The world population is rising; this increase directly correlates with a rise in life insurance policyholders. The global life insurance market has been growing at an astonishing rate, not to mention the prevalent awareness about insurance, its various benefits, and its dire need in such an economically unstable world, which has nearly doubled the number of policyholders in the past few years. Adding to that, the middle-class population’s growth and the early adoption of insurance have become commonplace, resulting in an expansion of the life insurance market. This expansion created a demand for life insurance software, catering not only to enterprises but to organizations of all sizes.

What is Life Insurance Software?

Life insurance software is now a critical tool that helps organizations manage the two most important factors of the business: Client relationships and Policy portfolios. Modern life insurance software is more than a technological solution; it goes beyond administrative capabilities, encompassing policy management, claims processing, customer engagement, compliance, analytics, and so much more. The goal of using such a solution is to enhance transparency by providing exceptional service and fostering strong customer relationships, as well as simplifying claims and policy-making through workflows, automation, and AI/ML algorithms.

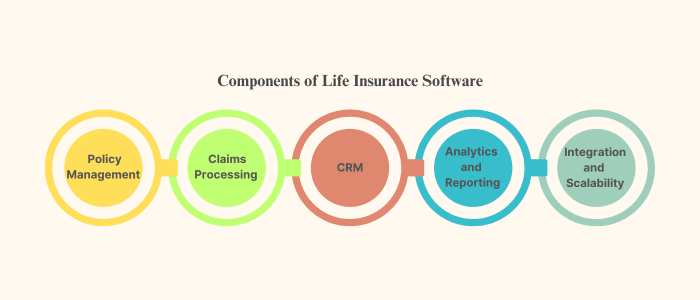

What are the Components of Life Insurance Software?

With the complexities in the life insurance sector, addressing the pain points aside, every good life insurance software should be equipped with at least these five critical components.

1. Policy Management: Comprehensive platforms will have various features related to policies, including coverage amounts and verification, quote generation, premium payments, modifications, and renewal dates. A platform that is unified makes it easy to access information, verify it, and ensure errors and compliance issues are reduced.

2. Claims Processing: Handling claims has never been more straightforward with automated workflows and real-time tracking, digitization, and analysis of data. They help not only to simplify the process, leading to quick claim resolutions, but also to reduce operational costs.

3. Customer Relationship Management (CRM): Modern solutions provide a 360-degree view of the customers, and the vast amount of data that comes with it is analyzed to provide insights, recommend products to clients, and even upsell. With various CRM capabilities, insurers offer personalized service and targeted market campaigns.

4. Analytics and Reporting: Making data driven decisions has become the norm in today’s digitized world, gathering data from various sources and thoroughly analyzing them can present growth opportunities, optimize product offerings and pricing to meet the client’s needs in this competitive market.

5. Integration and Scalability: The ability to integrate with existing software, third-party applications, data sources and providers, and other digital marketing tools. For example, an insurance accounting software or insurance compliance software is considered a specialized software many would want to upgrade to. Moreover, investing in a software is a long-term commitment; insurers would want a software that scales with them as they grow.

What are the benefits of Investing in a Life Insurance Software?

The investment and implementation of a modern life insurance software offers not just these but more benefits as well.

- Increase in operational efficiency

- Reduced administrative costs

- Stringent compliance adherence

- Data accuracy and security

- Customer satisfaction and retention

A thorough analysis can showcase that these benefits far outweigh the cost of implementation.

When considering various software options, our blog on P&C Insurance Software and Health Insurance Software provides a broader perspective on different lines of business.

Top Life Insurance Software

This blog focuses on the various life insurance software options, detailing their features and benefits. Consider this a comprehensive guide to life insurance software, helping you choose the right solution for your organization.

Oracle Life Insurance Solution

Oracle life insurance solution incorporates underwriting, policy processing, billing, and claims to create a configurable life insurance software that has a flexible, digital-first, and rule-based approach to it.

Key Features

- Oracle Insurance Analytics, Reporting and Integration Repository (ARIR) is a data store add-on that offers real-time data exchange with producers and service providers, intuitive dashboards, and business intelligence tools.

- A flexible, unified policy administration that covers the entire policy life cycle through a rule-based system for individual life and annuity and group insurance products, all on a single platform, with detailed audit trails and product configuration capabilities.

- Oracle claims administration offers intelligent automated adjudication, provider pricing definition, product definition, and authorization management.

- Oracle Insurance Data Exchange allows carriers, producers, and service providers to exchange data, enabling submission in various formats with data format translation.

- The software utilizes customer data to offer personalized digital experiences on various channels, self-service options, assisted customer service models, and targeted offers.

- The platform is compliant with the standard methods of encryption and adheres to IFRS 17 and LDTI accounting standards.

Benefits

Unified Platform: It eliminates the need to use multiple systems for different modules, and system maintenance can be conducted through a common set of configurable business rules.

Oracle Insurance Calculation Engine: A rule-based product configuration tool serves as a centralized location for defining rules that external carriers utilize for rules and calculations, supporting various lines of business and functionalities.

Oracle IFRS 17 Software: The IFRS 17 Analyzer meets the accounting requirements, such as Solvency II, IFRS 9, LDTI, and CECL, through data aggregation, CSM calculation, and finance and actuarial applications.

G2 Reviews: 4.2 / 5.0 (10 reviews)

Strengths: Reviewers have raved about the intuitive interface, which helps with navigation and customization; another noteworthy aspect is the centralized data management capabilities for document and policy information storage.

Limitations: The visual design is said to look outdated, and the platform itself is occasionally slow and even freezes in case multiple applications running.

EIS OneSuite

EIS OneSuite is a SaaS platform made specifically for life and annuities. This solution uses a future-ready approach with various features designed to launch products faster, increase your agents’ productivity, and easily meet customer expectations.

Key Features

- EIS’s automated continuous underwriting support has replaced questionnaires and manual assessments; with real time data collection and analysis, risk assessment and pricing are accurate.

- Through open API integration, EIS helps business users connect with third-party tools and IoT devices and even facilitates customer campaigns for events.

- It offers no-code configuration so products can be quickly developed with capabilities to launch multiple customizable products. Additionally, its decoupled microservices architecture supports rapid innovation.

- Built on a customer-centric architecture, EIS eliminates data silos, creating automated touch points throughout the customer’s journey and offering personalized experiences.

- By putting the entire tech stack into one platform, there is no need for numerous PAS, reducing costs and technical complexities.

- The product structures are easy-to-understand, making it convenient for all age groups to buy policies and claims.

Benefits

Engagement Tools: There are resources available that provide agents with the knowledge and skills to provide better service and handle their book of business.

Future-Readiness: The architecture allows for continuous integration with the latest insurtech technologies and ensures data integrity.

G2 Reviews: 4.6 / 5.0 (4 reviews)

Strengths: Reviewers mention that EIS’s platform has a user-friendly interface with advanced billing and cash management abilities.

Limitations: The need for configuration is a common issue, many users reported that the platform requires extensive configuration to be able to meet the requirements.

Majesco L&AH Core Suite

Majesco’s L&AH intelligent core suite is a SaaS-based solution that combines policy, billing, and claims on a single platform. The platform features extensive APIs and innovative built-in tools. Majesco transforms digital experiences for clients, agents, and brokers by offering a comprehensive solution that caters to the needs of individual, group, and voluntary benefits insurers.

Key Features

- Various insurance products such as individual, group, and voluntary benefits, are integrated on a common platform.

- Rapid product launches, ready-to-use product templates, and a powerful rating engine are the most noteworthy features of policy management. These tools help with product flexibility, allowing for quick adjustments and updates.

- The platform handles the underwriting process with an intelligent workbench. Claims adjudications are facilitated through dynamic case management and skill-based adjudications.

- The claims management module automates the entire process, eligibility checks increase the speed, and 360-degree claim dashboards provide all the required information to increase responsiveness and resolution time.

- There are flexible settlement options for claims as well as appeals management, all with the goal of improving customer satisfaction.

Benefits

ClaimVantage Integration: ClaimVantage is built on a Salesforce Lightening platform to enhance many aspects of claims processing for all the insurance products.

API-Driven Ecosystem: The platform integrates with third-party applications and services.

Gartner Review: 4.8 / 5.0 (3 Reviews)

Strengths: There is praise online about the product suite and its capabilities, particularly the rating engine, future-proof approach, and collaborative approach they have towards the development of solutions.

Limitations: A common complaint is performance issues, slow response time, and the need for resources for maintenance and vendor services.

Cognizant Digital Solution: Life & Annuity

Cognizant Digital Digital Solution: Life & Annuity is a unified platform. By consolidating systems with a comprehensive portfolio of digital tools with automation capabilities, the solution aims to reduce various costs while maintaining operational excellence.

Key Features

- It combines insurance expertise with insurtech tools (cloud, data insights, automation, and artificial intelligence (AI), creating a comprehensive technological infrastructure.

- The solution has advanced automation capabilities for specific functions and end-to-end operational processes. By using leading automation platforms, Cognizant enhances employee productivity.

- Policy administration functionality supports all policy-related services, offering various product types, such as individual life, annuity, and retirement administration.

- Digital customer service capabilities are quite extensive, with proactive and predictive customer interactions, multiple customer channels, and better customer experiences.

- Cognizant’s Digital Finance and Accounting uses advanced capabilities, turning procure-to-pay, order-to-cash, record-to-report, and financial planning to business insights, improving the financial health of the organization.

Benefits

OIPA Implementation: Cognizant is the only Oracle Platinum partner offering various services to carriers and users who wish to leverage Oracle’s benefits.

Cognizant’s Services: Cognizant offers managed, consulting, and implementation services, which include a combination of people, processes, and technology that simplifies operations.

Global Presence and Experience: The platform is used by 7 out of the top 10 global insurance giants, expanding over 20 global delivery centers, more than 248 technology presence, and 3,600 life and annuity operations experts.

Sapiens CoreSuite for Life & Annuities

Sapiens CoreSuite is built on Sapien’s renowned insurance platform. The single-platform approach offers a holistic view of all client information from PAS to communication streams. The cloud-native, end-to-end platform’s extensive API library enhances its capabilities by combining digital engagement tools with advanced, robust functionalities.

Key Features

- The cloud-native architecture provides flexible deployment options, scalability, and lays emphasis on the need of the hour– a future-proof SaaS solution though DevOps/NoOps mechanism.

- The platform supports individual and group life annuity products as well as managing investments and voluntary benefits.

- Pre-integrated with Sapiens DigitalSuite, it has various built-in tools, digital enablement, and API Layer components.

- The intelligent configuration tools are low code/no code, making it convenient with self-service configuration capabiltiries. They also consist of Smart Packs with pre-configurated product templates and a large catalog of product options.

- Sapeints intelligence is embedded in the platform, providing a wide range of data management and analytics capabilities, including a comprehensive view of clients and policy dashboards.

Benefits

Global functionality: Sapiens’ multi-territory approach is assisted by multilingual and multicurrency options, not to mention it also supports global expansion and reach.

Regulatory Compliance: The platform is built to support current and future changes. With streamlined testing before going live and comprehensive documentation, the platform reduces errors, improves CX, and ensures adherence to regulatory requirements.

System Consolidation: The platform’s unique approach eliminates the need for migration from existing systems by offering a cloud-based end-to-end solution.

Gartner Reviews: 3.5 / 5.0 (4 reviews)

Strengths: Users seem to like the flexibility and modularity the solution offers, considering the low-code/code configurations. Sapiens’ expertise and functional support is well appreciated by many users as it smoothens the implementation process.

Limitations: The high costs of professional services and policy management raise concerns about budget overrunning. Integration challenges are also a common issue in reviews.

Keylane Plexus

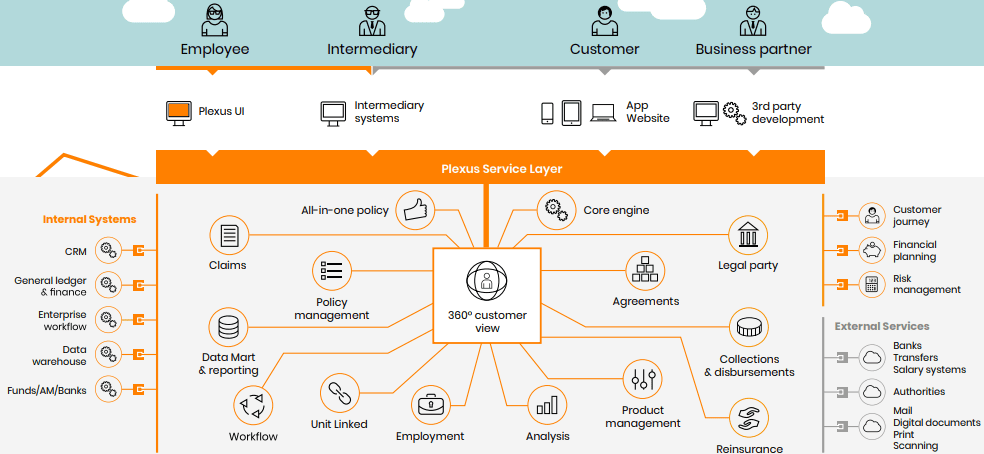

Keylane Plexus is a SaaS Life & Pension platform that addresses the major concerns in the life & pension industry today: regulations, market differentiation, technological upgrades, and more. Plexus fortifies an organization’s digital foundation with technological innovations and tools to accelerate time-to-market and meet customer expectations.

Key Features

- The end-to-end SaaS architecture is a complete web-based software deployed on a cloud environment with third-party ecosystem connectivity, easing integration with legacy systems or existing applications.

- A service-oriented architecture for omnichannel delivery and connects with external services like banks, authorities, and mail systems. The solution integrates through API layer connectivity to in-house or third-party tools such as CRM systems, general ledgers, and enterprise data warehouses.

- A stringent, evolving compliance framework ensuring regular local and regional regulatory updates, assessments, and adaption. It also manages transaction traceability and control.

- Plexus provides customizable client portals with journey templates, customer-centric interactions, and automated incorporation of customer changes through straight-through processing.

- The modular system design covers the core engine, policy management, collections & disbursements, Product management, Data Mart & reporting capabilities. The modular design offers flexibility and scalability like never before.

Benefits

Add-On Modules: Apart from the built-in modules, the platform offers various add-on modules, including legal party management, claims handling, unit-linked management, Employment tracking, reinsurance contract management, and more.

Keylane’s Services: The platform offers consulting, implementation, and migration services. A dedicated implementation and migration support team, along with a data migration competence center, has successfully completed over 90 projects.

Gartner Reviews: 3.5 / 5.0 (8 reviews)

Strengths: The platform’s stability and flexibility are particularly suitable for the life industry. Keylane’s knowledgeable team and modern tech are frequently praised for ease of collaboration and proper implementation support for on-time delivery.

Limitations: Slow response and poor performance stability are recurring issues that hinder CX, and users are also frustrated by the lack of proper customer support from Keylane’s end and the integration challenges they faced.

INSTANDA Life and Health Insurance Platform

INSTANDA’s Life and Health Insurance Software is a no-code platform with a customer-centric approach, integration capabilities, and quick speed-to-market benefits. By digitizing the life and health insurance industry, INSTANDA aims to create new products, expand to new markets, and provide various services to better support its clients.

Key Features

- The sophistical no-code configuration environment comprises an intuitive drag-and-drop interface that supports quick launches by bypassing lengthy product development cycles and allows for changes without any dependency on IT expertise.

- The SaaS platform operates on a cloud-native architecture with unlimited API and Webhook integration abilities, connecting with various technological ecosystems.

- INSTANDA’s unified platform manages the entire insurance lifecycle, from submission to ongoing policy administration.

- INSTANDA’s intuitive employee portal is equipped with self-service capabilities, namely customization of plans, submitting claims, and accessing information, all on the same interface.

- There are various portals specifically designed with the users in mind: consumers, brokers, and internal teams, to organize and optimize engagement across multiple channels.

- The system eliminates the need for clerical work through document generation and processing capabilities, resulting in the acceleration of policy issurance workflows.

Struggling with Document Generation? Check out Perfect Doc Studio, Multilingual Customer Communication Management (CCM) Platform, for a personalized digital experience with support for 100+ languages, ready-made templates, and intuitive design.

Benefits

Customizable User Experiences: The platform offers complete customization of customer interfaces and user journeys. This allows business users to create unique experiences that are tailored to meet specific market segments or audiences.

Behavioural Analytics: The data collected is used to create personalized insurance offerings for customers.

G2 Reviews: 4.3 / 5.0 (3 reviews)

Strengths: The software is known for its digital and quick policy processing capabilities, improving sales. Users also praise the adaptability and user-friendly aspect of the platform.

Limitations: Some common complaints have been the limitations of system compatibility that can only be overcome with specific setups and are inconvenient. Similarly, some development tasks also require expert intervention.

Accenture Life Insurance & Annuity Platform

Accenture Life Insurance & Annuity Platform (ALIP) is an insurance solution that delivers products quickly through industry-leading tools that automate, configure, test, and integrate to launch more products, reduce operation costs, and provide superior customer service. Built on a fully configurable, angular-based platform, ALIP is a rules-driven insurance policy management software with various deployment options.

Key Features

- ALIP’s extensive library of ready-to-use life and annuity products includes Traditional life products, Non-traditional offerings, and Diverse annuity products.

- Product configuration can be done through a modern workbench and workflow, actuarial calculation engine, transactions and fund components, and Product Testing Workbench and Debugger.

- The platform’s architectural design features a single and continuously improved code base through Kubernetes to reduce IT maintenance and low-/no-code applications simplified maintenance updates.

- The actuarial calculation engine can support complex formulas and product tables.

- The out-of-the-box product templates are preconfigured and tested to expedite product launch. Additionally, preconfigured rules are applied to new product features, riders, and benefits to product structures and calculations.

- ALIP’s Base First Approach, Continuous Upgrade Program, Client Advisory Board, ALIP University consolidate best practices and latest enhancements, aiming to reduce customization needs and expedite time to market.

Benefits

Deployment Options: The design offers flexible and cost-effective Software as a Service (SaaS) and Platform as a Service (PaaS) models.

Compliance Features: ALIP includes built-in compliance functionality for U.S. tax processing and can configure rules and calculations for the global market.

Transaction Management: The platform handles cash management, claims processing, billing, and more with integrated transactional capabilities.

Gartner Review: 4.1 / 5.0 (9 reviews)

Strengths: Reviews have highlighted the flexibility ALIP offers in product configuration (quick market response, product development, launches, and more). The vendor support is well recognized by many, and Accenture works towards effective communication and understanding of client needs.

Limitations: Common complaints include manual processes for managing configuration changes, which result in man-made errors and, thereby, delays. Business users note there are typically long timelines for enhancements and updates.

Alternative Life Insurance Software

1. Guidewire Insurance Suite

2. OneSheild Enterprise

3. DuckCreek Technologies

4. Insurity Platform

5. Damco Solutions

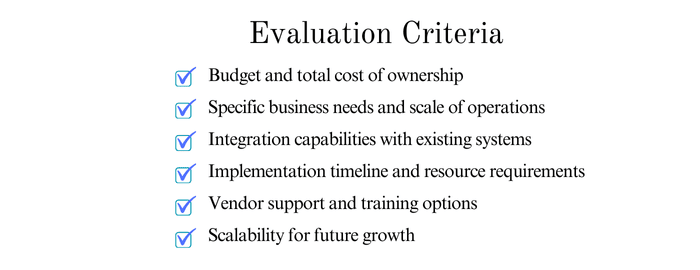

These life insurance software are some of the solutions that are well recognized for their features, CX, and industry accolades. However, choosing the right software is an entirely different paradigm. Below is an evaluation criteria to help guide you in making this decision.

After a thorough understanding of your business needs, it becomes easier to choose the right software that caters to various needs and has different approaches to the life insurance industry.

Conclusion

There is no one-size-fits-all, especially with so many life insurance software in the running. When selecting the right software, typically there is an assessment phase, where users would conduct a thorough assessment of the organization and its needs. Then comes the selection phrase, where users would compare the potential solutions with their requirements to find the best fit. Finally, we have the deployment planning phase, where users focus on the implementation and the changes it brings.

Interested in specialized solutions? Explore our blogs on Insurance Claims Management Software, Insurance Billing Software, and Insurance Policy Management Software.