporting Capabilities: Data is the future, and every health insurance software should be equipped with Risk Modeling, Performance Benchmarking, and Reporting dashboards, to name a few of the capabilities they use to generate actionable insights to make more informed choices.

Technological Foundations: Modern health insurance software leverages the latest insuretech technologies, such as artificial intelligence and machine learning, blockchain applications, API-first infrastructure, and cloud infrastructure.

These are just some of the core components that should be present in every modern health insurance software. Nonetheless, the insurance industry is constantly changing but we can predict the latest trends that will be considered all the rage in 2025: value-based care support, preventative health initiatives, and others.

To learn more about the benefits of automation and how technology can enhance your operations, consider skimming through our blogs on Underwriting, Accounting, Compliance, Quoting, and Analytics.

Top Health Insurance Software

Oracle Health Insurance Software

The Oracle Health Insurance Management System is an Oracle cloud-based scalable platform that combines flexibility, robust framework, and out-of-the-box capabilities to perform excellently.

Key Features

Policy Administration: The platform includes group and membership management system for commercial and government businesses, featuring automated multichannel enrollment processing for cafeteria-style benefits plans and premium calculation functionality with automated retrospective adjustments.

Claims Administration: Oracle’s claims administration consists primarily of claims pricing, which includes Intelligent claims pricing with provider contracting and an integrated authorization management system. Additionally, claims adjudication covers automated claim-benefit adjudication and rules engine for high auto-adjudication rates.

Enterprise Rating: A rating engine that provides accurate rates and centralizes rate management to reduce costs. Moreover, it includes intuitive product design tools to quickly create and deploy new products, offering multivariate pricing and rate analysis tools. It also integrates with federal and private exchanges.

Authorizations: Oracle Health Insurance Authorizations is an authorization and referral management system with multi-source authorization capabilities, including direct authorization entry. It supports flexible authorization parameters such as amounts, units, or time periods, allowing unlimited service lines per authorization. It also includes configurable preauthorization matching rules.

Value-Based Payments: Oracle offers a configurable payment model that utilizes business rules in natural language. It features a calculation engine that supports trial, final, and recalculations. The system provides detailed payment traceability and audit capabilities even when accepting multisource data for member information. Additionally, with an adaptive user interface tailored to payment model configuration, the system supports retroactive and prospective payments.

Data Exchange: Oracle Autonomous Database is a scalable data exchange platform featuring AI-driven cloud infrastructure, industry-specific design accommodating health insurance integration challenges, and a future-ready architecture with Oracle’s technology stack.

Cognizant TriZetto

The TriZetto® Facets® core administration system by Cognizant was designed for healthcare payers and is used by over 80 healthcare organizations. It features a cloud-based platform, integrating consumer, care, claims, and revenue management capabilities on a flexible unified platform.

Key Features

Cloud-Native Architecture: The platform has a cloud-optimized design compatible with various vendors and conducts quarterly updates for continuous integration.

Advanced Intelligence Capabilities: Facets Insights integrates AI and ML features that predict outcomes, offer proactive responses, and reduce manual intervention in transaction handling, all while continuously learning to enhance accuracy and reduce errors.

Real-Time Processing: Event-driven architecture publishes information about claims, members, and providers in real-time. Not only does it provide instant results for submitted claims and accurate cost estimates, but it also provides a detailed explanation of benefits.

Integration Framework: The Facets Open Access Solution allows real-time data publishing and web services. The framework features an open, modular architecture with REST-based APIs for easy integration; additionally, Facets Extensions gives users the ability to add custom business logic or information.

Workflow Management: Facets workflow automates the processing, prioritizing, and routing of work, while business rules help minimize manual intervention. It manages productivity in real-time by providing tools for supervisors to monitor and improve staff efficiency.

Multi-Line Support: The platform supports diverse product lines, including commercial Group, Individual, Managed Medicaid, Medicare Advantage, Part D, and Specialty health plans. It also includes built-in regulatory compliance capabilities, different payment options, and alternative payment models.

User-Experience: Facets offers a web-based user experience with a consolidated view of member benefits, claims, and billing. The platform is also equipped with intuitive applications that facilitate onboarding for new employees.

NewgenONE

The NewgenONE Platform for Health Insurance helps manage the entire operations, covering underwriting, policy administration, claims, and billing. NewgenONE’s platform integrates real-time billing, predictive insights, and AI-driven claims processing and risk scoring at various stages of the policy lifecycle.

Key Features

Policy Administration: The platform manages the lifecycle from issuance to termination with flexible product and plan configuration, including customizable parameters. It automates premium calculations and billing processes and offers real-time transaction updates, audit trails, and integrated checking functions for accuracy and accountability.

Claims Processing: Claims are streamlined by enabling omnichannel claims initiation on email, portals, branches, and social networks. It utilizes OCR-powered document data extraction, rule-based claims adjudication, automated case routing, AI-driven fraud detection, risk assessment, and KPI tracking and monitoring to enhance operations. Additionally, it features a centralized document repository with real-time document generation capabilities.

Underwriting Solution: The auto-underwriting engine features dynamic rules configuration, omnichannel application capture and processing, KYC, AML, and Dedupe screenings for customer verification, color-coded risk scoring, automated policy evaluation, and AI/ML-driven decision-making.

Health Quotation and Contract Management: The platform automates bulk data processing for group insurance, which includes validation checks to prevent duplicate quotations, uses rule-based premium calculations for group demands, smart case routing and approval workflows, reporting and monitoring dashboards, and dynamic contract generation with compliance checks.

Digital Onboarding and Customer Journey Management: NewgenONE offers personalized customer experiences across touchpoints and digital journeys based on client input and behavior. It simplifies the onboarding process by automating eligibility checks and benefit verifications.

AI and Analytics Integration: The NewgenONE platform integrates AI and analytics capabilities, which enables predictive analytics for risk assessment, fraud detection and prevention, real-time data insights, performance tracking and operational analytics, and compliance monitoring and reporting.

FINEOS AdminSuite

FINEOS AdminSuite was specifically built for Life, Accident, and Health insurance on a single technology platform. It is a component-based core system that addresses the unique challenges in the L&AH with its cloud-native architecture and integration framework.

Key Features

Integrated Core System: The component-based system consists of nine components: Absence, Billing, Claims, Payments, Policy, Provider, Quote, Rate, and Underwriting, which can work independently or in tandem. The single-platform architecture prevents data silos and facilitates interaction between the nine components and their functions.

Cloud-Native Technology: The platform’s approach is a SaaS-based deployment on AWS with financial services competency certification, around-the-clock serviceability, security protocols, and automated compliance frameworks.

Comprehensive Product Configuration Engine: A configurable product engine designed for L&AH with a unique plan and product architecture to allow for rapid portfolio expansion and product deployment capabilities.

API Integration: The framework is designed for comprehensive digital service, engagement, and integration APIs for third-party applications and B2B ecosystems, and enterprise portals.

Intelligent Automation Capabilities: The automation capabilities include role-based models with pre-configured workflows, embedded AI tools for automated decision-making, and smart automation capabilities for simplifying complex processes.

No-Code/Low-Code Configuration: Equipped with business-friendly tools for redesigning products and processes without coding, extension capabilities for customer requirements, customizable forms, business rules, and automated correspondence.

End-To-End Digital Engagement: The platform consists of omnichannel interaction capabilities with an integrated customer experience on all channels.

Real-Time Analytics and Reporting: FINEOS has embedded business insights and operational analytics in its platform. Additionally, it has data visualization capabilities and actionable intelligence.

Regulatory Compliance: FINEOS features automated regulatory compliance monitoring, a unified data archive designed to meet audit requirements, and even incorporates embedded security protocols and compliance frameworks.

Munich Re – MEDNEXT

Munich Re’s MEDNEXT is an end-to-end health insurance management system designed for insurers of all sizes across both domestic and international provider medical insurance (iPMI) lines. It accommodates various currencies and is organized into multiple modules that address specific aspects of health insurance management.

Key Features

Product Configuration Module: The platform offers flexible and easy configuration of products using multi-tier logic: package, plan, and benefit; the coverage configuration includes limits, deductibles, co-pays, waiting periods, and exclusions without technical expertise. It also supports product cloning and versioning, flexible premium calculations based on user-defined criteria, components, and formulas, and configurable network and territorial coverage with multi-currency support.

Quotation and Application Module: This module features an option-driven quotation system with policy information management. It also integrates member demographics and medical data collection for more accurate underwriting decisions, premium calculation, and claims processing systems.

Enrollment Module: MEDNEXT provides dynamic customer, policy, and member structures with a robust premium engine and manages the complete lifecycle from issuance to renewals or terminations, all the while maintaining time-based policy and member images, including premium calculations during the policy year. It also supports complex global client structures and allows for bulk upload processing for initial policies and endorsements, along with integrated workflow and task management capabilities.

Claims Adjudication Module: The solution features configurable claim amounts, including formulas and tax calculations, automatic adjudication of product coverage rules, and provider price lists. It comes with comprehensive out-of-the-box claims screening rules and user-configurable edits, as well as fraud and cost containment assessment automation via claim scoring, SLA monitoring, multi-currency support, and workflow and task management integration.

Medical Provider Module: The platform supports multiple provider types, user-defined groups with custom healthcare provider grouping, custom coverage rules implementation, and provider contracting supporting various service categories and pricing methods.

Authorization Module: The platform supports detailed structured medical information management, various diagnosis standards, authorization calculation based on product and provider contract rules, automatic claims estimation, SLA monitoring and workflow integration, and customizable communication templates with multi-currency support.

Sales & Commissioning Module: MEDNEXT supports multiple distribution channels and hierarchies, automatic commission creation, configurable commission contracts and schedules, and unlimited tax configurations on commissions based on specific criteria.

Billing Module: The billing capabilities extend to unlimited tax configurations, split billing between customers and members of the family, administration-only services (ASO) billing, and draft bill support with multi-currency functionality.

Reinsurance Capabilities Module: The platform supports configurable treaty management, reinsurance reporting for premiums and claims, claims reconciliation functionality, and configurable reinsurance account management.

Administration Module: This module offers comprehensive insurance company information configuration, including custom field configuration, multiple currencies, exchange rates, and taxes configuration, premium computation methods configuration, multiple premium payment methods setup, cancellation type configuration, invoice attributes definition, and many more.

Guidewire Insurance Suite

Guidewire, primarily used in the P&C landscape, is built with a modular design and a flexible platform that allows for it to be used in the health insurance sector. It consists of three core systems: BillingCenter, PolicyCenter, and ClaimsCenter. They work together to improve the overall performance of the organization.

Key Features

Core System Integration: Through the combination of BillingCenter, PolicyCenter, and ClaimsCenter, the platform ensures seamless data flow and prevents data silos and operation silos.

Product Design Capabilities: With visual product conceptualization tools, automated technical implementation of product specifications, and autogeneration of quote-and-buy digital experiences, facilitate intuitive insurance product creation.

Cloud-Native Architecture: The platform’s purpose-built cloud services include rating and rules engines, continuous updates by Guidewire with feature toggle controls, and it is a subscription-based model, ensuring access to the latest technology.

Analytics Integration: The platform is embedded with Guidewire Data Platform for insurance-specific data management, real-time monitoring with Guidewire Explore, Competitive benchmarking with Guidewire Compare, machine learning capabilities with Guidewire Predictive Analytics, and Cyence Risk Insights Starter Kit for underwriting.

Insurance Lifecycle Management: The platform encompasses a range of features such as product definition, multi-channel distribution capabilities, underwriting with embedded analytics, and complete policy management.

Open Platform: The framework supports third-party integrations, and provides access to 175+ partner applications through Guidewire Marketplace and developer resources and documentation for customization.

Security and Compliance: The platform is ISO 27001 certificated and PCI DSS compliant, adheres to SOC 1 and SOC 2 auditing standards, and validates AWS Financial Services Competency.

TCS BaNCS for Health Insurance

TCS BaNCS for Health Insurance is an end-to-end, cloud-based solution suite built to address health insurance challenges such as operational disruptions, data traffic, customer expectations, and the need to keep up with technological innovations. With the proper technical foundation, including API-driven architecture and microservice-enabled components, TCS BaNCS provides the tools to succeed.

Key Features

Product and Plan Management: This module features a single window-based product configurator, UI-driven configuration for new product and plan development, limits, co-payments, co-insurance, deductibles, and exclusions management, and includes built-in rules management and workflow configuration tools.

Master Data Setup: The Medical entity/coding compatibility supports ICD, CPT, DRG standards, as well as master data mapping, including ICD v CPT, ICD v Age, ICD v Gender. It also integrates one-to-one and one-to-many mapping systems supporting ICD-9 and ICD-10 formats.

Customer Relationship Management: The operational CRM provides a holistic view of the customer with integrated complaint management functionality, channel-specific premium, commissions, incentives, tax management, and customer onboarding.

Provider and Network Management: It involves the maintenance of service providers (including onboarding processes, contract management, provider analytics) and clinician networks, the management of price lists and fee guides for medical services, packages, and drugs with versioning control for tariff changes.

Underwriting and Policy Management: The platform recommends products based on client’s profiles, provides quote comparison across multiple plans, multiple billing and payer handling, and approval/referral process support business validation, and comes with an underwriting workbench with member-level underwriting.

Policy Servicing: The Financial and non-financial endorsement with merger capabilities and prorated adjustment functionality is present; it also supports policy cancellations, suspensions, reinstatement, and renewal.

Authorization and Claim Management: BaNCS simplifies the claims and pre-authorization process through auto-adjudication, supporting both E-claims and E-Pre-authorization. It incorporates role-based authority for claim approval and automated reserved processing, business rules for fraud detection, and automated requirement notifications by SMS or emails.

Workflow Management: It offers out-of-the-box integrated workflows, featuring real-time hot spots for more informed decision-making and a core work intel processing engine with management information (MI) reports.

Technical Architecture: The platform supports many functions, including multi-line, multi-channel, multi-entity, and multi-currency capabilities. By using an open architecture with over 1,500 published RESTful APIs, it offers easy integration as well as cloud-agnostic deployment options. Additionally, it operated within a DevOps-enabled environment and a layered, componentized J2EE architecture.

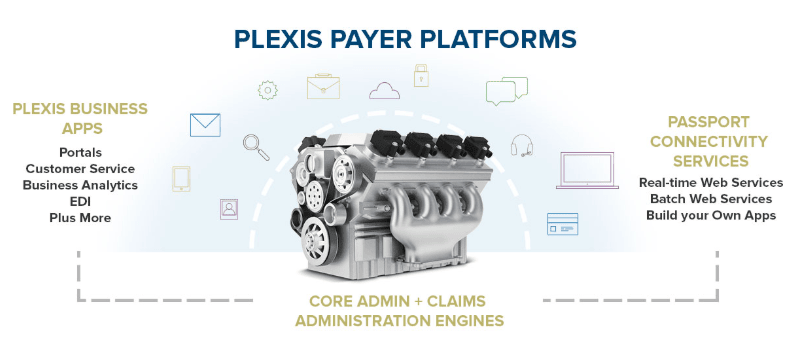

PLEXIS Core Administration and Claims Management

The PLEXIS core administration and claims management platform manages multiple lines of business, including medical, vision, and dental products, on a centralized, flexible system catering to different health plans, such as Medicare Advantage, managed Medicaid, and commercial providers.

Key Features

Core Administration and Claims Management Capabilities:

Claims Processing: A high-performance adjudication engine encompassing real-time claim editing capabilities and bulk claim adjustments.

Benefits Administration: There is configurable benefit plan management for multiple products, benefit plans, reimbursement arrangements, and different lines of business.

Member Management: The presence of a robust eligibility verification and enrollment system helps manage member data and even supports dual-eligibility members.

Provider Network Management: There are workflows embedded to manage provider networks, referrals, and authorizations.

Premium Billing Administration: Premium billing Management covers retroactive adjustments and multiple premium rate structures.

Multi-Level Security: The framework uses easy-to-manage security settings, including configurable user access controls and permissions.

Regulatory Compliance Tools: The HIPAA-ready EDI platform supports ICD-10, CMS 1500, UB04 standards, and data exchange.

Intelligent Alerting System: The system automates notifications across user-defined media devices and comprehensive reporting for better decision-making.

Capitation Management: The solution is equipped with tools for managing provider capitation arrangements and contracts.

Comprehensive Reporting: A library of standard reports that can be customized to meet specific needs.

Extended Business Applications

Provider and Member Portals: Users can opt for self-service access through the web or mobile interfaces to acquire critical information.

EDI Hub: There are end-to-end electronic workflows for claims and encounter data (RAPS/EDPS).

Business Intelligence Integration: The advanced analytics and predictive modeling capabilities provide actionable insights.

Care Management Integration: A unified platform for Utilization Management (UM), Utilization Review (UR), and disease management for preventative initiatives.

Fraud, Waste, and Abuse Detection: There are automated tools to identify fraudulent or suspicious patterns so risks can be detected and prevented or at least mitigated.

Passport Connectivity Services

API Integration Layer: It provides real-time connectivity between core systems and business applications.

Ecosystem Integration: Interoperability and collaboration are enhanced by connecting in-house systems and third-party applications.

Workflow Automation: It streamlines business processes across the organization.

Conclusion

Health insurance software has been a critical asset for insurers, in fact, most enterprises uses such platforms and solutions to streamline their operations. It may seem like the investment is high but look at the ROI, some simple math will show business users how much they can save by adopting a Health insurance software. The shift from manual systems to automated platforms has already begun and by tte looks of it, almost everyone has jumped on the inevitable digitization bandwagon, not just to meet the expectations of tech-savvy consumers who want everything at the tip on their fingers but also to ensure compliance with evolving but equally stringent regulations.

With options like Oracle, FINEOS, Munich Re, Cognizant, TCS NewgenONE, Guidewire, and PLEXIS, organizations can find tailored solutions that align with their business requirements. We’ve explored the main features of these health insurance software programs. Ultimately, this change is bound to happen; it’s better to approach it with more information and make the best choice.

Interested in specialized solutions? Explore our blogs on Insurance Claims Management Software, Insurance Billing Software, and Insurance Policy Management Software.