Claims are the backbone of any insurer. This has always been the absolute truth in such a customer-centric domain as the insurance industry. For decades, insurance has been something people turn to for protection against loss, health issues, and financial uncertainties. An insurer’s job is to fulfill the promise of providing monetary compensation when unexpected and unfortunate events occur. Building on this promise is the foundation of trust and integrity that insurers establish among their policyholders.

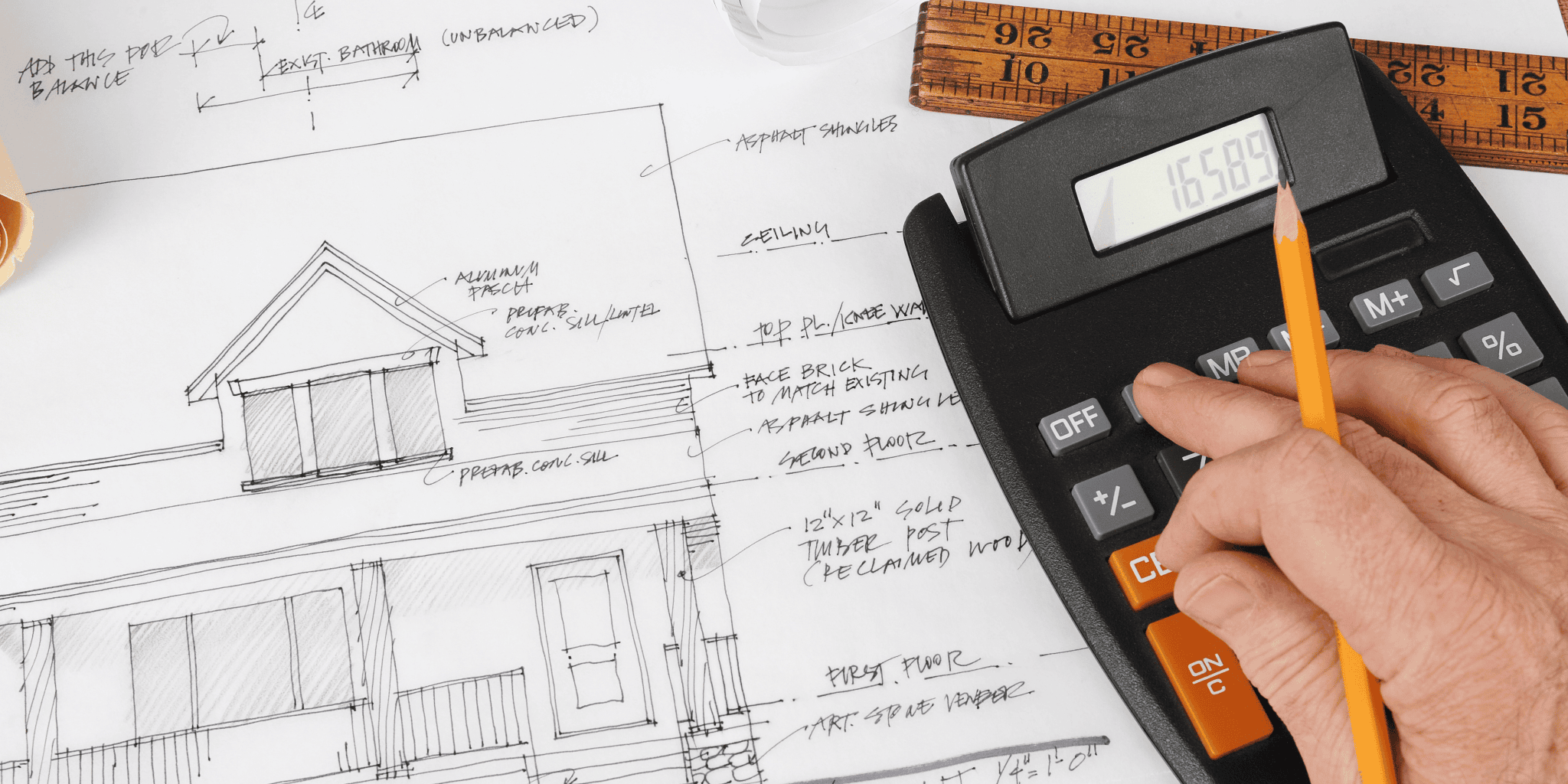

Processing claims today is entirely different from what used to be the manual and grueling process of estimation. Back then, if you had met with a car accident, the adjuster would be responsible for estimating the settlement value. He or she would have to go through tens if not thousands of manuals, auto parts brochures, catalogs, and more just to find the cost of the parts required. It didn’t end there, there were other considerations, such as how old the car was, Can we get the original parts as replacements, or do we need to find alternatives? What would be the labor cost to fix the car?

This process is time-consuming, and with the rate at which claims are submitted these days, it would not only be inefficient but also illogical to continue with manual processes when estimating processes can be automated. Typically, claims management software comes with estimating tools, but specialized solutions, insurance estimating software, help insurance adjusters and contractors obtain accurate and precise estimates for repairs or replacements.

What is a Insurance Estimating Software?

Insurance estimating software is a suite of tools used by adjusters that calculate claim costs. The software primarily generates detailed cost estimates for repairs and replacements and ensures proper documentation. Its estimating capabilities are owed to its extensive industry database, advanced algorithms, historical data analysis, real-time market costs, and more.

Insurance estimating software automate the calculation task to reduce the time and resources required for claims processing. Not only does it make an adjuster’s job easier, but allows them to spend time on complex cases which require their expertise.

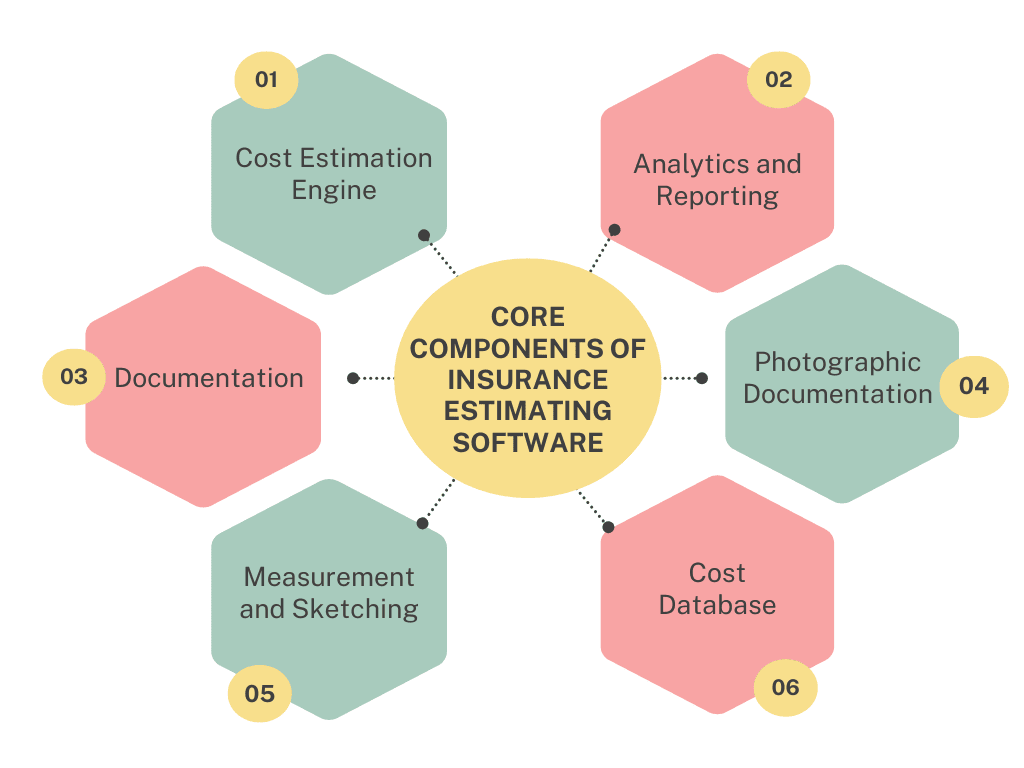

Core Features and Capabilities of Insurance Estimating Software

1. Cost Calculation/Estimation Engine: The algorithms embedded in an insurance estimating software help process numerous aspects of repairing the damage, including material expenses, labor rates, market price variations, and more, to analyze the data and provide accurate estimates.

2. Analytics and Reporting: An insurance estimating software includes reporting tools that can generate comprehensive reports based on claim data, trends, market analysis, and performance metrics. The solution’s extensive document storage assists in the analysis, and can be further enhanced by utilizing an insurance analytics software.

3. Documentation: Insurance estimating software’s structured document maintenance organizes claim documentation with version control and adjuster notes, if any. It also includes all policyholder communication, contractor estimates and invoices, and documentation related to regulatory compliance.

4. Photographic Documentation: A modern insurance estimating software is equipped with photographic documentation capabilities, such as georeferencing, automated photo categorization and tagging, drone usage for aerial views, and AI-powered damage detection in photographs, and its capabilities can be enhanced by using an insurance verification software.

5. Measurement and Sketching: Digital measurement tools convert field data into an accurate digital representation of all damages while sketching tools automatically calculate all the data as adjusters create digital diagrams.

6. Cost Database: By offering real-time pricing, adjusters can consider material costs, labor rates (specific to the region), and specialty contractor rates. Additionally, it adjusts the pricing based on market-specific rates.

Property Insurance Estimating Software

Using specialized tools for property management? read up on our blogs on P&C Insurance Software and Insurance Quoting Software for insights on new technologies.

Xactimate: Property Claims Estimating Software

Xactimate is a solution specifically designed for property restoration estimates. This tool offers a suite of features that have transformed how adjusters manage property claims. Adjusters use this tool to generate property loss estimates and claim settlement offers, automating the process to ensure that there are no delays and that customer satisfaction remains at an all-time high. Xactimate is known for its flexible platforms, easy software installments, and integrated property data options.

Key Features

- Xactimate is available on three platforms: Xactimate Mobile, Xactimate Online, and Xactimate Desktop. The mobile platform facilitates on-site estimation with real-time data synchronization.

- XactScope utilizes a virtual property model with established prompts to guide users and provide a complete estimate. It adds line items, quantities, and actions as users scope a loss.

- The solution’s real-time pricing updates across Xactimate Sketch AR™ is a property measurement tool that uses augmented reality tech to take direct-to-sketch measurements on mobile devices.

- Pricing research covers 468 geographical regions, 20,000 surveys, and analysis of over 124 million data points annually.

- XactAnalysis is an integrated tool that monitors the entire claim cycle with real-time error detection and performance benchmarking.

- The restoration manager is designed for property damage and restoration jobs, managing tasks, controlling schedules, monitoring costs, and handling communication with technicians and trade partners.

- Xactimate Time & Materials™ helps construction professionals track costs, send invoices, and report expenses directly to the insurer.

Benefits

Weather Integration: Xactimate’s benchmark feature updates daily storm data, including a 90-day historical weather data access, and presents address-specific weather reports

XactContents: The solution includes a content repository that enables access to major retailers for replacement items, including discontinued products, vendor-specific items, and general quote items.

Customer Experience: The platform has multilingual reporting capabilities and delivers detailed documentation.

Cloud-Based Storage: The platform’s cloud storage enables users to access it from various devices. In addition to proper document storage, cloud capabilities enhance collaboration among users.

Compliance: XactXpert is a cloud-based rules engine that ensures adherence to compliance by providing real-time guidance.

Symbility Suite of Tools

Symbility (Core Logic) is renowned for its claim-estimation technology, streamlining the claims process by addressing the complexities adjusters face. The platform includes a comprehensive feature set: Claims Connect, Mobile Claims, Video Connect, Desk Adjuster, Business Intelligence, Link, and Quality Connect.

Key Features

- Claim Connect is a cloud-based workflow management platform powered by a rules-based engine. It features an easy-to-use interface, mobile architecture, in-app notifications, contextual quick actions, and integrates with over 50 industry providers.

- Mobile claims facilitates on-site verifications by utilizing Virtual diagramming, voice annotation, photo documentation, logic-based questionnaires, a prefill tool, and full pricing capabilities

Video Connect enables adjusters to collaborate with policyholders through geocoding verified live videos, allowing real-time remote property inspection and preventing fraud. - Desk Adjuster uses a patent-pending, logic-based methodology to simplify the adjusting process. Through guided experience and automated question flow, it reviews claims, prepares estimates, selects repair or route options, and updates claim status.

- Business Intelligence converts claim data to actionable insights through performance analytics, comparative analysis, and data mining capabilities.

- Quality Connect enables users to review and reinspect claims through an electronic review system and customizable questionnaires. The reinspection can remain confidential, and all Quality Connect review data is utilized to identify recurring issues.

Benefits

Link: The web application helps communication between insurers and policyholders. The self-service portal provides policyholders access to a detailed repair calendar, notes, photos, and other documentation.

Operational Excellence: Carriers engaged with Symbility’s analytics team have an average “Received to Contact” time of 1.83 days vs the industry average of 2.4 days

Customer Experience: The web portal, Link, ensures transparency, self-service, and consistent response. Symbility has a proven record of quick resolution that enhances CX.

Integration: The platform has an open API framework and prebuilt connectors for leading industry insurance platforms.

Damco Property Damage Estimation Solution

The Damco Property Damage Estimation is a suite of advanced features designed specifically for adjusters and carriers. The estimation tool utilizes innovative technologies like Artificial I Intelligence (AI), Machine Learning (ML), and Optical Character Recognition (OCR) for accurate estimation, and Damco uses Pytorch and Fast AI for the implementation.

Key Features

- AI, ML, and OCR are used to analyze images and data from loss estimation reports.

- The platform allows for customization of Quality Assurance (QA) rules, ensuring users can accommodate internal standards on all the claims.

- All the reports on the platform utilize ML to validate them in real-time to prevent any errors.

- Damco’s loss estimating solution works with existing solutions like Xactimate to ensure precise estimation and proper review.

Benefits

Mobile Access: The mobile platform allows adjusters and users to access the platform remotely, ensuring on-site inspections and report generation.

Reporting Tools: The platform’s customizable reporting tools can easily generate loss estimation reports.

Real-Time Pricing: All the estimates are based on up-to-date pricing information as per the market conditions.

OCR: OCR Tech captures images during inspections, so all the relevant data is processed and included in the final report.

Automotive Insurance Estimating Software

Mitchell Estimating Solution combines over 75 years of expertise with innovative insurtech to deliver exceptional customer service and simplify the estimation of collision repairs for appraisers and insurance carriers. Mitchell addresses the complexities of automotive insurance in this modern era by utilizing cloud capabilities, Virtual Appraisal Solutions, and claims automation technology.

Key Features

- Mitchell’s platform can be accessed on any device with the internet, allowing for remote work and access to OEM repair procedures and diagnostic tools.

- Mitchell’s real-time pricing ensures the platform is updated with parts prices and labor times.

- Mitchell’s Intelligent Estimating analyzes images of damaged vehicles and collision information with computer vision to convert data into estimate lines.

- Virtual Appraisers Solution is a customer self-service option that allows policyholders to submit photos of damaged vehicles, allowing appraisers to use these photos for estimation.

- The platform utilizes artificial intelligence to produce partial or complete collision estimates from images and vehicle data. It can also provide repair recommendations.

- Mitchell offers guided photo-capture technology that documents damage and Photo Capture On-demand for supplementary documentation.

Benefits

Vehicle Coverage: The platform provides coverage for a wide range of vehicles, including passenger cars, light, medium, and heavy-duty commercial trucks, as well as specialty vehicles like motorcycles, ATVs, and RUVs.

Reporting Capabilities: The platform generates comprehensive reports of market trends and provides insights through diagnostic tools.

AI Capabilities: The platform can convert photos and images into detailed component-level estimates and utilizes computer vision (Mitchell Intelligent Damage Analysis) collision information analysis.

Platform’s Accuracy: By using vehicle dimension data, Mitchell presents accurate structural repairs with OEM repair procedures.

Mitchell TechAdvisor: The platform provides complete OEM repair data, diagnostic trouble codes, parts and labor look-up, and other repair resources.

Snapsheet Virtual Appraisals

Snapsheet Virtual Appraisals Software offers a touchless claims experience to customers and provides operational efficiency and great ROI to insurance carriers. It is an innovative platform that covers FNOL, photos and documentation, work dispatch, damage appraisal, and repair management.

Key Features

- The software modules include Private Passenger, Commercial Specialty, Total Loss, Desk Review, and Subrogation.

- The platform collects photos from various channels, including SME-based submissions, email submissions, and web applications; it automatically recognizes vehicle make and model for accurate photo overlays.

- The platform updates state-specific guidelines and labor rates in real-time to ensure accurate pricing and estimation.

- FNOL processing includes its submission, related file display, estimating location mapping, shop locator, and dynamic guided interaction, with capabilities to ingest any data type.

- Snapsheet utilizes user prompts to obtain additional photos, follows up with users, and is capable of omnichannel communications.

Benefits

Intelligent Work Distribution: Snapsheet features role-based rules administration, capacity visualization, route claims based on users’ skills, and automatic reassigns work.

Flexible Implementation: The platform offers different deployment models, including Supplement Appraisal Staff, Independent Adjuster Optimization, and Efficient Claims Triage.

Investigation and Estimation Capabilities: The platform utilizes Shop Engagement Tools, Advances Estimating Management Tools, and Custom Operational Metrics.

Unified Platform: A single system provides all the tools required for a comprehensive virtual appraisal, from automation of work assignments to digital engagement.

CCC Smart Estimate

CCC Smart Estimate was introduced in 2018 as the world’s first AI estimating tool. This solution identifies vehicular damage from collision photos to recommend repair requirements and generate estimates with suggestions through CCC’s estimating logic and AI photo analytics.

Key Features

- The platform’s foundation is built on its ability to learn and improve as more claims are processed through the usage of AI tech and interaction with human estimators and adjusters.

- The AI-powered photo analysis assesses vehicle damage, while damage analysis predicts repair requirements, estimate lines, labor hours, repair and replacement parts.

- Smart Estimate automates parts sourcing during estimation based on carrier configurations.

- CCC’s estimating logic can be customized to meet the insurer’s business rules.

The platform can detect crashes in real-time for telematics-enabled vehicles connected to the CCC ONE platform. - The platform leverages CCC One’s relationships with over 350 insurance carriers and 24,000 repair shops.

Benefits

Rates and Taxes: Tax Automation is an add-on solution that integrates hyper-localizes rates of repairable vehicles into estimates to prevent tax discrepancies.

CCC Smart Total Loss: This feature determines total loss using a single-photo analysis.

CCC Smart Audit: Analytics and AI audit claims by flagging line-level outliers and routing specific claims to adjusters for reinspection.

Training: CCC utilizes a guided approach (provides hints and guidance), making it easy for new users to get trained on the nuances of estimation.

Conclusion

Any insurance carrier’s ultimate goal is to provide the required financial compensation to policyholders who turn to them during unexpected incidents. With an overwhelming increase in the number of claims submissions, insurers have the responsibility to equip themselves with tools such as an insurance estimating software that can cater to policyholders’ high expectations while protecting the company’s bottom line remains unaffected.

Solutions like Xactimate and Snapsheet help streamline the estimation process, not only enhancing the organization’s operational efficiency but also promoting a transparent claims process with policyholders.

Business Users must reflect on their current practices to ensure they are aligned with ever-changing market demands. Integrating innovative technology like an insurance estimating software is a step in the right direction to reinforce the trust and loyalty of your organization. It is time to embrace new technologies and become a leader in the insurance industry.