The ever-changing and evolving insurance industry has undergone a myriad of changes in the past decade and insurance professionals face various challenges in 2025. With the mounting pressure to deliver exceptional service, thereby retaining and growing their client base, they are simultaneously bogged down by various administrative tasks that make their job significantly harder. Additionally, there are complex regulatory requirements, market competition, and insurance operations that problems are faced by agencies of all sizes. These complicated issues go beyond the basic capabilities of management software, so a specialized suite of tools to address them is pivotal.

Modern insurance agency software is designed to meet these specific needs, unlike generic management tools, such solutions are based on years of expertise, with an emphasis on functionality and integration of workflows, compliance requirements across jurisdictions, client relationship management, and operational capabilities unique to the insurance industry.

Why Do Agencies Need an Insurance Agency Software?

Most agencies do have basic tools or segmented solutions to assist them in daily operations, unfortunately, it has been limited to record keeping, marketing solutions, or other standalone solutions. While they did not forsake insuretech innovations, quite a few agencies have yet to adopt an insurance agency software. By simply automating redundant and mundane tasks, an insurance agency software allows agents to focus on their primary responsibility, which is to serve their clients to the best of their abilities. Let’s dive into the numerous benefits of an insurance agency software.

Client Relationship Management

Acquiring and retaining clients, although an important job, depends on an agency’s ability to handle client relationships. A good insurance agency software would provide many insurance CRM software functionality, including a holistic customer profile, client policy details, integrated communication and interaction history, lead management, and more. Imagine Sarah, an agent, with a modern insurance agency software, has access to all this information and more, would be in a position to do her job without hoops to jump through to get the required customer data and provide personalized service. Not only is she increasing the likelihood of renewals but also referrals.

Workflow Automation and Process Management

Insurance agents are swamped with paperwork; from complicated policy management to claims processing, insurance professionals face various administrative tasks. Automation features reduce an agent’s heavy workload. This leads to a change in the role’s responsibilities, to concentrate more on client consultation and relationship building than prioritizing administrative work. Consider Jonathan, an insurance professional bogged down by red tape, but after the adoption of an insurance agency software, the system gathers client information, requests, organizes, compares quotes, and schedules follow-ups accordingly.

Jonathan’s experience highlights how technology can ease the burden on an agent, explore our blog on Insurance Broker Software for insights on how these tools can improve an agent’s efficiency.

Compliance Management

The regulatory landscape is ever-changing, and keeping up with it is not an easy task. Many people opt for a specialized insurance compliance software, however, an insurance agency software helps users by staying on top of regulatory changes and ensuring all policy documents, coverage, interactions, and any relevant documentation are automatically updated with the latest changes. For instance, David, an agent handling multiple jurisdictions, would be required to be aware of compliance changes in those specific regions. However, it is humanly improbable to keep abreast of all the new changes in different places, an insurance agency software tracks and ensures everything is in order, preventing the risk of non-compliance, penalties, and even enhancing the agency’s reputation.

For further details, read this Quora post on ‘What are some of the best insurance agency software tools available?‘

Top 5 Insurance Agency Software

With the insurance industry growing, there are many software and insuretech innovations. Below are some of the best in the market.

Applied Epic

Applied Epic’s Agency Management System is a comprehensive system that manages prospecting, CRM, market access, quoting, accounting, reporting, and policy and Benefits Administration. The solution is browser-native with an open architecture foundation, which allows flexibility and integration to meet business needs.

Key Features

- The system is integrated with Benefits Management, where a benefit-specific screen presents plan information, rates, coverages, eligibility criteria, and TPA information. It also covers commission rate tier management and custom form management and templates.

- The platform’s business process management handles workflow automation through pre-built workflows and customizable process adaptation and reassignment.

- Applied Epic AMS is integrated with an insurance-specific accounting system that handles financial planning, reporting, and financial oversight, including analysis capabilities. It is equipped with financial tools built for insurance agency operations.

- The software oversees policy management with real-time access to policy information. It also manages back-office administration processes and document organization and retrieval.

- CRM integrations with platforms like Salesforce provide a holistic view of the client’s profile and centralize visibility for new business prospects and renewals. Additionally, Applied Epic includes integrated sales pipeline tracking and management.

- The document management system organizes documents based on agency guidelines with customizable folder hierarchy options, advanced search, reporting, and version control capabilities.

- Applied Epic integrates with a quoting application for personal and commercial lines, along with product selection and pricing optimization. It effectively reduces data entry errors and includes direct insurer quoting in the AMS.

Benefits

Insurer Connectivity: The platform automates exchange of information with carrier partners, downloads the policy directly into the AMS, and streamlines insurer communication channels.

Reporting and Data Analytics: Applied Epic’s system derives graphical business insights from system data, conducts performance analysis and profitability assessments, and offers actionable insights.

Omnichannel Customer Service: The software integrates with customer self-service portals that are available 24/7, offers mobile app connectivity, and service delivery options across various channels.

Future Readiness: The open architecture and flexible platform design supports integrations with both applied and third-party applications.

EXLynx

EZLynx’s Management System is a cloud-based platform with intuitive tools for agency management and automation. It is packed with tools that help with policy management, rating, submissions, and so much more. EZLynx allows users to streamline daily tasks with automated workflows and easily access customer quotes, policies, claims, and documents in one organized place.

Key Features

- EZLynx’s Agency Workspace, a collaborative environment, where users can feature notes, tasks, checklists, reminders, and notifications to ensure team members are on the same page.

- The Automation Center manages workflow automation, handling redundant tasks with predefined triggers and actions for common scenarios.

- Client Center is a 24/7 self-service portal for clients to access policies, generate certificates, submit change requests, track claims, and much more.

- Communication Center integrates messaging solutions, such as email, text, e-signature, Outlook/Office 365, and even postal mail.

- Retention Center is a unique interface with predictive analytics that identifies at-risk clients to communicate better and simplify renewals through policy comparison capabilities.

- Sales Center is an insurance-specific CRM and pipeline management tool with Agency Insights functionality designed to identify cross-selling opportunities.

- Submission Center handles the submission process from submission to binding, including product and appetite guidance to improve outcomes.

Benefits

Regulatory Compliance: Through structured document management and standardized workflows, EZLynx helps organizations to adhere to regulations and carrier requirements.

Mobile Capabilities: The solution provides on-the-go support for agents, with mobile access, users can look up policy information, access documents, and more importantly location-based features when they are away from the office.

Accounting Capabilities: The solution is integrated with premium trust accounting that tracks income, receivables, payables, and commissions.

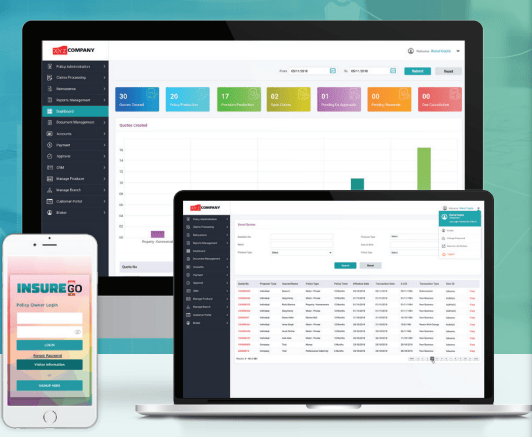

Damco InsureEdge

Damco’s InsureEdge is an insurance agency software that was developed by experts with over 20 years of experience in the insurance industry. It encompasses features specifically designed for policy management, claims management, reinsurance, and customer engagement. With a “digital-first” approach, InsureEdge is set to transform insurance operations while reducing costs and enhancing productivity.

Key Features

- The software’s policy administration capabilities ensure an end-to-end policy lifecycle management with automated creation of personalized quotes, overseeing endorseents, renewals, and cancellations, and integrated document management.

- InsureEdge’s comprehensive claims processing capabilities span from FNOL to settlement using AI/ML-powered processing, Intelligent Document Processing (IDP) features, and automated workflow management.

- Reinsurance management includes a multi-level treaty setup model, bordereau reports integration, policy administration integration, and even supports facultative inward and outward business.

- The solution provides complete CRM and customer engagement through unified communication management with clients, brokers, agents, and vendors. It also identifies and converts leads from various sources, offers digital customer onboarding and customer journey mapping.

- InsureEdge’s interactive customer self-service portal enhances transparency and communication, and the agent portal has real-time data exchange between agents and users.

- The platform is built on an Open API library for third-party integrations and integrates with accounting systems, loyalty programs, and regulatory platforms.

Benefits

Mobile Application: InsureEdge comes with a customer-centric self-service app for policy management, digital payment processing, and query management and resolution.

Document Management: The solution consists of a digital document repository with easy generation and access to policy and claim related documents. The platform supports document uploading and is integrated with physical file movement tracking.

Reporting and Analytics: InsureEdge includes over 80 standard and statistical reports, data-driven dashboards, and IFRS 17 compliance for reporting.

Product Administration: System configuration and customization are used to manage role-based permissions, access control, and user management. Additionally, it manages rate configuration, discounts, and loadings setup.

Regulatory Compliance: The platform adheres to multi-state compliance requirements for diverse operations, consisting of automated regulatory and statutory reporting and data access points for compliance reporting.

AgencyBloc

AgencyBloc’s AMS+ is a cloud-based insurance agency software, empowering professionals to simplify their operations, improve client relationships, and enhance sales. AMS+ is a specialized solution that supports Health, Senior, and Benefits industry catering to independent agencies, uplines, and carriers.

Key Features

- AMS+ allows retail agencies, GAs, IMOs, FMOs, and call centers to manage their complete sales to service process in one platform.

- The customizable lead form builder, lead vendor posts, and lead importing tools bring in leads that are automatically assigned to agents based on customizable lead routing rules.

- The solution is integrated with industry-focused VoIP functionality to make prospecting easier for agents. With a built-in scheduler, appointments can be easily made; these appointments automatically adhere to electronic compliance communications like scope of appointment and consent to contact.

- The Quote+ solution handles the entire quoting process all the way to closing. Quote+ provides the tools to shop medically underwritten, community rated, and ancillary products from different carriers and compare them to make the suitable choice.

- The Quote+ secure online medical health questionnaire allows users to create and update health data and securely map it to carrier forms.

- The platform helps users track groups, policies, agents, enrollments, employments, and relationship data together. It keeps notes, call recordings, and other important interaction history in one area of the platform for easy reference.

- AgencyBloc’s Commissions+ helps agents uncover missing compensation; it quickly imports carrier statements, uncover lost commissions, set up agent hierarchies, define revenue payouts, and provide online agent commission statements.

- Commission+ also helps agencies monitor the performance of downline agents and agencies

Benefits

Customer Communication: An email marketing and text messaging tool helps agents enhance their sales. Agents can utilize click-to-call functionality, set up call queues, play pre-recorded messages, set up voicemail drops, and more.

Reporting and Data Analytics: The platform can build custom industry-specific reports in AMS+, generate insightful reports for sales, servicing, commissions, renewals, cross-selling, and more.

Cross-Selling and Renewals: AMS+ helps agents identify clients that lack specific coverage and starts the selling process from scratch.

Regulatory Compliance: AMS+ is HIPAA compliant, conducts regular audits for HITRUST and SOC2 Type II, and adheres to standardized security standards.

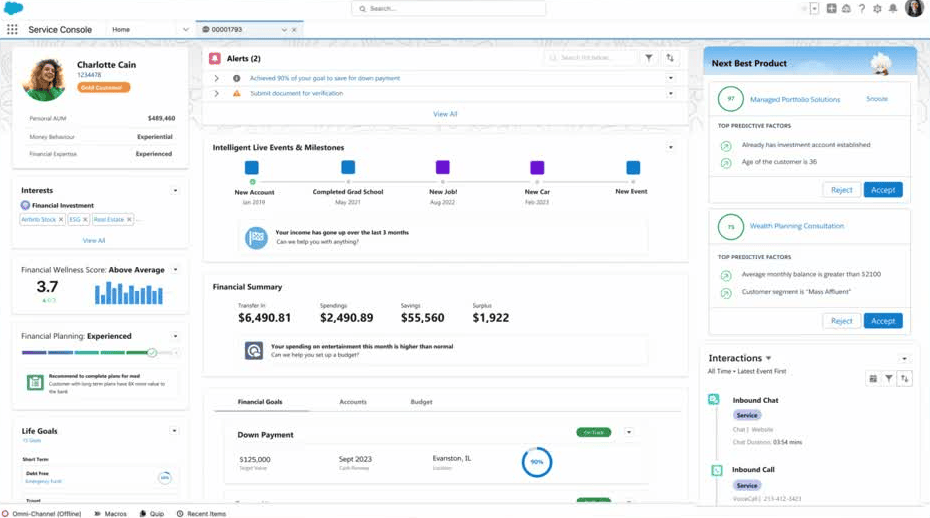

Salesforce

Salesforce’s Customer 360 for insurance agencies and brokerages is custom built with AI-powered technology, unified data, and automated workflows. It encompasses Marketing, Sales, Service, Data, IT and Analytics. It utilizes a portfolio of technology and services to help the front, middle, and back office to address the challenges in the insurance domain.

Key Features

- The unified data presents a 360-degree view of clients, carriers, and partners, and offers integrated data management across different systems and touchpoints.

- The platform’s sales and marketing capabilities include automated opportunity management and lead tracking, out-of-the-box producer marketing tools, digital demand generation with AI-powered segmentation, and generative AI support for sales processes.

- Customer 360 automates claims tracking and processing, including real-time updates and self-service options for clients, and manages the entire policy lifecycle.

- The solution operates in the cloud, encompassing marketing, sales, service, and analytics, and employs a low-code platform for custom AI agent development.

- The platform’s splits and revenue management capabilities include producer split arrangements and assignments, direct bill commission processing and reconciliation, and expected revenue tracker.

- The MarTech stack comes with various tools and marketing functions, including digital advertising, email activation, social media marketing, marketing intelligence, and much more.

Benefits

Mergers and Acquisitions Support: Customer 360 is equipped with tools for integration and collaboration during agency mergers.

Integrated Communication Tools: The platform utilizes Slack and other tools for collaboration amongst team members and client communication.

RFP Management: With reusable question banks and automated workflows, the platform simplifies proposal process requests.

Compliance and Security: Customer 360’s platform is encrypted, monitors events, includes field audit trail management, and provides secure data sharing and collaboration tools.

Agentforce Sales Coaching: Sales coaching is powered by the agency’s CRM data to support sales reps with prep for client meetings, producers to practice their pitches and review feedback based on the specific deal and its current stage.

Conclusion

In the year 2025, the insurance market is moving towards the goal of complete digitization. Adopting insurance agency software isn’t just keeping up with the times but the need of the hour. These platforms have gone beyond basic book keeping abilities or appointment scheduling functionalities; they have transformed how insurance operations run. For insurance agencies to navigate the complexities, the question now isn’t whether or not to invest in a specialized software but rather which would be most suitable for their specific business requirements, be it in terms of lines of business, scalability, compliance, or specialized capabilities. The right software for your organization is just a few clicks away!

Many Agency Software offer various functionalities, but if your organization requires specialized tools, dive into our blogs on Insurance Quoting Software, Insurance Policy Management Software, and Insurance Analytics Software.