Insurance quoting is the first step in the lengthy process of creating an insurance policy, and it is also a vital step. By providing the initial estimate of the cost of coverage, quoting is a deciding factor in whether potential policyholders will buy the plan. With numerous insurance carriers, providing competitive quotes is essential for attracting policyholders in today’s market.

Traditionally, the process of quoting has been time-consuming and tedious. To buy an insurance policy, one needs to inform the insurer of the detailed list of items they want insured and any other coverage details, and based on this information, insurance agents would estimate costs and provide policy details.

Although the process appears straightforward to the average Joe, potential policyholders go over a multitude of questions. Additionally, they also provide any other relevant information to insurance agents. The level of inquiry varies based on the type of policy, and the more complex the policy is, the more attention to detail is required.

Modern insurance quoting solutions or tools make this process easier through the integration of technology. This allows insurers to offer quotes and the entire policy details quickly. By reducing errors and increasing the speed at which quoting is completed, insurers gain a competitive edge to thrive in today’s market.

What is an Insurance Quoting Software?

Simply put an insurance quoting software is a tool that helps agents gather all the relevant data and use that information to generate quotes, but that, of course, is just the gist of it. An insurance quoting software is more than a glorified calculator. The solution integrates with existing systems, including insurance policy management system and insurance billing software, insurance underwriting software, and more, to equip business users with the right tools to easily generate quotes. There are quoting tools for almost every line of business that would cater to specific requirements in that segment.

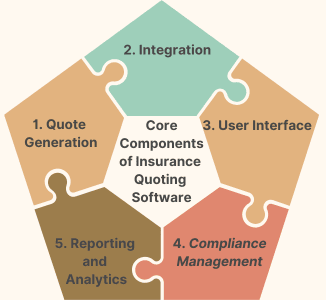

Core Components of Insurance Quoting Software

Modern insurance quoting software come with built-in features to ease the job of insurance agents and increase customer satisfaction through timely response. Here are some features that a good insurance quoting software should have.

Quote Generation: The platform should automate the generation of quotes without affecting the accuracy and speed with the help of complex rating algorithms. Capabilities such as multi-carrier rate comparison and price adjustment based on risk factors are necessary to provide accurate quotes.

Integration: The solution should have API connectivity, third-party integration, and integrate with existing systems, such as CRM, AMS, underwriting platforms, and other systems that would facilitate the policy-making process.

User Interface: For a modern tool, the user interface needs to be equipped with various functionalities, including a quote input form, questionnaire management and reporting, customizable workflows, and other capabilities.

Compliance Management: An insurance quoting software must comply with specific regulations. For instance, health insurance quoting would require HIPAA compliance. Additionally, it should include audit trails, adhere to state-specific rules, and implement version and data privacy controls.

Reporting and Analytics: Any modern tool must include real-time analytics, such as performance dashboards, agent performance reports, and market trend analysis. Business intelligence (BI) is now a commonplace capability offered by such solutions.

Tip: These are five of the most important features in insurance quoting software; however, market-leading solutions offer more than these capabilities. When selecting software, business users must thoroughly evaluate the tool’s features and ensure they meet business requirements

Multi-Line Insurance Quoting Software

EZLynx

EZlynx Consumer Quoting™ is a web-based insurance quoting software that automates recording, tracking, and follow-ups. Through its first-class integration, accessibility, form optimization, automated contact, agent options, and lead capture, EZLynx provides customers with a digital CX on par with enterprise-level organizations to meet the growing demand of today’s customers.

Key Features

We handle large amounts of data and information from various sources; in today’s day and age, traditional processes have been proven inefficient. Modern insurance compliance software forms the foundation of an insurer’s regulatory framework, automating manual processes, mitigating risks, preventing redundancies and human errors, and providing real-time compliance monitoring. These solutions can help organizations:

- The platform has vehicle pre-fill functionality (through LexisNexis), and EZLynx has implemented consumer-tested forms designed to reduce abandonment rates during quoting.

- The platform supports multi-line insurance quoting, including auto, homeowner, commercial, and healthcare sectors.

- The Lead Management System (LMS) captures leads by allowing consumers to generate real-time quotes. It also automates workflow triggers for follow-ups on incomplete quotes.

- In automated follow-up emails, a secure link is provided to the consumer to seamlessly complete their quoting process from where they left off.

- Apart from consumers who opt for self-service options through the EZLynx widget, agent options such as direct agent contact allow agents to reach out to prospects.

Benefits

Weather Integration: Xactimate’s benchmark feature updates daily storm data, including a 90-day historical weather data access, and presents address-specific weather reports

XactContents: The solution includes a content repository that enables access to major retailers for replacement items, including discontinued products, vendor-specific items, and general quote items.

Customer Experience: The platform has multilingual reporting capabilities and delivers detailed documentation.

Cloud-Based Storage: The platform’s cloud storage enables users to access it from various devices. In addition to proper document storage, cloud capabilities enhance collaboration among users.

Compliance: XactXpert is a cloud-based rules engine that ensures adherence to compliance by providing real-time guidance.

Health Insurance Quoting Software

1. Health Sherpa

Health Sherpa is the USA’s largest ACA agent enrollment platform, with enhanced direct enrollment (EDE) capabilities, and has been approved by CMS. What typically takes half an hour to do on Healthcare.gov can be completed on Health Sherpa in minutes. This not only reduces the time but prevents users from going through a tedious enrollment process. The platform generates quotes, manages applications, and enrolls clients through a single platform.

Key Features

- EDE integrates with healthcare.gov API and payment processing and includes an integrated document upload and management system.

- The platform automatically fills in renewal applications, provides real-time eligibility verification and alerts, and options to search for drugs and providers.

- The sales and marketing tools available on the platform consist of customer-branded enrollment sites for self-service, bulk email marketing, campaign tracking, lead scoring models, and customer journey tracking.

- The administrative dashboard reports data in real-time and exports enrollment and lead data. It also includes life-change reporting capabilities and DMI resolution tools.

Apart from the pre-filled applications for renewals, the platform also directs users to a white-labeled site for easy renewals.

Benefits

Document Management: The platform allows clients to upload and manage documents, and automatically notifies users to upload additional documents if there are any discrepancies in them.

Lead Scoring Model: The platform analyzes conversion probability to prioritize leads and based on the data it also enhances marketing and telesales strategies.

Compliance: The platform includes CMS-approved EDE, automated regulatory updates, compliant communication tools, and audit trails to ensure transparency. Moreover, it also securely stores documents.

Administrative Controls: The platform’s multi-level user management system and document retrieval system, including 1095As, ensure security.

Issuer Service Accounts: The platform allows internal agents to sell or offer services to a customer regardless of how they were enrolled into the system (through brokers or Healthcare.gov)

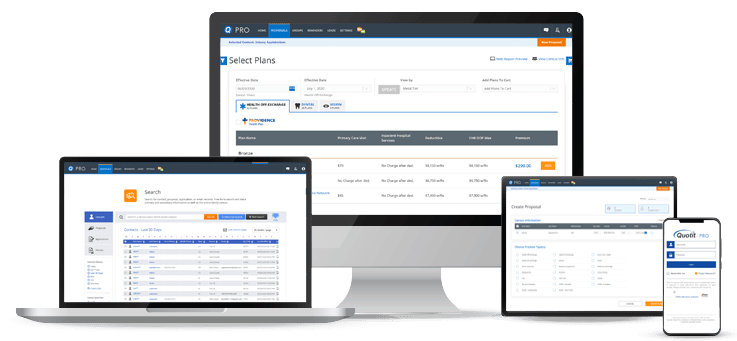

2.Quotit

Quotit is a health insurance software that allows users to quote, enroll, and manage leads on a single platform. With a primary focus on convenience, personalization, and automation, Quotit aims to increase efficiency and productivity to drive sales and service delivery. It combines data management capabilities, quoting, and enrollment functionalities to provide an end-to-end quoting solution.

Key Features

- With a specialized health plan data infrastructure, the platform can access nationwide carrier data with real-time access to hundreds of carriers. These plans are also continuously updated to ensure no disparity.

- The quoting engine features multi-carrier quote generation with the option to customize proposals using PDF or web-based formats.

- The platform includes an Amazon (shopping website) style shopping interface, allowing caparisons and automating cross-selling capabilities for supplemental products.

- The customer shopping portal offers self-service to generate quotes and compare plans with 24/7 automated selling capabilities. It can be accessed through various devices, including mobiles.

- The enrollment process includes Enhanced Direct Enrollment (EDE) capabilities for ACA plans, processes digital applications for different types of insurance, and integrates stacks through API connectivity.

Benefits

Deployment Options: The solution has flexible deployment options, including out-of-the-box solutions or standalone API access.

Lead Scoring Model: The platform analyzes conversion probability to prioritize leads and based on the data it also enhances marketing and telesales strategies.

Compliance: The platform has built-in regulatory compliance frameworks that handle data and transmission, monitor and report compliance, and perform regular updates to the framework.

Revenue Benefits: Through an easy enrollment process, the various self-service options, cross-selling capabilities, and 24/7 availability of the portal, the platform expands the market and increases conversion rates.

Scalability: The platform has enterprise-level CRM integration fully capable of supporting a growing business. It also has customizable workflow configurations.

Auto and Property Insurance Quoting Software

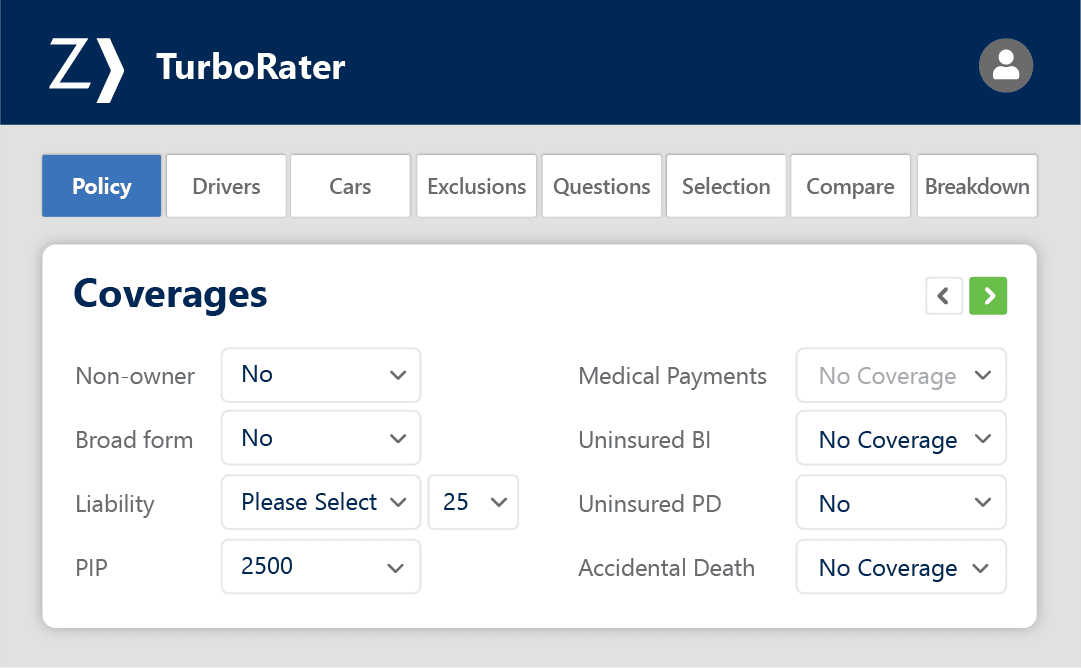

1. TurboRater (Auto and Property Personal Lines)

ITC’s TurboRater is a quoting platform that delivers quotes from over 250 insurance carriers across 50 states (USA) in a single place. TurboRater caters to a specific niche– personal lines for auto, motorcycle, and property insurance quoting and rating. The platform is a web-based software that utilizes the latest technologies and continuously upgrades with new features.

Key Features

- The platform is a browser-based system that can be accessed on any device connected to the internet, providing integrated quoting for auto, homeowners, condominium, renters, dwelling, fire, and motorcycle policies.

- The solution utilizes a single-screen entry interface and built-in underwriting rules with automated validation to reduce errors.

- TurboRater integrates with more than 30 agency management systems and ancillary products, including lead vendors, motor vehicle records, roadside assistance, and insurance for Mexico.

- The platform analyzes operational performance and agent performance by examining reports on closing ratios based on different parameters, producer performance, and more. It also tracks and analyzes quotes through location-based metrics.

- TurboRater presents a side-by-side comparison of the various plans, coverage, and premiums, offering flexible coverage adjustment capabilities.

Benefits

Compliance: The platform offers server-side storage and centralized data management functionality, role-based access, audit logging, and real-time compliance checking during quote generation.

Data Protection: The solution guarantees encrypted data transmissions for all quote operations, automatically backs up data, and includes recovery protocols.

Market Basket: Market Basket is an analytical tool designed to transform raw data into actionable pricing intelligence using market intelligence and data mining and covers various auto risks.

Analytics Infrastructure: The platform consists of model-ready data structures with multi-format export options and historical data preservation.

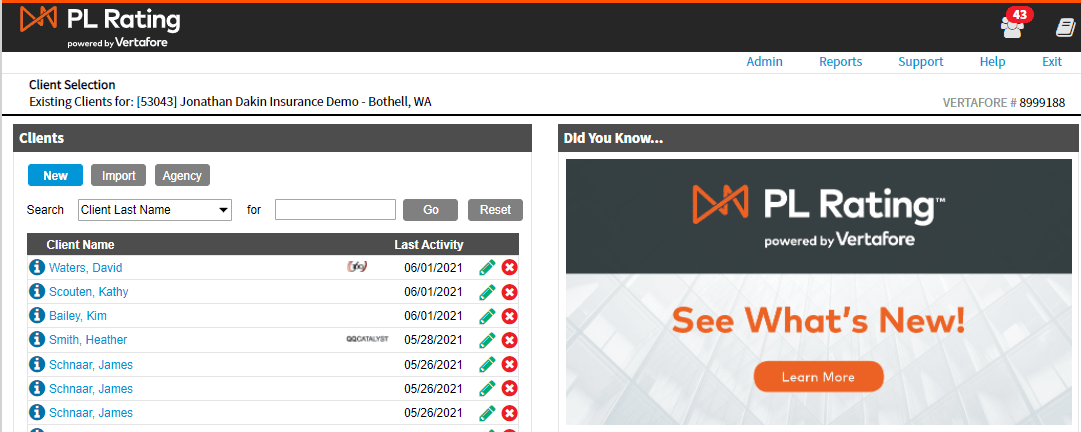

2.PL Rating by Vertafore (Auto and Property Personal Lines)

PL rating is a real-time comparative rating solution that connects directly with over 320 carriers (49 states + DC in the USA). The platform offers multiple quoting capabilities, real-time carrier capabilities, and open architecture to provide excellent customer service to business users.

Key Features

- The platform mimics an interview-style application process with automatic ITV calculations, one-click binding, and Home pre-fill from CoreLogic (MSB).

- For auto quotes, PL Rating uses integrated driver and vehicle information from LexiNexis at Quote (SAQ), court-based traffic violations from TransUnion, and access data related to court violations for a nominal price.

- PL Rating templates can be customized using preset defaults and company-specific questions for any line of business.

- The platform covers different lines of business, including Automobile, Homeowners, Package, Renters, Condos, and specialized coverage like Motorcycle and Dwelling Fire in California.

- PL Rating’s partnership with National Flood Services (NFS), Selective Flood, and Aon Edge Private Flood Insurance allows the platform to automatically generate flood premiums on home quotes.

- PL Rating also offers Life premiums through general agents on all auto and home quotes.

Benefits

Integration Capabilities: The platform offers true management system integrations, including Vertafore’s AMS 360, Sagitta, and QQCatalyst. Additionally, providing access to over 20 different management systems.

Unlimited Quote Templates: The platform allows agents to create and cusotmize unlimited number of default quote scenarios matching their agency’s needs.

Mobile Access: There are some versions of PL rating that offer mobile access, so agents can quote and bind remotely.

Third-Party Add-Ons: The platform leverages technologies from third parties, including Solutions at Quote (SAQ), Violation Prefill, CoreLogic (MSB) prefill home characteristics, CoreLogic (MSB) ITV, and Vertafore’s Consumer RAte Quotes (CSQ).

3.Bold Penguin (Auto and Property Personal Lines)

Bold Penguin is an insurance quoting software designed by insurance agents for insurance agents, addressing the common pain points faced in the quoting process. It specifically caters to small and medium-sized businesses. The software consists of four primary tools: Terminal, Exchange, Storefront, and Analytics. By utilizing the software’s tools, Bold Penguin aims to enhance efficiency and simplify the quoting and binding process.

Key Features

- Bold Penguin’s universal quoting software application implements a single application form, integrates multiple carrier applications, and collects data across various coverage types, all on a unified interface.

- Through multi-carrier integration, the platform has access to over 40 carriers, over 100 carrier products, and 15 coverage lines, including Excess and Surplus Market (E&S).

- Bold Penguin Exchange uses appetite-matching algorithms to monetize out-of-appetite risks. It prescreens potential prospects who have expressed interest so agents can reach out to those leads.

- Bold Insights, a quotes and commission dashboard, monitors data, tracks real-time performance metrics, and reports workflow automation analytics.

- Bold Penguin Storefront Pro includes configurable workflows, allowing control over agents’ interaction with the customers, promoting community building through channel partners, and offering customizable branding.

Benefits

Carrier Access: Bold Penguin has partnered with national, regional, and specialty carriers to provide comprehensive converge comparisons. Additionally, it offers options to apply for direct appointments or sub-appointments if needed.

Customer Experience: Bold Penguin expands the market to provide broader market coverage and offers 24/7 digital access to business users.

Submission Link®: All the policies and clauses are converted to data, and the Submission Link itself includes prebuilt enrichment, triangulation, and document extractors.

Market Expansion: The platform offers real-time eligibility checks and expands available coverage options for clients.

Conclusion

Quoting functionalities and capabilities are typically present in insurance software. However, in cases where organizations want to invest in a specialized tool that caters to their quoting needs, they would opt to implement insurance quoting software. These tools enhance accuracy and boost customer satisfaction, which improves operational efficiency. These tools are equipped with the latest insurtech innovations, offering opportunities to expand their market reach. A dedicated insurance quoting software ensures you remain competitive in today’s market.

Interested in learning more about the various software solutions available for insurance professionals? Check out our other blogs on Insurance Accounting Software, Insurance Verification Software, and Insurance Estimating Software for more insights.