“Accounting is the language of business.” — Warren Buffett

The global insurance market is projected to experience significant growth in the coming years, with a compound annual growth rate (CAGR) of 3.5% expected through 2030. It’s clear that technological advancements are also becoming crucial for staying competitive. Additionally, companies in the insurance industry operate in a highly regulated environment. Suppose you’re an Insurance Accountant, Chief Financial Officer (CFO), Internal Auditor, Regulatory Compliance Officer, or work in a related field. In that case, you recognize that the efficiency of financial management can significantly impact an organization.

Traditional accounting methods cannot handle the high volume of daily transactions, provide real-time financial visibility, adapt to ever-changing regulations, and address today’s insurance complexities. Simply put, traditional practices are no longer up to the task.

An accounting insurance software is a tool designed to meet such challenges, helping insurers manage their financial operations efficiently.

Investing in insurance accounting software can lead to better financial management, reduced operational costs, and improved overall efficiency. These platforms are built to manage the specific complexities of insurance companies and tackle the difficulties that cannot be handled by traditional practices.

Insurance Accounting Software and Its numerous Benefits

An insurance Accounting software is an automated financial record system that consists of many tools, overseeing accounting tasks with ease. It handles tasks such as tracking premiums, managing claims, processing payments, and generating financial reports. The right tool will streamline your premium accounting process, support multiple currencies, policies, and payers, prevent data silos, and provide complete audit and compliance trails all while running simpler account tasks in the background.

Below are a few benefits of implementing an insurance account software:

Operational Efficiency: These software extend beyond basic bookkeeping features. Not only does it automate routine tasks, but it is also capable of automatic data flows between differnet systems, modules, even teams or departments, effectively preventing data silos and any man made error. Apart from preventing errors, it also keeps the data in sync and saves users a lot of time.

Financial Reporting: The built-in checks feature reduces human error, reports risks to the carriers, provides revenue and transaction reports, and accesses Business performance data through Business Intelligence (BI) to understand your sales funnel and nook of business. With advanced reporting and analytics that give you real-time insights into your financial performance, claims trends, and premium collections, business users are up-to-date on the organization’s financial health.

Interested in improving your company’s financial performance? Check our blogs on complementary software: Insurance CRM Software, Insurance Analytics Software, and Insurance Quoting Software.

Data Management: The unified platforms centralize data for better management and accessibility. With a cloud-based platform, the software takes care of carrier submissions, quotes, payments, ACORD forms, and policy templates all under a unified platform. Additionally, it supports your back-office tasks and manages multiple companies and books while archiving data to facilitate tracking and trend analysis.

Security and Compliance: The software is built specifically for insurance to keep up with ever-changing regulations, both local and international, such as generally accepted accounting principles (GAAP) or International Financial Reporting Standards (IFRS) by automating compliance reporting and offering audit trails. It also follows the best cybersecurity practices to protect you from cyberattacks. Moreover, it offers secure admin access and detailed permission controls, so you can easily manage who has access to what information—whether it’s employees, clients, or other stakeholders.

To understand the regulatory aspects of insurance accounting, read our blog on Insurance Compliance Software.

Integration: An insurance accounting software needs to work with existing systems, like CRM tools, policy management systems, claims processing platforms, and more. Only seamless integration can allow information to flow smoothly across departments, another factor that reduces manual data entry error and boosts overall efficiency. By automating data transfers and keeping records in sync, the software not only helps prevent errors and data silos but also saves you a lot of time.

Better Decision-Making: Insurance accounting software offers advanced reporting and analytics with actionable insights for better decision-making. Streamlining the workflow through automation allows people to focus on tasks that require a human touch and allocates resources accordingly.

To understand the different facets of insurance operations better and how an insurance accounting software can help your organizations, check out our blogs on billing software and claims management software.

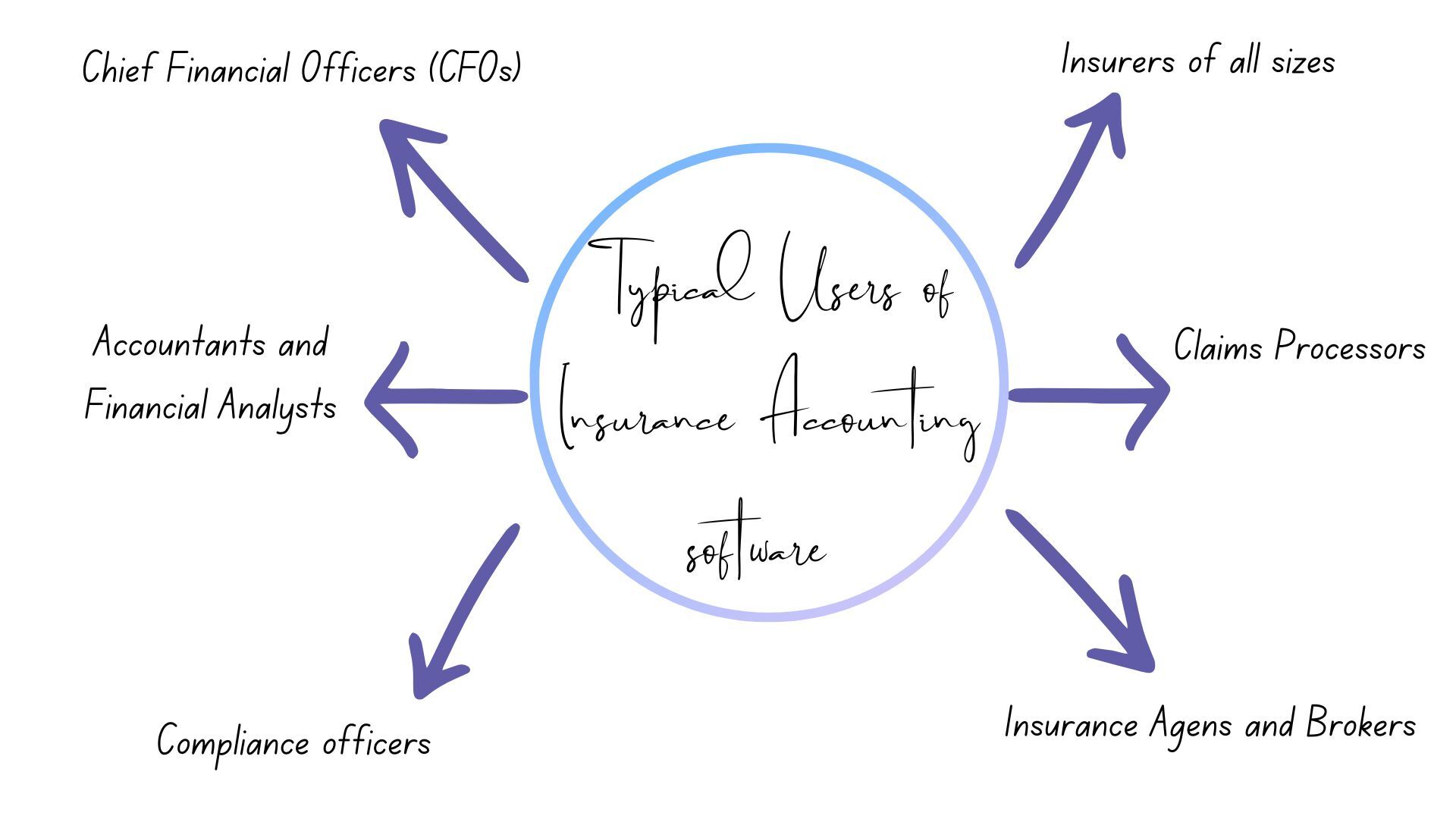

In today’s market, insurance accounting software is the bedrockof the billing process, servinf a a diverse range of insurance professionals across the industry.

Want to Automate Template-Based Document Production?

Perfect Doc Studio simplifies complex document generation, including policies, insurance quotes, letters, claim documents, and more, in over 100 languages. Its intuitive drag-and-drop interface allows businesses, particularly in the insurance sector, to easily create, customize, and distribute personalized communications across global markets.

Top Insurance Accounting Software

Here’s a curated list of Insurance Accounting Software designed to help you make informed decisions, ensuring you choose the most suitable solution for your needs. Compare and select the best insurance accounting Software for your insurance business.1. SAP Financial Products Subledger

SAP S/4HANA financial products Subledger (FPSL) is a solution designed for multi-valuation insurance accounting to standardize a central database for shared integrated operational, analytical, and economic worlds. By utilizing SAP Fiori, a user-friendly platform with advanced functionalities for insurance accounting, including financial instruments and insurance contracts.

Key Features

- Besides supporting financial instruments and insurance contracts, the software enables multiple reconciled valuations for numerous accounting methodologies to provide financial product support.

- The data management features entail SAP HANA data tiering technologies, a structured data model for financial accounting, and a virtual data model for analyzing subledger journal entries.

- The solution handles a large volume of data and utilizes two-level partitioning for optimal performance.

- The software supports various accounting functions through numerous methodologies (amortized cost, fair value, and more), accounting cycles, and valuations in multiple currencies.

- The system monitors both on-balance-sheet and off-balance-sheet items to ensure that all journal entries are tracked. It recognizes updates such as actuals and experience variances to maintain accuracy.

- Equipped with tools for actuaries and accountants, simplifying change analysis and the assignment of change reasons.

Benefits

Data-driven Decisions: The software allows users to create forecasts, plans, simulations, and feature change analysis for strategic decision-making.

Risk Management: With credit risk accounting functions, the software documents financial risks and includes change analysis features.

Compliance: The software is compliant with various account standards, both national and local (IFRS, US GAAP), and comes with preconfigured solutions to adhere to regulations.

Integration Capabilities: The system integrates with SAP Business Partner, SAP S/4HANA General Ledger Accounting, and external general ledger systems.

Scalability: It is suitable for organizations of different sizes and has multiline capabilities.

2. Oracle Insurance Accounting Platform – NetSuite

NetSuite’s cloud platform combines AI features with real-time analytics to help financial leaders improve operations by combining bookkeeping with strong compliance management, enhancing business performance. It is a part of Oracle’s broader suite of applications but also works as a standalone software. NetSuite’s excels in managing multi-entity operations and complex financial processes, all while ensuring compliance standards, such as ASC 606, GAAP, and SOX.

Key Features

- NetSuite’s general ledger allows flexibility and visibility with rich reporting functionality and enhanced audit trails. It can also customize account types, transactions, and reporting segments.

- The unified platform presents a complete view of the real-time cash flow and financial performance. Analytics reports on metrics such as premiums, policies, bills, and more help users make informed decisions.

- The software’s view of money flows enhances cash management, as it is equipped with comprehensive tools to optimize cash flow and monitor and manage liquidity.

- Automated invoice delivery, payment processing, and collections management make managing accounts receivable easy. This also increases liquidity and reduces the credit-to-cash cycle.

- Accounts payable automation offers early payment discounts and protection from payment fraud. Users can save time and increase productivity through automated review and approval workflows.

- The tax management features manage multiple tax jurisdictions ensuring compliance with numerous tax codes. It also provides detailed real-time reports with line-item tax details.

Benefits

Cloud Accessibility: The cloud-first approach allows people to work remotely and maintain productivity from any location.

Cost and Fees: Netsuite has an annual subscription model that includes a core platform license, operational modules, and the number of users. Accounting capabilities can be subscribed to separately.

Support: The accounting program comes with a free NetSuite license and access to NetSuite’s account.

Scalability: It is suitable for businesses of all sizes, and can scale its size as you grow from small startups to large enterprises.

3. Sapiens FinancialPro

Sapiens FinancialPro is part of the broader Sapiens suite; it was designed to address the insurance industry’s unique requirements for cash statutory and HAAP reporting. It features customizable user-defined accounting structures, robust reporting tools, multi-currency options, and cutting-edge budgeting and allocation tools. It also functions as a stand-alone tool with complementary solutions that work seamlessly to increase efficiency.

Key Features

- The software entails a flexible account key—a 55-position, multiple-element, user-defined account key that allows customization of account charts to increase the granularity of data.

- The system can handle multi-basis accounting and inter-company transactions through various accounting bases, particularly useful for organizations requiring adherence to multiple regulations and jurisdictions.

- The platform provides data-level security by account, company, department, or any element of the accounting structure and controls a user’s ability to post, print, and access data.

- The FASB 52-compliant system allows users to enter journals in multiple currencies, convert at the journal level, translate currencies at the account balance level, maintain various books, and revalue additional book currencies.

- The F9 reporting tool integrates Excel with the system (including all modules and complementary Sapiens products) to create custom financial statements.

Benefits

Advanced Budgeting, Allocation, and Consolidation: The intricate features maintain multiple versions of budget data for the fiscal year, combined with the audit capabilities, it reduces errors.

Complementary Products: FinancialPro comes with StatementPro, CheckPro, IntelligencePro, and F9 Reporting Tool.

Expert Support: The implementation includes a team of Sapiens experts who assist in collecting and reporting required information and incorporating best practices to meet business goals.

Payment Controls: Payments are prioritized by group or vendor and can be tracked by amount, bank account, general ledger account, or disbursement status. Users can generate payment invoices for individuals or groups.

Vendor Controls: The software allows unlimited user-defined vendor types, invoice types, and payment terms with override options.

4. Flexi

Flexi’s accounting software is a market leader in the enterprise space. With over 30 years of experience, delivering premium accounting solutions in the cloud or on-premise. Renowned for its flexibility, it offers robust features such as multi-company consolidations, multi-book accounting, multi-currencies, deployment options, and multi-database compatibility without the need for excessive maintenance or consulting fees.

Key Features

- Flexi Financials’ core accounting suite includes General Ledger, Accounts Payable, Accounts Receivable, Purchasing, Fixed Asset Management, Project Accounting, Account Reconciliation, Financial Reporting, Analytics (Excel-Based or Cloud BI), Financial Report Writer, and Budget.

- FlexiWorkflow automates tasks, streamlines business operations, and implements custom business rules.

- The software also offers add-on web-based applications such as Invoice and Billing Management, Vendor Management, Payments Processing, and T&E Expense Management.

- Flexicloud ensures security, optimum performance, low costs, and seamless software updates.

- The platform instantly accesses full transaction details from the original journal entry to a visual map of approvals, providing complete audit trails.

Benefits

Financial Planning and Analysis Suite (FP&A): The software offers tools for analytics, budgeting, and forecasting by integrating AI to deliver real-time financial data, which enhances decision-making.

Multi-Entity and Multi-Currency Support: The platform consolidates multiple entities in real-time, automates intercompany balancing, simplifies multi-company accounting, and facilitates currency conversion for ease of use.

Cloud Integration: This web-based software requires no IT resources or manual maintenance as automatic updates occur. It is equipped with Microsoft Azure’s security features and benefits.

Support: The SaaS delivery model includes personalized account executive support without excessive consulting fees.

5. Insly

Insly Accounting and Reporting solution was primarily built for MGAs (Managing General Agents) and insurers. The software takes a comprehensive approach, encapsulating premium insurance accounting features like real-time data management, enhanced compliance and audit trails, specialized double-entry ledger, automated workflows, and robust reporting capabilities.

Key Features

- The software automates premium accounting tasks in real-time, streamlines direct and agency billing, automates debt management with customizable payment reminders, and automatically cancels policies in case of non-payment.

- The platform also automatically creates invoices based on policy data, ensuring every invoice generated is 100% accurate.

- The double-entry ledger system ensures data accuracy with built-in prepayment balance and ledger entry management. It also prevents rounding errors and unallocated cash issues, maintains a view of commissions and risk shares, and facilitates financial reporting.

- The software facilitates compliance with insurers’ data requirements and presents written/paid/claim bordereau to send to the insurer. Alternatively, it also allows users to share real-time data with the insurer.

- The software features an extensive audit trail that logs all user actions and changes to the policy for compliance.

Benefits

Multi-Currency Support: The software supports multiple currencies for invoices, installments, and payments.

Customizable Reporting Capabilities: Business users can create configurable reports to meet their specific needs or use standard templates that can be modified without code or technical expertise.

Business Intelligence: In addition to customizable dashboards that analyze performance, BI also presents risk aggregates, precise conversion and renewal rate tracking, and comprehensive insights into sales channels.

Built-in Data Accuracy Features: The software helps you achieve data accuracy through age debtors and creditors report, sales day, purchase day, cash book reports, trial balances, prepayment balances, account statement reports, and MGA revenue reports.

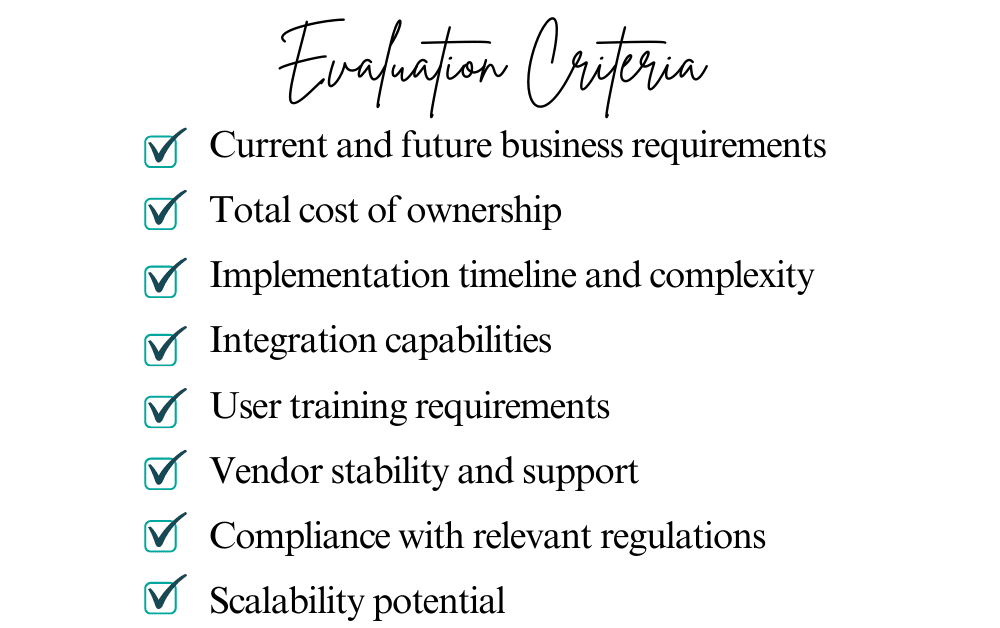

Make the Right Choice for Your Organization

Before selecting insurance accounting software, consider these factors and make an informed decision that will yield a high return on investment.

Conclusion

Investing in insurance accounting software is crucial for enhancing efficiency and accuracy in such a competitive industry. These tools ease financial operations, from processing claims to managing premiums, and ensure compliance with regulations. By automating routine tasks and providing actionable insights, insurance accounting software helps reduce costs and supports business growth.