Today’s insurance industry has been struggling to adjust to the changing trends, increasing competition, growing fraudulent developments, and customer expectations; Data is the anchor that ties these issues together seamlessly. Gut-feel decisions are a relic of the past; through data-driven decisions, insurers attain foresight and accuracy to prevent any impact on the company’s bottom line and CX. Sifting through an increasing volume of data from different sources is challenging. P&C insurance software collects data from sources such as social media, intelligent home devices, field agents, customer activity, and telematics. In contrast, health insurers look at previous medical records and history, social media, wearable devices and health apps, socioeconomic factors, and more.

Harnessing and using this data to make informed decisions is crucial to drive profitability and customer satisfaction and assess risks. Insurance analysis has been around for 30 years, simple insurance analytics in the 1990s, integration, automation, and cloud-based solutions in the 2000s, predictive analytics in the 2010s, and now we’re incorporating AI and big data. Over time, insurance analytics software has become an indispensable tool for insurers of all sizes.

Why Insurance Analytics Software is Now an Indispensable Tool

Gone are the days when underwriters spent weeks assessing risks; insurance analytics software facilitates modern insurance operations by converting raw data into actionable insights that save time and streamline the entire insurance process. Data isn’t just used to assess risks for underwriting anymore and verify insurance, analysis helps identify critical trends and customer behavior patterns, optimize pricing strategies, improve claims management, detect fraudulent activities, and personalize insurance products, all leading to improved efficiency.

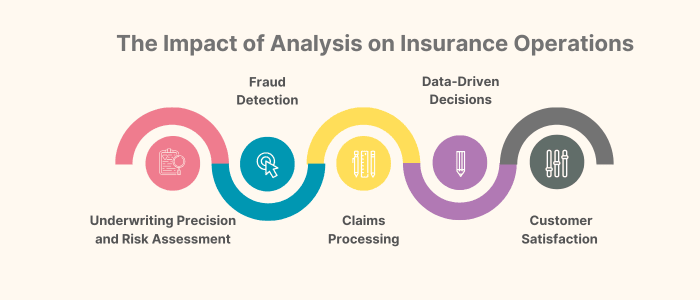

The Impact of Analysis on Insurance Operations

The past two decades have seen the emergence and importance of insurance analytics software and how it has transformed operational processes from the foundation. Below are some facets where analytics has been effective.

Underwriting Precision and Risk Assessment

Utilizing an insurance analytics software ensures underwriting precision by identifying suspicious patterns and intricate indicators of fraud that might otherwise be overlooked. By leveraging AI, big data, and ML, an analytical software can reduce human errors and assess risks more efficiently so underwriters can spend their time on complex cases that require expert attention. Additionally, it can also provide accurate pricing recommendations, identify new market opportunities, and enhance the insurer’s risk portfolio.

Fraud Detection

Modern insurance software uses tools to analyze vast datasets to identify suspicious patterns and detect anomalies. Such proactive detection ensures insurers can get ahead of the issue and mitigate fraudulent claims. For instance, research conducted by ABI shows that fraudulent claims are detected every 5 minutes, and frauds worth £3.3 million are detected every day in the UK. In the US, Insurance fraud steals at least $308.6 billion every year from American consumers.

Claims Processing

Modern insurance analytics software check submitted claims for errors, duplication, outliers, incomplete or missing data, irregular structure, and even irrelevant data points. Legitimate claims get faster payouts, while suspicious claims are flagged for further scrutiny, leading to operational efficiency and proactively preventing fraud.

Data-Driven Decisions

The use of insurance analytics software in the insurance industry not only occurs across the various stages of the underwriting process but can also predict risk, fraud, accurate pricing, and other metrics that are all data-driven. Data analysis is presented transparently with intuitive visualizations and precise outcomes. In fact, such software allows insurers to strategize and align with customer expectations, business opportunities, and ever-changing market trends.

Customer Satisfaction

An insurance analytics software doesn’t just enhance an insurer’s operation but also helps with customer retention. Digital platforms analyze customer data so insurers can predict the needs and gain insight into their activity, behavior, and preferences to curate custom plans, cross-selling opportunities, and communication strategies. Moreover, it can also identify issues resulting in customer churn and mitigate them.

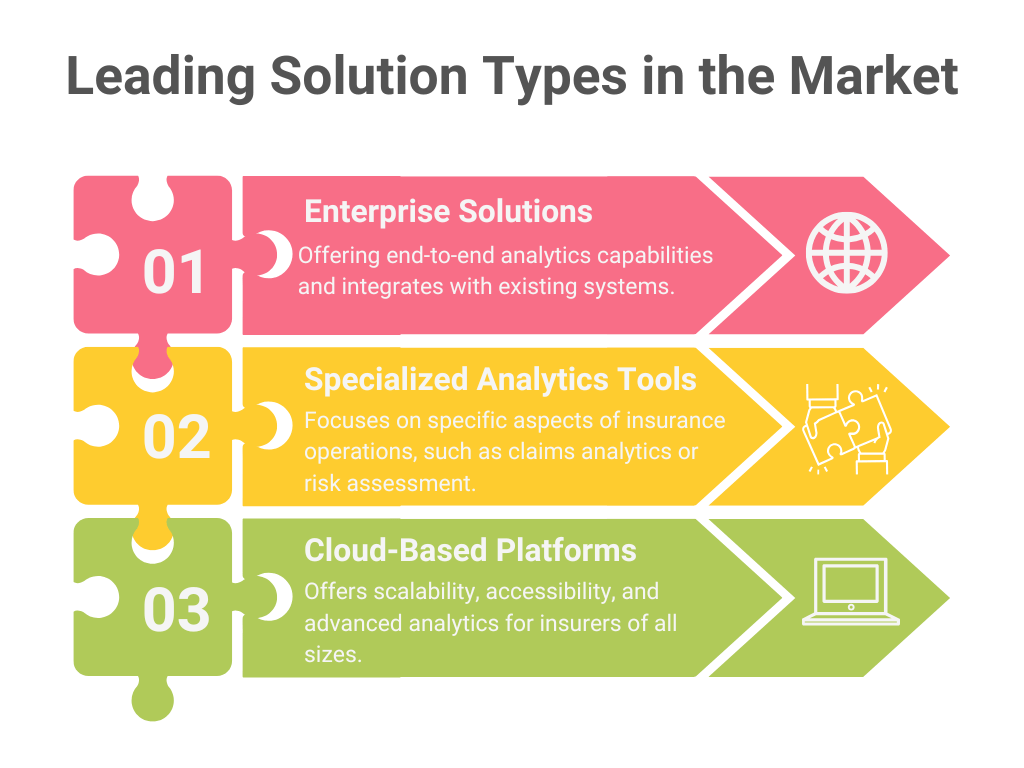

Top Insurance Analytics Software Solutions

The insuretech domain offers many insurance analytics software solutions that cater to different needs and scales of operation. This blog will look at some of the top solutions in the market that fall under these solution types.

Want to Generate Documents In Bulk ?

With Perfect Doc Studio, you can simplify bulk document generation in over 100 languages with its intuitive drag-and-drop interface. Our advanced features allow businesses to create, customize, and distribute personalized communications across global markets.

Top Insurance Analytics Software Solutions

SAS Viya (Enterprise-level)

SAS Analytics is the frontrunner in the market with its advanced AI capabilities and superior expertise in the industry. SAS Analytics is used by more than 1,400 insurance companies globally, which includes 90% of the insurance companies on the Fortune 500s global list. This solution’s broad usage is acclaimed as an end-to-end powerful analytics platform that allows users to make faster, more accurate, and more informed decisions. SAS Viya is cloud-based, user-friendly analytics that has evolved from the traditional SAS solutions, such as SAS and SAS enterprise.

Key Features

- SAS Viya’s advanced customer experience management capabilities give insurers a holistic view of customers across products, functions, and channels. Real-time analytics manages customer interactions to increase customer retention.

- The solution uses multilayered detection methods to detect and prevent various types of fraud, ranging from individual fraud to complex network-level fraud.

- SAS’s risk assessment tools utilize AI, predictive analytics, and IoT technologies to automate processes, handle data, and make decisions transparently while ensuring compliance.

- The platform’s dynamic pricing and product innovation capabilities include actuarial expertise and techniques as well as finely-tuned pricing and premium models to allow for expedited product release and quick modification of variables.

- The single analytical platform integrates finance, risk, and customer management to encourage collaboration across departments.

Benefits

Streamlined Compliance: The platform automates compliance processes, enables transparent and traceable decision-making, continuously monitors model performance, and systematically evaluates production models.

Decision-Making Capabilities: Through real-time data analytics, integration of financial and risk-related factors, and AI-driven automation enhance decision-making

Operational Efficiency: It not only streamlines data processing and analysis, but it also reduces duplication of efforts, automates reservation processes, and accelerates the deployment of rates into production.

Fraud Mitigation: The fraud prevention capabilities reduce financial crimes, protect the insuer’s fiscal health, and ensure smooth customer experience.

Future Readiness: SAS is known for its continuous innovation, agility, and competitive edge in an ever-changing market.

Tableau for Insurance (Enterprise-level)

Tableau analytics is the business intelligence platform that transforms raw data, from various sources and formats, into actionable insights. It provides a complete, integrated analytics platform by leveraging machine learning, statistics, natural language, and smart data prep. Tableau promotes data culture in a scalable manner for sustainable growth and success in today’s insurance market. Tableau is utilized by over 90% of financial companies, including insurance firms, in the Fortune 500 globally.

Key Features

- Tableau natively integrates with Salesforce’s Customer 360 platform to present a 360-degree informative view of insurance customers.

- The interactive dashboards perform real-time monitoring; they also present geospatial analytics for territory-based insights and have customizable reporting tools.

- Tableau enables business users to analyze data and generate insights without any technical or IT support.

- The solution integrates with various data sources and manages it under one unified platform.

- The solution’s Geospatial Visualization showcases geographical data to uncover location-based trends and insights.

- Tableau Public is a free platform that allows users to explore, create, and share data visualizations which can be incorporated into their visualizations and dashboards.

- The Migration SDK gives you the information and tools you need to build custom migration applications with C# and/or Python. With these tools, you can migrate users, permissions, projects, workbooks, data sources, metadata, and more.

Benefits

Tableau Roles: The platform offers three different user profiles: Creator, Explorer, and Viewer. Each has different functionalities and capabilities.

Scalability and Flexibility: Tableau provides a multi-dimensional data strategy, from choice in deployment via on-premises software, the public cloud, or cloud platform, to choice in operating systems with Windows or enterprise-grade version of Tableau Server on Linux

Improved CX:Apart from the 360-degree customer view, the platform offers personalized customer journey analytics, identifies cross-selling opportunities, and predicts customer retention and churn to improve service delivery.

Proactive Risk Management: Through predictive analytics and ML, users can identify trends and potential risks and mitigate these issues before they materialize.

Competitive Advantage: The solution helps identify market trends, encompasses strategic planning capabilities, provides product innovation insights, and most uniquely presents territory-based performance analysis.

Oracle Insurance Analytics (Enterprise-level)

Oracle Insurance Analytics Software Solutions combines three components: Oracle Insurance Data Foundation, Oracle Financial Services Analytical Applications Infrastructure, and Oracle Insurance IFRS 17 Analyzer. This platform utilizes advanced analytics with industry-specific features and a data management framework and analytical application architecture to improve decision-making across finance, risk, and actuarial services that can drive top- and bottom-line growth. While ensuring reliance, the solution delivers long-term strategic value.

Key Features

- It complies with International Financial Reporting Standard (IFRS) 17, the Financial Accounting Standards Board (FASB), and Long Duration Targeted Improvements (LDTI).

- The solution handles end-to-end management of complex computations and accounting and financial and management reporting.

- Oracle ensures data integrity and conducts pre-built checks for calculations such as contract value estimates, service margins, risk adjustment, contractual service margin (CSM), and more – at a policy or group level through business event rules and methodologies.

- Oracle’s cross-functional analytics occurs throughout the enterprise, where different departments can view and analyze the same data.

- The solution removes inconsistencies across ledgers, books, and marts for auditable reporting and analysis. It also tracks audit trails consistently and transparently across all analytical domains.

- The solution calculates service margins at both contract and cohort levels.

- Through predefined reporting templates, the system streamlines the reporting process.

Benefits

Deep Domain Expertise: Oracle’s expertise enables them to deliver a ready-to-deploy comprehensive data model rooted in real-world analytical experience. It supports General Measurement Model (GMM), the Premium Allocation Approach (PAA), and the Variable Fee Approach (VFA).

Data Foundation: Oracle’s data foundation is insurance industry-specific, which sources and provisions complete, accurate, and timely data that provides enterprise coverage across life, non-life, health, and reinsurance lines of business.

Specialized Dashboards: The solution provides actionable insights to CXOs through customized finance and risk management dashboards and reporting.

Oracle Financial Services Analytical Applications: This solution encompasses capabilities to proactively manage Financial Crime, Compliance, Risk, Treasury, Finance, and the Front Office.

Flexibility and Scalability: The solution easily integrates with other software and grows to meet the needs of the organization. It has the flexibility to accommodate new compliance requirements—the need of the hour in an evolving landscape.

TIBCO Platform (Enterprise-level)

TIBCO Platform brings together all of TIBCO’s solutions on a unified platform– making it stand out in the market due to its real-time processing and visibility and control over data analytics. It combines advanced data analytical features with comprehensive data measures to optimize your business’ performance and unleash its full potential. The software can be deployed on-premise, cloud, or edge environments.

Key Features

- The solution uses ML and predictive analytics to present actionable insights and predict trends by integrating and managing data from different sources.

- TIBCO Platform’s single control frame monitors and correlates application metrics, logs, and traces to identify and eliminate bottlenecks.

- Its robust security measures include role-based access control, separated ingress traffic for enhanced security, PCI; HIPAA; and FIPS 140 compliance, and other general security practices as per industry standards.

- The solution’s advanced data integration connects applications, data, and devices from any location. It easily extracts data such as customer information, claims data, and risk assessments.

- Equipped with high-performance processing abilities, the system is capable of supporting millions of transactions daily.

- A centralized enterprise asset repository facilitates the discovery of all TIBCO and non-TIBCO APIs, applications, and documentation in a single location and automatically generates documentation for new applications with clear code ownership assigned

Benefits

Visual Relationship Graph: The solution identifies relationships between different assets within the organization to enhance comprehension of the system’s architecture.

Customizable Templates: Equipped with pre-built templates, development projects can be launched quickly.

TIBCO Flogo Extention for VS Code: Tibco Flogo Enterprise applications can be designed, built, and tested using a local visual code design experience.

Cost Reduction: Apart from automating manual tasks, which reduces operational costs, the system promotes collaboration with trading partners to fine-tune supply chains and enhance CX.

Operational Efficiency: The system claims a 60% reduction in time to identify and resolve critical issues and a 30% faster development of new applications.

Moody’s Analytics (Enterprise-level)

Moody’s Analytics Solution for Insurance is a comprehensive suite of tools that has been designed to tackle financial risk assessment, regulatory compliance, and data analytics.

Through the integration of sophisticated software, models, data, and analytics, the solution enables insurers to make data-driven decisions. This allows the breakdown of silos otherwise found in legacy and varied systems and presents a holistic view of risk.

Key Features

- Moody’s has premier catastrophe risk modeling capabilities, which cover natural disasters, climate change, cyber threats, and emerging risks.

- The system can access thousands of processor cores to handle raid batch calculations with improved accuracy.

- The real-time monitoring and proactive risk mitigation strategies are crucial aspects of risk management.

- The solution comes with AXIS actuarial system, which analyzes; reserves; and supports pricing and Life insurance, and annuity financial modeling aspects. It has multiple computation capabilities and produces timely results.

- The user-friendly interface simplifies risk modeling by allowing people to run simulations with the touch of a button.

- Primarily focusing on risk assessment and regulations, the platform complies with industry regulations such as IFRS 9, LDTI, and solvency II. Additionally, it utilizes anti-money laundering and sanction compliance tools.

Benefits

SME Support: Moody’s Analytics’ consulting services are offered to insurers to optimize the usage of the solutions to attain the maximum value. It also provides up-to-date regulatory requirement support.

Advances Catastrophe Risk Modeling: Moody’s Analytics leverages over 30 years of catastrophe modeling expertise which is validated by actual losses to present comprehensive coverage for natural disasters.

GridLink-as-a-service (GLaaS): GLaaS is a cloud-based service that scales compute capacity on demand to reduce processing times of complex calculations.

Cloud-Native Platform: Apart from integrating various data sources, the platform is known for its scalable architecture, high performance, and ML capabilities.

Custom Configurations: The solution can be customized to meet the requirements of the business, by accommodating storage capacity and computing parameters.

Guidewire Analytics (Small and Medium Insurers Segment)

Guidewire Analytics is a robust solution that bridges the gap between raw data and actionable insights by embedding itself in the claims and policy workflow. By integrating into the daily operations, Guidewire enhances operational efficiency, profitability, and accuracy through intelligent risk assessments, predictive analytics, and cooperative scores. Guidewire’s Predict component was awarded the ‘Predictive Analytics Solution’ of the year across all industries by 2023 Data Breakthrough Awards.

Key Features

- HazardHub is a Guidewire tool that analyzes, scores, and grades property risk for any U.S. address. It also delivers insights to core systems immediately. It analyzes over 1.400 risk factors and assesses a range of hazards from tornados to wildfires.

- Cyence, a division of Guidewire, offers cyber risk modeling for insurers and reinsurers, equipping them with tools for effective underwriting and profitable pricing.

- Predict is Guidewire’s smart predictive analytics segment; it builds, imports, and deploys custom models. It also monitors and measures a model’s impact on risk selection and pricing.

- Cooperative scores improve subrogation recovery through pre-built scores that guide claims teams into their workflow.

- Canvas’s catastrophe response through geo-visualization of policyholder locations and claims enhances management.

- Explore is Guidewire’s AI-powered BI tool which optimizes operations across policy and claim departments.

- Compare conducts real-time continuous analysis of claim performance against industry benchmarks to plan improvement strategies.

Benefits

Customer Success Support: Guidewire’s dedicated success team offers ongoing support, training, and best practices for users to improve and maximize the analytics solution.

Risk Assessment Features: The comprehensive set of tools offered by Guidewire, such as Cyence, Predict, HazardHub, and more, presents underwriters with the data to quote reasonable risks and decline bad ones.

Underwriters: Some features that would facilitate the job of underwriters are accurate pricing models, risk selection capabilities, portfolio management, and retention of profitable policyholders.

Claim Handlers: Some features that would facilitate the job of claim handlers are smart claims triage, subrogation recovery, and catastrophe response and management.

Applied Analytics (Small and Medium Insurers Segment)

Applied Analytics is a tool designed by Applied Systems to transform data from various sources into actionable insights that will guide business users to make more informed decisions. It acts as a personal data scientist to manage complex system data and presents it in a clear and visual manner for easy comprehension. The solution easily integrates with existing systems and features Employee PerformanceTracking, Client Retention Analytics, Insurer Relationship Management, and Premium Benchmarking.

Key Features

- Applied Analytics comes with employee productivity dashboards that track overall employee performance, including acquisitions, task completion times, attrition renewal rates, and sales goal achievements.

- Premium Benchmark Dashboard is a feature powered by data from over a million policies, which compares current policies to similar ones in the market to ensure proper pricing and renewal validations.

- The solution enables analysis of clients, policies, premiums, and revenue retention, with options to filter data by quarter or year-to-date with the goal of enhancing client retention.

- The solution also includes Sales Performance Metrics which evaluates new, renewed, and cancelled business at the policy level with options to assess revenue by employee.

- The solution presents insurer relationship insights based on an analysis of policy, revenue, volume, and overall activity and suggests areas to focus on.

Benefits

Features Dashboards: Applied analytics has multiple dashboards that are frequently updated. Some notable ones are Retention Summary, Book of Business Policy, Insurer Summary, and Employee Productivity.

Visual Interface: Presents data through a dynamic visual interface and graphical report views that are accessible to all team members.

Resource Allocation: The software presents a snapshot of team performance on dashboards; this will help management better delegate work and fill gaps in operations.

Riskmap Dashboards: An innovative dashboard that can see current COVID-19 case counts by county, helping insurers monitor and prepare accordingly.

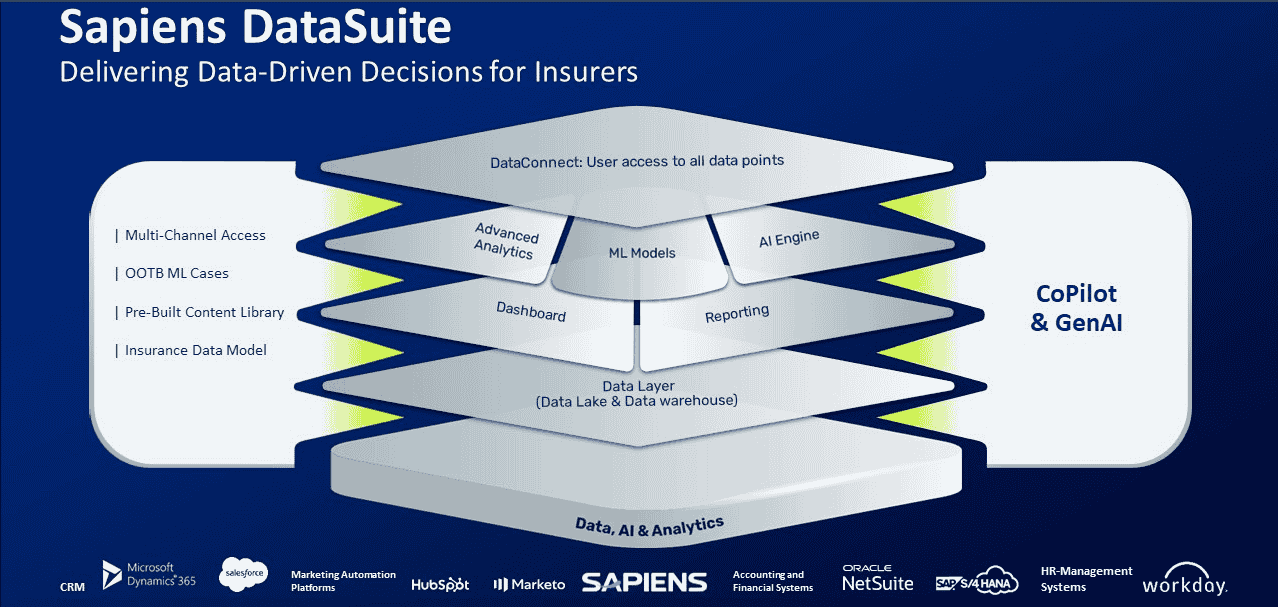

Sapiens DataSuite (Small and Medium Insurers Segment)

Sapiens DataSuite is an insurance data analytics solution that features Microsoft Power BI, ML, predictive models, GenAI, and more insuretech innovations. DataSuite’s two fundamental elements are SmartStore and Digital Information Hub (DIH); the combination of the two delivers extensive data analytics functionalities. This solution is modeled to be a robust and scalable solution that supports future growth and innovation.

Key Features

- SmartStore is a pre-built centralized data hub with an insurance-specific data structure, data marts, and logical models designed for in-depth analysis of the insurance sector.

- The pre-defined ELT/ETL layer helps transfer data from the operational system to the analytics data hub to transform transactional data into an analytical data model.

- DIH is comprehensive to handle enterprise-level data needs, including unstructured big data sources; it includes capabilities such as data quality control checks, auditing,and data de-duplication, and supports multiple currencies and countries.

- DataSuite offers an extensive library of pre-built analytics tools, such as 70 proven reports and 10 dashboards for immediate use, custom reports, and an embedded copilot system.

- The solution easily integrates with Sapiens and non-Sapiens systems from APIs, FTP sites, databases, file systems, and unstructured & big data sources.

Benefits

Customer and Agent 360° View: A single view approach provides a detailed view of customer behaviors, preferences, and interactions through the consolidation of information from various touchpoints.

Advanced AI and ML: The solution embeds AI and ML in both back-office and front-office processes. It leverages AI and ML models across the value chain.

Persona-Based Portals: DataSuite utilizes dynamic portals for customers, agents, brokers, and employers. Additionally, it includes advanced UI and self service capabilities.

Future-Proof DataSuite is regularly updated and includes an open architecture that supports digital readiness and accessibility.

Key Takeaways

- The solutions presently in the market are broadly categorized into enterprise and small and medium insurers solutions. The differentiating factors are the features, functionality, and tools they offer.

- Users looking to invest in an insurance analytics software should select a solution that matches the needs and size of their company. Enterprises find success with feature-rich and comprehensive solutions, while small and medium insurers can consider specialized options.

- Based on the market trends and the emergence of insuretech solutions, users can find software solutions that fit their specific needs and budget with little research.

Conclusion

The insurance sector is at the precipice of transformation; with the ever-changing regulations and increasing amount of data, an insurance analytics software is the need of the hour. By investing in one, not only do you leverage the features that enhance operational efficiency, mitigate the threat of fraud, and reduce costs, but also have a competitive edge in the market. Evidently, the insurance sector emphasizes a customer-centric approach, and analytics tools facilitate meeting this goal by adjusting pricing strategies, personalizing insurance products, and meeting evolving customer expectations. Embrace the benefits that come with a data analytics solution today!

If you’re interested in streamlining operations, be sure to read our blogs on Claims, Policy, and Billing management to gain a better understanding of how your competitors are leveraging technology.