Fintech companies need to be aware of the rules and regulations surrounding their industry, which is also one of the hardest tasks in the industry. As 2025 progresses, organizations face a more complex set of rules and regulations considering future technological developments, geopolitical changes happening in the world, and the behavior of global consumers. As such, below, let us discuss the major issues and trends that depict the regulatory compliance environment in the coming year.

Global Trends in Regulatory Technology

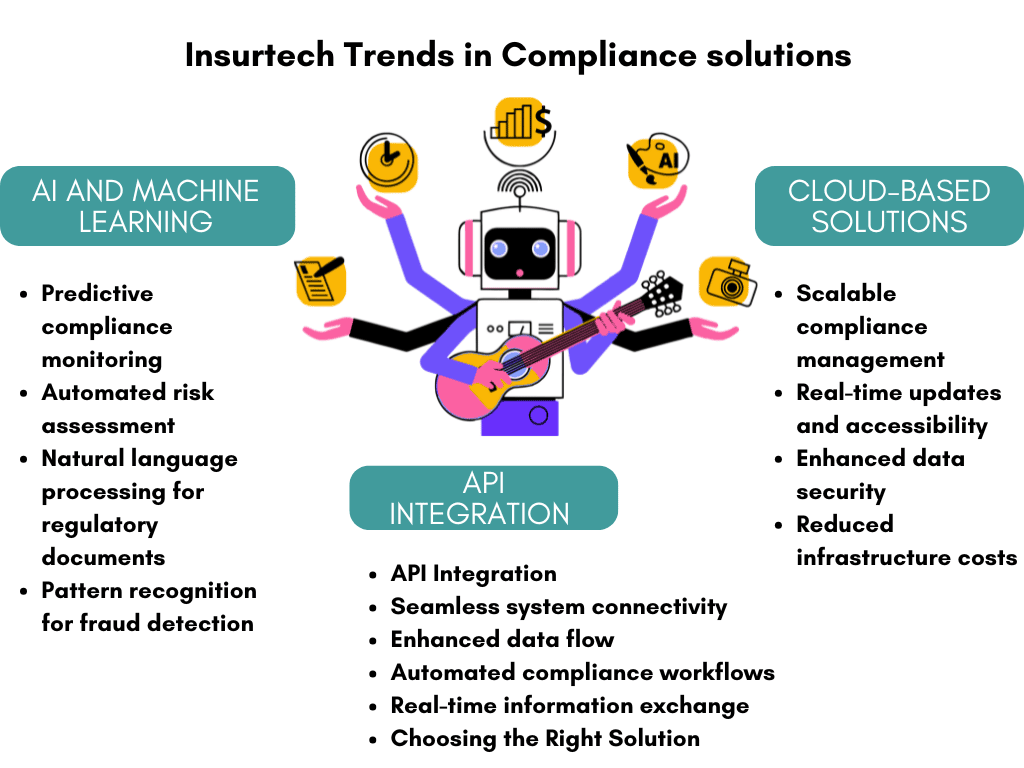

We handle large amounts of data and information from various sources; in today’s day and age, traditional processes have been proven inefficient. Modern insurance compliance software forms the foundation of an insurer’s regulatory framework, automating manual processes, mitigating risks, preventing redundancies and human errors, and providing real-time compliance monitoring. These solutions can help organizations:

- Automate compliance workflows

- Conduct predictive analysis to anticipate and mitigate risks

- Create audit trails and record of data

- Manage Licenses and track training and certification requirements

- Protect data and provide robust security measures

Solutions like Insurance verification software and insurance analytics software can further assist in verifying compliance related issues, often, proactive enough to identify and mitigate any loss.

Insurance compliance software is here to stay. “Insurance Compliance Software Market size was valued at USD 381.2 Million in 2023 and is expected to reach USD 758.5 Million by the end of 2030 with a CAGR of 10.5% during the forecast period 2024-2030”, based on research conducted by Market Verified Reports. With the increasing complexity, various jurisdictions, and digitizations, companies must adopt regulatory technology (A.K.A. RegTech) to help move from outdated compliance practices and integrate RegTech solutions to stay competitive in the market. RegTech would also utilize the latest solutions to optimize efficiency; for instance, AI generates multiple documents that include specific regulations and relevant information.

Perfect Doc Studio helps to create personalized documents, emails, sms, and phone calls in your customer’s preferred language with just a few clicks.

Want to Generate Documents In Bulk ?

With Perfect Doc Studio, you can simplify bulk document generation in over 100 languages with its intuitive drag-and-drop interface. Our advanced features allow businesses to create, customize, and distribute personalized communications across global markets.

Enterprise-Wide Insurance Compliance Software Solutions

Here are two of the leading Insurance compliance software solutions that facilitate maintaining compliance for carriers and organizations that handle multiple lines of business.

ComplyAdvantage Mesh (Multi-Line Insurance Compliance Software)

ComplyAdvantage Mesh is a cloud-based platform that combines AML risk intelligence with company and customer screening and ongoing real-time monitoring. This platform offers a 360-degree view of financial crime risks providing users with a proactive approach to compliance. With holistic risk detection capabilities such risk database and insights and advanced risk scoring and case management, ComplyAdvantage is considered a frontrunner in compliance management solutions.

Key Features

- The platform tailors your screening approach using flexible risk configurations to align with specific risk policies; it screens customers against sanctions, PEPs, watchlists, adverse media, and enforcement data.

- The proprietary risk database covers and identifies hundreds of sanctions and watchlists, allowing access to catalogs of global enforcement and negative news archives.

- Accuracy standards are curated by regulatory affairs experts using ML and intelligence; these risk entities have flexible rules to optimize signals.

- Mesh’s automated risk scoring is data-driven and configurable with dynamic customer risk scores.

The centralized alert review and investigation system facilitates monitoring changes in risk profiles and automates rescreening based on it. - The platform encourages collaboration across teams and includes a full audit trail to capture any decisions made, the rationale behind them, and their timing.

Benefits

Integration: The platform offers real-time, batch, and SFTP options for integration purposes, and a development experience team to assist users with best practices.

Security: Mesh maintains compliance certifications such as SOC 2 Type II and ISO 27001. Additionally, it is aligned with GDPT and has role-based permissions.

Minimize False Positives: The platform claims to achieve a 60% reduction in false positive rates which would reduce work.

Network Link Analysis: This scours ownership chains and transaction paths and the graph database technology reveals risks in personal and corporate relationships.

Regime Flexibility: The rules and parameters can easily be configured to meet regulatory environments and business jurisdictions.

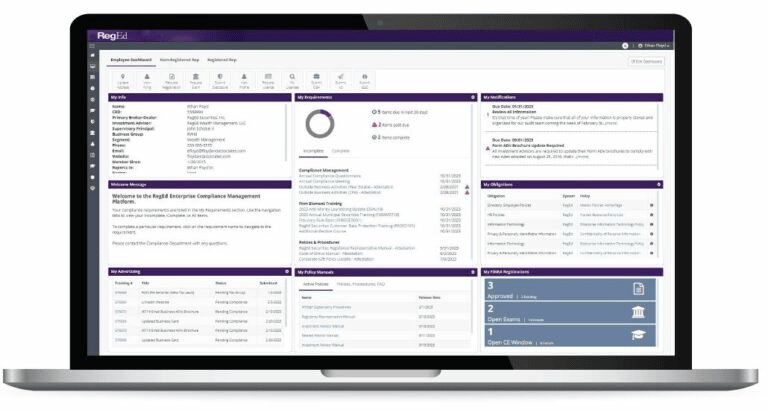

RegEd Compliance Management Solution Suite (Multi-Line Insurance Compliance Software)

RegEd Compliance Management Solution Suite is a market leader in compliance management with its transformative features and enterprise-grade capabilities. Through Centralized compliance management, regulatory change management, and comprehensive audit management, RegEd gives a competitive advantage and modernizes compliance operations.

Key Features

- RegEd manages various compliance aspects and key regulators such as FINRA, SEC, and state DOC through a centralized repository.

- The solution plans, conducts, and reports on branch inspections based on the guidelines, customizable audits, and integrated remediation.

- The AI-powered Advertising Review System includes intelligent automation, smart workflow management, compliance SmartView™, collaboration tools, and version control.

- The solution encompasses extensive Brand Audit Management with a mobile-first approach, risk scoring analysis, automated documentation, pre-population features, and real-time deficiency tracking.

- The user-friendly interface simplifies risk modeling by allowing people to run simulations with the touch of a button.

- Advanced Regulatory Change Management is an important feature that continuously monitors and reports with simple and easy-to-understand expert analysis.

Benefits

Compliance Questionnaire: The solution allows insurers to initiate, distribute, and track annual compliance assessments.

Transparency: The platform provides extensive reporting and tracking capabilities while maintaining audit trails.

Implementation and Support: The platform offers the combined regulatory expertise of 450+ years and comprehensive implementation support.

Compliant Management: The platform conducts automated FINRA reporting through e-submissions of complaints to prevent redundancies in data entry. Additionally, configurable templates allow for customer interaction.

Mobile Platform: With an HTML5 offline applet, the platform conducts audits without an internet connection on tablets.

Compliance Solutions by Line of Business

Health Insurance

MetricStream Regulatory Compliance

MetricStream’s Regulatory Compliance Management solution combines intelligent automation with advanced reporting and monitoring capabilities, making it a valuable tool for carriers and organizations of any size to adapt and thrive in the complex health insurance industry. MetricStream’s solution boasts an impressive track record; notably, it reduced compliance activity management time by 90%, cut policy update time by 55%, and accelerated regulatory change response time by 60%.

Key Features

- The platform automates workflows by streamlining compliance activities’ creation, review, and approval.

- Regulatory Compliance captures and processes regulatory updates from over 750 global authorities and automates filtration and distribution of regulatory alerts.

- The centralized framework maps regulations, risks, controls, and issues and connects them to relevant business functions, locations, and legal entities.

- The central repository promotes collaboration across enterprise silos through a centralized portal that integrates policies and documents.

- The solution provides real-time analytics of compliance activities through dashboards with drill-down capabilities. Additionally, it conducts trend analysis and proactive risk identification.

- A systematic approach to policy creation that emphasizes collaborative review, approval, and exception requests.

Benefits

Strategic Decisions: The solution supports proactive risk management, data-driven decisions, real-time insights on various engagements, findings, and trends to help users make informed decisions.

Compliance Advisory: The platform’s advisory services enable the front line to seek clarification from second-line functions to ensure comprehension of advice and its implementation.

Regulatory Changes: The platform identifies, curates, and extracts applicable regulatory changes from multiple trusted providers, including subscription and publicly available data sources.

Incident Management: Regulatory Compliance follows established protocols for case and incident planning and administration, recording, triaging, routing, investigating, tracking, and closure.

Healthcare Compliance – The Guard™

The Guard™ is a compliance SaaS platform specifically designed to manage compliance needs in the health insurance industry. This comprehensive management system utilizes user-friendly software and dedicated Compliance Coaches™ to protect patient information and maintain OSHA medical and dental, and HIPAA compliance. With innovative features like Compliance Dashboard, tailored policies, and extensive training, The Guard™ simplifies health insurance regulations.

Key Features

- The Guard™ includes an advanced ticketing system that handles reporting and management of incidents, ensuring proper documentation in accordance with HIPAA.

- The Compliance Dashboard presents a holistic view of all compliance tasks, tracking employee training, incident management, remediation efforts, and risk assessments.

- The platform offers configurable templated policies and procedures that meet HIPAA requirements.

- The platform conducts guided risk analyses across privacy, security, and device management and assesses technical, physical, and administrative controls.

- The Guard™ includes a secure repository for compliance documentation with version control and allows easy access to materials on an intuitive interface.

- There are structured protocols for handling data breaches, and the platform adheres to HIPAA-mandated timeframes for incident response.

Benefits

Training: The platform offers comprehensive training modules (90+ courses) on HIPAA regulations, cybersecurity best practices, and more. It also tracks and monitors employee progress.

Support System: The dedicated Compliance Coaches™ offer personalized guidance, while the HIPAA experts help with compliance questions. Additionally, the platform provides virtual implementation support through the proprietary Achieve, Illustrate, Maintain™ process.

Vendor Management: The platform automates business agreement handling, tracks and monitors vendor documents, and monitors PHI access for partnerships.

Cost Considerations: The pricing plans are specifically built based on the organization and its needs.

P&C Insurance

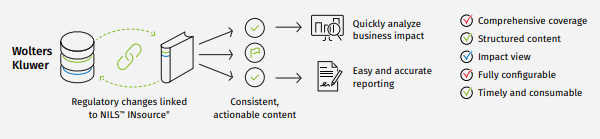

Wolters Kluwer OneSumX

OneSumX® for Regulatory Change Management by Wolters Kluwer utilizes a centralized approach to track regulatory changes across a list of global agencies. It combines structured, value-added content, and RegTech tools to prioritize transparency. This solution’s centralized approach facilitates the simplification of compliance complexities and strategic business insights for a sustainable and future-ready insurance compliance software.

Key Features

- The Centralized Regulatory Library provides coverage of laws, rules, and regulations from over 1,400 regulatory bodies worldwide while ensuring the library is continuously updated to check for the latest regulatory changes across jurisdictions.

- The platform ensures any changes in regulation are dynamically linked to relevant areas in the library.

OneSumX provides structured, value-added content that flows through a single data feed with common data fields across all regulators. - The platform links material regulatory cases to existing laws and regulations through automated monitoring of regulatory developments.

- Automated workflow capabilities include task generation and assignment functionality, automated follow-up systems, and complete audit trails.

Benefits

Impact Assessment Tools: The platform assesses the impacts of regulatory changes and generates workflows, assignments, tasks, and automates follow-ups for timely implementation of changes.

Key Regulatory Information: OneSumX links all regulatory changes to the original source content so users can review the context and better comprehend the implications of any change.

Quick Change Event Implementation: The solution accelerates change event implementations by eliminating horizon scanning, filtering, and first-level analysis that can otherwise gridlock your regulatory change process.

Transparency: With features like user-defined and ad-hoc report generators, the solution aggregates real-time reports for senior management, individual lines of business, and regulatory agencies.

Predict 360

Predict 360 facilitates predicting risks and optimizing regulatory compliance for insurance companies of all sizes. It offers continuous risk and compliance monitoring under one platform. With the option to choose from multiple configurations and intuitive and interactive data visualization integration, the platform is modular and designed for and by experts.

Key Features

- The platform offers centralized risk management to identify, quantify, monitor, and mitigate various categories of risks, including business, credit, operational, and compliance risks.

- Automated compliance management allows for real-time collection, storage, and tracking of compliance-related activities, ensuring automated regulatory change monitoring and impact assessment, a centralized compliance monitoring and testing framework, and policy and procedure document management with version control.

- Risk Control Self-Assessment (RCSA) capabilities include capturing residual risk ratings and automating risk assessment scheduling and assignment to business users.

- The risk management suite provides real-time risk profile updates, enterprise-wide risk visibility, advanced issues and incidents management, and documentation linking and testing capabilities.

- The platform comes with various compliance management tools, and some notable mentions are third-party and FinTech partner compliance oversight, marketing advertisement review application, and Integrated training management system.

Benefits

AI-Powered Platform: The platform is capable of natural language processing for regulatory change analysis and has predictive analytics to identify risks.

Proactive Risk Assessment: Predict360 automates preliminary risk assessments for regulatory impact and risk maps to comprehend regulatory changes and their effects.

Business Intelligence: The built-in BI engine offers reporting and dashboard capabilities that provide holistic insights into the business enterprise and operational risks, as well as data and metrics to mitigate those risks.

Cost Considerations: Risk related to any third party will be verified to ensure it complies with applicable laws and internal policies.

Auto Insurance

LexisNexis (ALIRtS) (US-Based Software)

LexisNexis® Automobile Liability Insurance Reporting System (ALIRtS®) is a solution specifically designed for automotive insurance compliance. Unlike generic compliance software, ALIRtS covers mandatory automobile liability coverage reporting, compliance management, regulatory reporting, and more. The automotive domain has numerous regulations across multiple jurisdictions, and ALIRtS offers a centralized and automated end-to-end compliance solution.

Key Features

- Single data submission capabilities ease the reporting process by utilizing the existing LexisNexis Current Carrier data feed.

- ALIRtS continuously monitors for changes in regulatory requirements, adjusting reporting formats, transmission protocols, data content, and filling frequency to reflect the new changes.

- The platform corrects Vehicle Identification Number (VIN) for rejected VINs and consolidates all error and submission reports.

- The platform offers access to the web portal for subscribing carriers, allowing users to view activity reports, manage verification requests, track specific vehicles or VINs, and automate suspension clearance and error resolution.

- The platform supports both personal auto insurance and commercial lines through the same interface.

- The platform automatically identifies reportable events such as new policies, vehicle additions, and carrier compliance.

Benefits

Reporting Capabilities: The platform’s comprehensive reporting covers different business lines, allowing insurers to send one file covering all reporting needs.

Compliance Management: ALIRtS’ platform includes dynamic adaptations for state-mandated changes, real-time coverage verification capabilities, and standardized formats for multi-state reporting.

Interactive Web Portal: The platform centralizes state issue management, vehicle and policy tracking capabilities, and automated suspension clearance and verification response.

Vin Management: Apart from the VIN correction process, the platform can track vehicle and VIN history.

Verisk Portfolio Assessment and Compliance (US-Based Software)

Verisk’s Portfolio Assessment and Compliance combines automated workflows, analytics, 50+ years of expertise, and dedicated support to help auto insurers adapt to regulatory changes. Its capabilities include DMV reporting, managing forms, handling statistical data, and other features that would make it an efficient tool for auto insurers. Verisk’s auto insurance compliance software is available separately for both personal and commercial auto insurance.

Key Features

- The platform’s centralized approach helps track and monitor compliance obligations and activities, sending alerts in case of issues or any deadlines.

- Automated reporting covers various regulatory requirements, including DMV reporting and lienholder notifications.

- The platform’s intelligence analyzes over 34.5 billion statistical records and regularly reviews 10,000+ bills, 8,000+ regulatory actions, and 2,000+ court decisions.

- Verisk’s Coverage Verification (CV) services allow outsourcing of compliance tasks related to DMVs, lienholders, and loss payees.

- CV – ALIT automates state DMV compliance across 38 jurisdictions on a single data feed.

- Mozart Form Composer manages end-to-end forms workflow, and an AI-powered language engine ensures consistency in policy language.

Benefits

Form Management: The platform includes advanced forms organization capabilities with 50 customizable metadata fields.

Integration: The platform integrates with the System for Electronic Rates & Forms Filling (SEREF), it also automates data extraction and integrates it for data warehousing.

Reporting: Verisk provides real-time insights into compliance trends, analysis, statistical plans, and potential risks, allowing users to view data insights through data contribution analytics.

Support: Verisk offers actuarial support and product consulting from experts, regular updates on any reported issues, customizable solutions for specific business needs, and assistance in implementation.

How to Choose the Right Solution?

Consider these factors before deciding on the right insurance compliance software that would best suit your business needs:

- Check to see if the insurance software facilitates maintaining regulatory requirements for your specific line of business.

- Does it integrate with your existing systems, third-party applications, and other essential tools?

- How scalable and flexible is the software? Consider the future growth of your organization, long-term goals, and whether it can adapt to future regulatory changes.

- Research solutions you’re interested in to understand the user experience, cost, and how comparable organizations optimize it.

- Investigate vendor support and implementation methodology and timeframe.

- Many organizations integrate billing, policy, or even claims software to ensure regulatory compliance is met for the entire insurance lifecycle.

Many organizations integrate billing, policy, or even claims software to ensure regulatory compliance is met for the entire insurance lifecycle.

Conclusion

With so many solutions available in the market, it is pivotal to select the right solution; not only does it give you a strategic advantage, but it also saves your organization valuable time, resources, and money that would otherwise be spent on traditional compliance processes. Additionally, one needs to consider the cost of inaction. Simply put, improper compliance can result in violations and penalties, hinder your ability to enter new markets quickly, and, last but not least, damage your reputation.

In this digital world, an insurance compliance software is paramount to survive in the evolving market. Embrace the tools and capabilities RegTech offers!