The technological advancements, the necessity of automation, the sharp drop in interest in employment in the insurance sector, and the need to adapt to the challenges faced in today’s market all of these factors have led to Insurance billing software becoming more prevalent in the past few years. Insurers today are grappling with underwriting loss, payment tracking, fraudulence, policy renewals, regulatory compliance, sustainability, and the biggest issue posing a risk is customer satisfaction. While an accounting software or tool can prepare and validate financial statements, a billing software is necessary to ensure services are billed and reimbursed.

Billing software and automation tools have revolutionized the insurance industry with the goal of mitigating these risks. Automation and digitization of the billing process can bring tremendous benefits to any organization.

It streamlines billing management, reduces errors, and increases overall efficiency. Insurers have turned to innovative technologies like generative AI, cloud, low-code/no-code, digital twins, and quantum computing to improve operations, address cost pressure, and enhance customer experience.

With so many options to choose from, deciding on the right billing software is right for your organization’s needs is a pivotal step in adopting digital practices. Are you struggling to make the right choice?

This blog will walk you through everything you need to know, listing out the features and benefits of the top 5 billing software available in the market. Let’s better evaluate the software and make an informed decision on the right billing software for you.

What is Insurance Billing Software?

Insurance billing software is a tool designed for insurers. It automates the billing process, from invoice generation to payments and refunds. Due to its advanced technology, it is becoming an essential system in any organization that deals with insurance. It not only eliminates the high possibility of human errors that have negatively impacted the revenue of insurers, but also streamlines financial workflows of insurance organizations, all while maintaining regulatory standards and providing real-time policy information.

Billing goes hand in hand with policy management and Claims management. Read our blogs on both for a deeper understanding!

The Growing Need For Automation

Efficiency: Billing software allows employees to focus on other aspects of their jobs, like strategizing and planning. The staff would also benefit from a reduction in repetitive and mundane work.

Accuracy: Billing systems reduce human errors that would otherwise naturally occur in the billing process. Even an additional zero or a lack of it would adversely impact a claim, leading to more manpower needed to correct it.

Security and Regulations: Billing software follows the latest and updated industry protocols. Insurance agents and organizations handle sensitive information, so they have to comply with stringent regulations, such as HIPPA guidelines or IRS regulations.

Customer Experience: Billing systems’ automation schedules payments, provides real-time information, and enhances the overall CX. Streamlining the billing process also significantly benefits the customer.

To enhance your organization’s performance, read our blogs on Insurance CRM software and Insurance Quoting software to find out how these tools can enhance your billing process by improving client relationships and pricing strategies.

Consider these statistics:

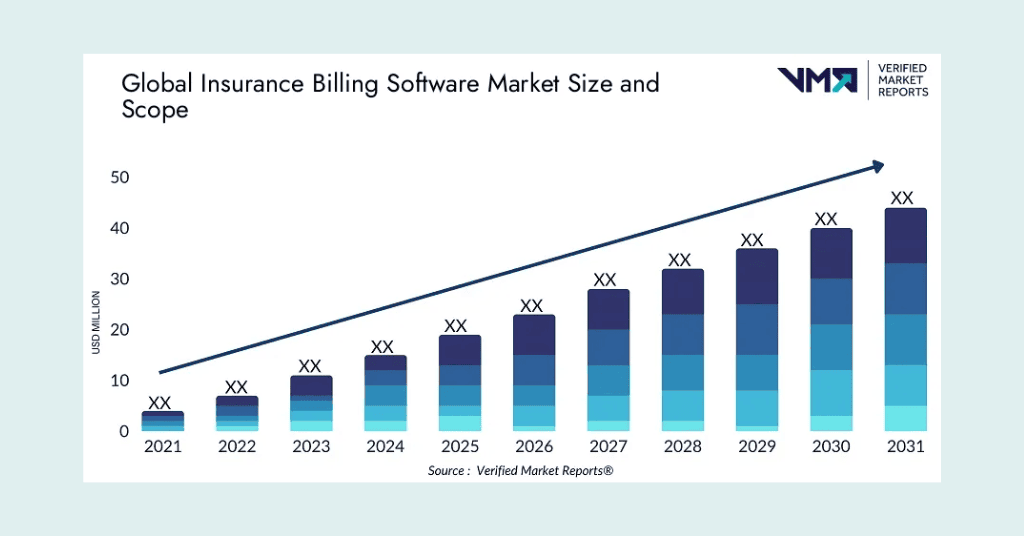

The Insurance Billing Software Market was valued at USD 20.1 billion in 2023 and is projected to grow to USD 35.2 billion by 2030, with a compound annual growth rate (CAGR) of 8.32% during the forecast period from 2024 to 2030.

According to Verified market reports, here’s an overview of the global insurance billing software market size and scope

Before discussing top billing insurance software in the market, its future outlook, or the market segment analysis, let’s review some essential features that every billing solution should include.

Critical Factors You Need to Consider in Software Evaluation:

Billing Functionalities: Organisations of different sizes would have different requirements. One size fits all is a relic from the past, customisation capabilities are important to support premium calculations, payment processes, and invoice generation and management.

Integration Capabilities: Can the software integrate with core systems and external systems? The core system consists of policy administration systems, accounting software and others, while external integration focuses on banking systems, customer communication platforms and more. Proper synchronization ensures seamless functioning and prevents data silos.

Regulatory Compliance: Depending on the organization’s size, different types of insurance are subject to specific state and national or international regulations. For example, GDPR applies to international operations, SOC2 type II certification, HIPAA for health insurers, or specific P&C insurance regulations.

Security Features: Billing involves handling sensitive customer data regardless of the insurance type. Data encryption and two-factor authentication are common security features we see daily. The software should ensure secure document storage and regular security updates and patches to prevent security leaks or breaches.

Reporting and Analytics: Billing software simplifies data analysis, providing insights from premium collection analytics to policy billing status reports. Standard reporting is the cornerstone of the insurance industry. Advanced analytics, with the help of AI and IoT, assist us with revenue forecasting, performance reports, predictive payment behavior, and more.

Scalability and Innovation: Billing requirements will expand as your business grows. The billing system’s architecture should be able to handle billing complexity and increased transaction volume. Additionally, it should have InsurTech integration capabilities to keep your organization current in this ever-changing market.

Cost: Consider not only the cost of purchasing this software but also the various direct and indirect costs involved. Indirect costs like training expenses and maintenance costs should be factored in. Organizations should ensure their budget covers both direct and indirect costs before deciding on a system.

Training and Support: The software’s user interface should be user-friendly with a minimal learning curve. Since your employees will use the software daily, choose something intuitive and clear. Consider if the software offers implementation resources and adequate support for your employees.

Want to Generate Documents In Bulk ?

With Perfect Doc Studio, you can simplify bulk document generation in over 100 languages with its intuitive drag-and-drop interface. Our advanced features allow businesses to create, customize, and distribute personalized communications across global markets.

Pro Tip: Develop a scoring matrix based on these factors to evaluate different software options and make an informed decision tailored to your organization’s needs.

The Top 5 Insurance Billing Software for Enterprises

Let’s explore the top five billing software options for enterprises, covering everything from pricing to features to help you choose the best software for your insurance business.

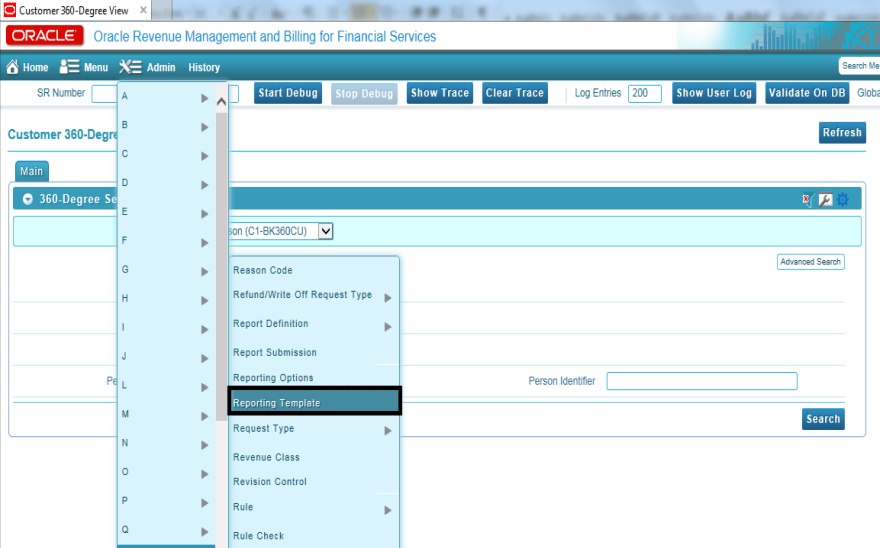

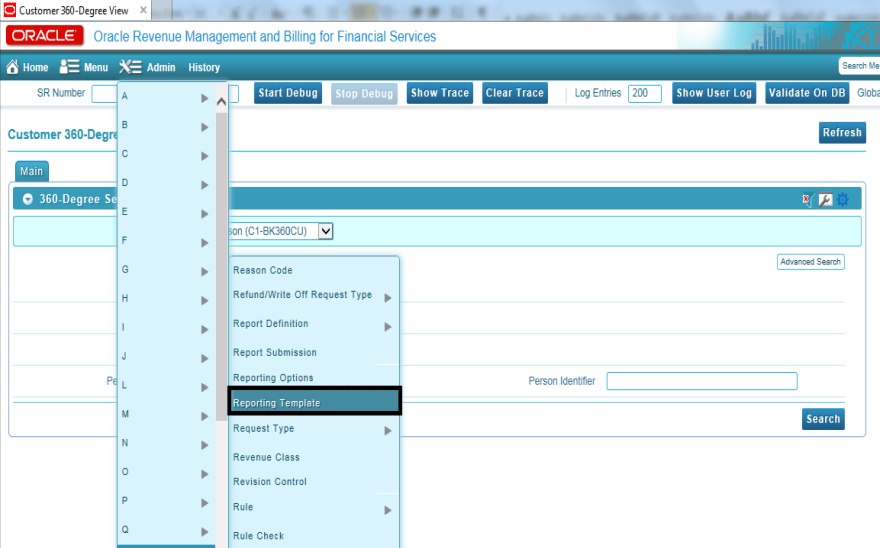

1. Oracle Insurance Revenue Management and Billing (ORMB)

Oracle Insurance Revenue Management and Billing (ORMB) is an enterprise-level cloud-based billing solution that utilizes end-to-end AI/ML-powered pricing, billing, and revenue realization on a single platform. It was designed primarily for the healthcare industry. ORMB is well-known for its robust premium calculation engine, database technology, and service-oriented architecture.

Key Features

- ORMB’s premium calculation engine manages pricing for different lines of business with its sophisticated payment allocation rules, validation rules, and revenue recognition.

- ORMB’s flexibility and customization allow for ad-hoc bill generation, on-demand invoices for instant revenue recognition, and pro-forma invoices for trials.

- Its vast API library integrates with Oracle products and other billing systems to maintain data consistency across payment gateways, self-service portals, account systems, and CRM platforms.

- The Billing 360 portal provides consolidated billing information for each customer giving easy and holistic access to financial transactions. It handles multiple currencies and languages, making it suitable for international operations.

- Security is built into the system to maintain detailed audit logs and meet regulatory compliance requirements. Access controls and data protection are at the forefront of the many security protocols provided by ORMB.

| Price | Free Trail | Users |

|---|---|---|

| Contact Oracle for pricing details | 3 months free trial through its quick start program | Ideal for mid to large-sized organizations |

Benefits

Data Management: Handles high volumes of data to ensure reliable storage and retrieval, making it a valuable tool for organizations looking to maintain long-term records, while also facilitating compliance with regulatory requirements.

Analytics and Reporting: The platform’s accumulation portal tracks different products, bill information portal presents detailed transaction views, off process adjustment portal manages ad-hoc adjustments, the bill drill-down portal presents transaction down to membership level calculations, and the audit event and repricing portal presents an overview and tracks audit events, repricing requests and its corresponding calculations.

Scalability: Effortlessly manages increased transaction volume and growing operations. Its modular system architecture utilizes only necessary features and allows for the addition of new functions.

Flexible Plan Configuration: The platform supports various health benefit plans (ACA, Group Medicare Advantage, Retiree, COBRA), customizes rate structures as per parameters such as gender, age, tier, tobacco usage, and more, and is capable of repricing qualifying life event.

Automation: This prevents human error by automating payments and offers advanced reporting capabilities—streamlining workflow management.

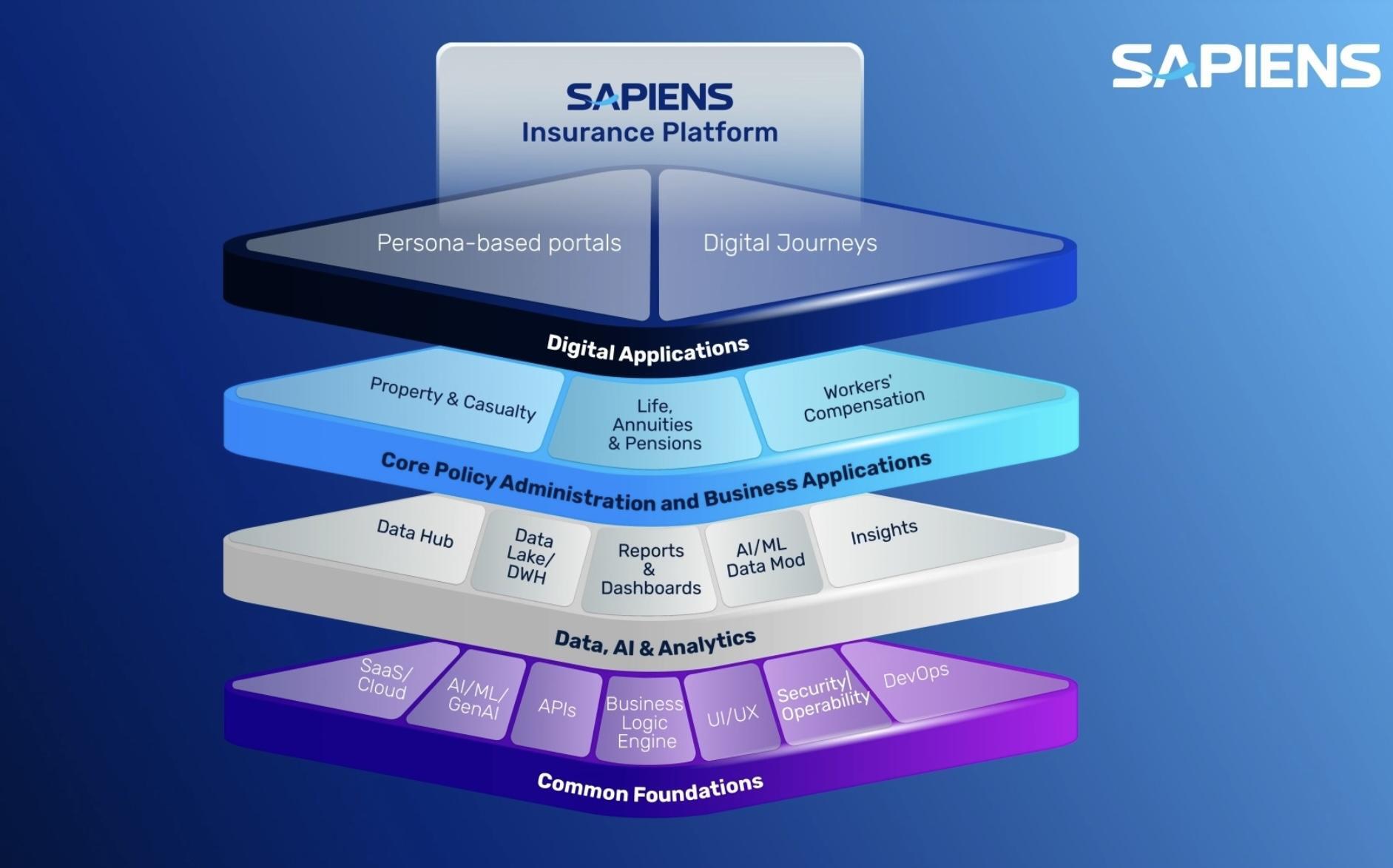

2. Sapiens BillingPro

Sapiens Billing is a cloud-based end-to-end modern billing and revenue management solution specifically designed for property and casualty insurance companies but also caters to life, health, and more. It is part of the broader Sapiens Suite of insurance software solutions. IT automates the entire billing lifecycle, offers various payment options, and features self-service portals for customers and agents.

Key Features

- The core system handles direct and agency billing models, automating the billing cycle while implementing security measures to protect against data leaks.

- Revenue recognition offered by the platform is oriented to insurance industry standards and regulations, managing billing activities of various policies and handling multiple currencies and languages making it suitable for international operations.

- The platform automates the billing lifecycle, which includes disputes, offsets, disbursements, transfers, allocation, lockbox, and other billing activities.

- Different payment options are available to policyholders, including installments, pay-as-you-go models, and more, improving customer satisfaction and experience.

- The digital interface’s self service portal provides customers with consolidated billing information and facilitates modifications online. Likewise, agents also have a dedicated self-service portal. All this reduces operational costs and improves service delivery.

| Price | Free Trail | Users |

|---|---|---|

| Starts from $500,000 for an annual subscription. | Free trial available | Ideal for mid to large-sized organizations |

Benefits

Insurance-Specific Design: Developed specifically for the insurance industry, rules-based functionality, pre-equipped with best digital practices and common billing scenarios.

Payment Capabilities: The platform allows for flexibility in payment plans and updates of payment arrangements. Moreover, it also includes omni-channel payments.

Scalability: Efficiently manages increased transaction volume and growing operations.

Integration: The platform integrates with Sapien products and other billing systems through its modern APIs by leveraging current technological investments.

Data Insights: Real-time reporting and analysis showcase billing data. The revenue recognition system also optimizes future revenue strategies based on this information.

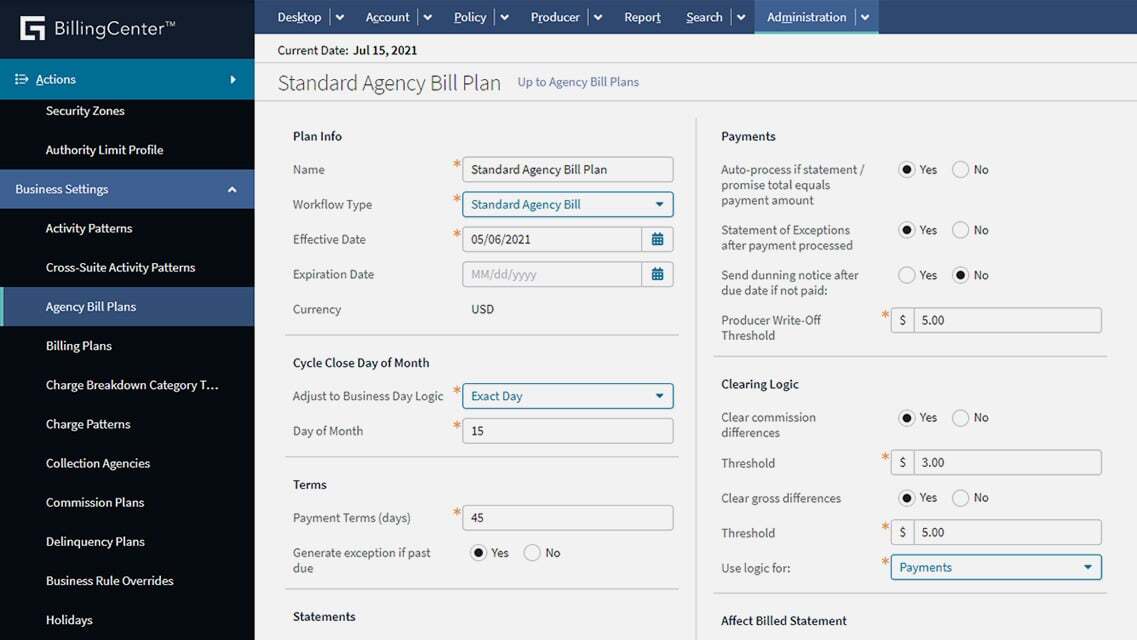

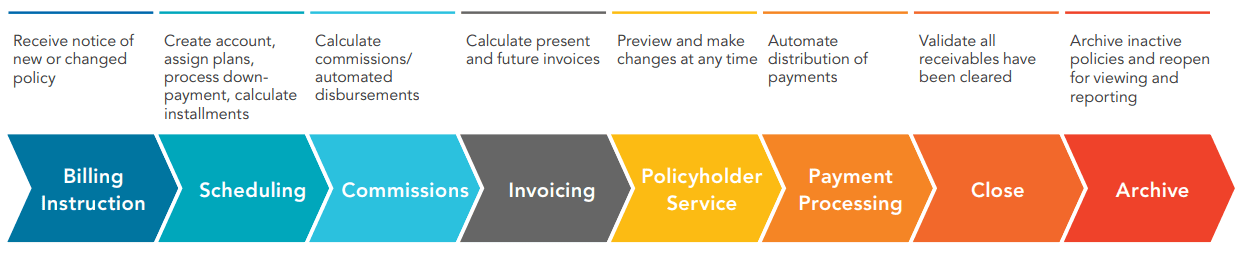

3. Guidewire BillingCenter

Guidewire BillingCenter is a billing management solution designed for property and casualty, but it supports all lines of business, as part of the broader Guidewire Insurance Suite. Guidewire’s prebuilt and automated workflows, digital user experience, flexible billing rules architecture, and more combine together to cultivate convenience and simplify billing processes.

Key Features

- The platform can process different types of bills, including direct and agency bills (including agency bill exception handling capability), while supporting various payment methods, from traditional checks to modern digital payments.

- The solution’s security allows for role-based permissions and data tagging for restricted access.

- Automation capabilities not only manage recurring payments, generate timely payment reminders, and process policy renewals but also personalize reminders based on the account’s activity or payment status.

- By integrating with DataHub and InfoCenter, billing users can utilize self-service BI tools to make informed decisions. The software also offers comprehensive reporting capabilities with a detailed analytics dashboard and performance metrics, all driven by data.

- Guidewire Cloud offers a scalable, secure, and easily updatable cloud delivery model for private, public, or hybrid deployment.

Use Case: The software is ideal for mid to large-sized Property and Casualty (P&C) insurance companies, health insurance payers, and life and annuity providers managing multiple lines of business with various payment plans and types. Additionally, organizations should have the financial resources and technical abilities to effectively utilize the software.

| Price | Free Trail | Users |

|---|---|---|

| Contact Guidewire for pricing details. | Free trial unavailable | Ideal for mid to large-sized organizations |

Benefits

Flexible Payment Options: Apart from supporting various payment methods, the system also allows policy holders to decide how they receive and pay their bills.

Integration: It can integrate with other Guidewire products or use APIs for third-party systems. It also supports legacy system integration.

Minimize Billing Leakage: It features equity warnings to prevent negative effects on billing plans, equity-based billing to avoid unpaid coverage and reduce costs by combining invoices.

Automation: Automates payments and communication to prevent human error and streamline workflow management

Risk Management: The system can detect fraud, maintain audit trails, and monitor compliance with its advanced security features.

4. Duck Creek Billing

Duck Creek Billing is a cloud-based billing management solution specifically designed for property and casualty insurance companies. Offering configurable invoicing, flexible payment plans, advanced reporting tools It is part of the broader Duck Creek Suite of insurance software solutions but also works as a standalone system.

Key Features

- The software can process over 700,000 invoices per hour; its scalability allows it to handle routine and high-volume processing.

- A single unified interface manages billing activities of various policies and handles multiple currencies and languages, making it suitable for international operations.

- It integrates with other billing systems to access product definition and more with its API-first design to maintain data consistency across technologies. It also pre-integrates with global alliance partners supported with multi-language options.

- The software comes with quick implementation and automatic software updates, reducing the need for technical support for maintenance and routine updates through a single point of change for any updation across integrated systems.

- A sophisticated self-service portal equipped with many features for customers to manage their bills and payments reduces the burden on customer service teams.

Use Case: The Software is ideal for mid to large-sized Property and Casualty (P&C) insurance companies, health insurance payers, and life and annuity providers, that are actively growing and have complex billing needs. It also works well for insurers who handle various products like auto, home, and commercial as everything can be managed seamlessly.

| Price | Free Trail | Users |

|---|---|---|

| Starts from $1000 for an annual subscription | No free trial | Ideal for mid to large-sized organizations |

Benefits

Centralized Management: The platform ensures enterprise-wide consistency and allows for various payment capabilities. Additionally, it features a one-click summary that displays the customer’s entire account information.

Custom Invoices: The solution configures billing forms and correspondence without coding.

Pre-built Solutions: The ready-to-use solutions include payment plans, billing forms and correspondence, E-billing, commissions, security, business intelligence, workflows, and rules.

Accessibility: The solution is web-enabled, service-oriented, event-based architecture through any technology connected to the internet.

Test Automation: The test automation center builds automated test scripts and conducts rapid validation to expedite product delivery.

Support: Duck Creek University offers comprehensive training (300+ web-based courses) and support. Additionally, there is a dedicated customer success team apart from the service team are available.

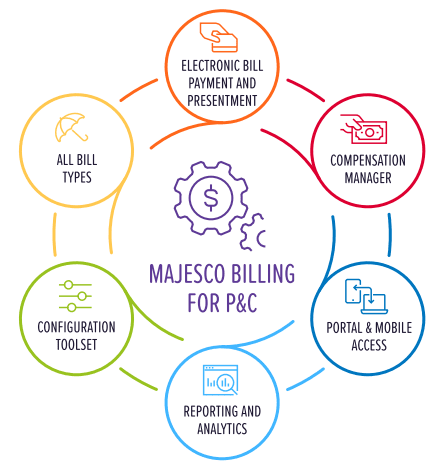

5. Majesco

Majesco is a cloud-native next-gen insurance billing software designed specifically for Property and Casualty (P&C) and Life, Annuity, and Health (L&AH) insurers. It is a comprehensive system that processes the entire billing lifecycle of various lines of business with pre-configured and ready-to-use content.

Key Features

- Advanced payment options include configurable payment plans and all bill types, multi-currency support, and various payment methods.

- Business intelligence is an in-built analytical tool which includes pre-configured metadata mapping that provides insights into performance, customer behavior, and industry trends in real time.

- Intuitive, user-friendly interface aimed to simplify navigation and improve operational efficiency.

- Integrates through extensive open APIs to its micro-service-based architecture. Pre-integrated with Digital Underwriter360, Digital Customer 360, Digital Electronic Bill360, and Digital Agent360 to deliver personalized and engaging customer and agent experiences.

- The platform encompasses an electronic bill presentement and payment (EBPP) system, supporting multiple payment meothds– both credit and debit cards, all while ensuring security.

Use Case: The software is ideal for mid to large-sized Property and Casualty (P&C) insurance companies, health insurance payers, life and annuity providers where sophisticated billing processes and features are required. It is best suited for organizations that are seeking digital adaptability, customer engagement, and scalability.

| Price | Free Trail | Users |

|---|---|---|

| Contact Majesco for pricing details. | Free trial unavailable | Ideal for mid to large-sized organizations |

Benefits

Compensation Managment: The platform’s rules-based commission engine handles the management and disbursement of agent compensation. It allows flexibility in commission contracts and extensive reporting on incentives and payments.

Comprehensive Functionality: Majesco offers numerous pre-configured software that easily integrates billing with policy and claim management.

Support Services: Majesco offers extensive training, resources, and after-sale service to help organizations make the most of the platform.

Self-Service Capabilities: Agents and customer portals can be used simultaneously on multiple devices, such as tablets and mobile phones.

Scalability: Majesco efficiently manages increased transaction volume and growing operations.

The Top Insurance Billing Software for Small and Medium Businesses

Now let’s look at the top billing software options for SMBs, covering everything from pricing to features to assist you in selecting the best software for your insurance business.

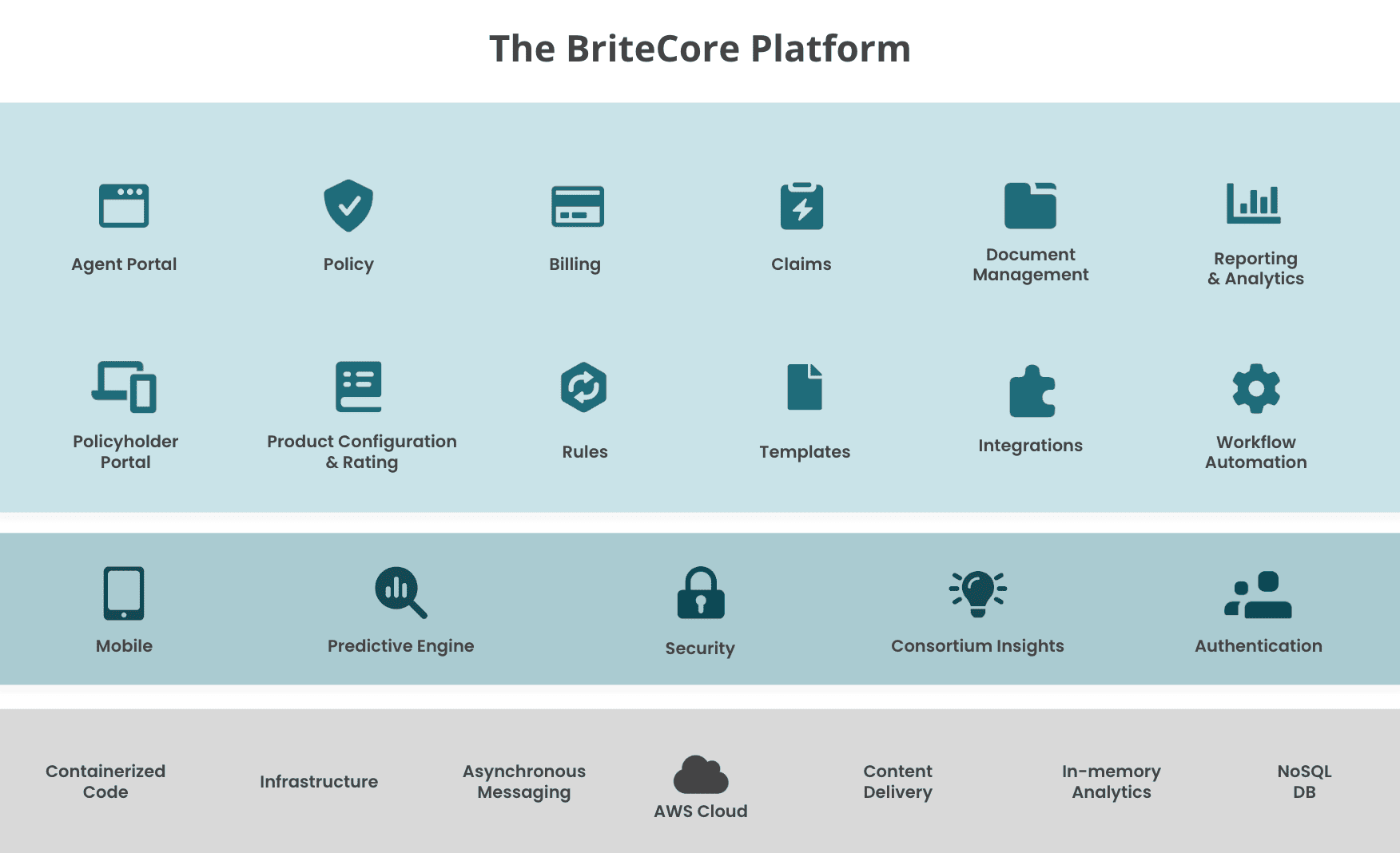

1. BriteCore Billing

BriteCore Billing is an end-to-end cloud-native billing and payment solution that prioritizes user experience and digital capabilities. BriteCore’s automation focuses on streamlining billing processes, enhancing customer engagement, and improving operational efficiency. It is part of the broader BriteCore insurance software solutions.

Key Features

- BriteCore’s system handles direct and agency billing, third-party billing, and account/list billing, offering flexible payment options.

- The automation processes invoices, non-pay notices, cancellations, renewal invoices, and reinstatements.

- Payments are calculated and scheduled in real-time with automated rules for payment application and disbursement.

- Documents related to billing, such as invoices and correspondence, are automatically generated, and users can check the generation and production. It also offers electronic document delivery.

- The platform integrates with other BriteCore products and connects to third-party systems through RESTful APIs to ensure data flow.

- The platform allows organizations to monitor user interaction and activities on the portal, such as document openings and payment activities.

Use Case: Best suited for regional insurance carriers, MGAs, specialty insurers, startups, and mutual insurance.

| Price | Free Trail | Users |

|---|---|---|

| Starts from $5000 for a monthly subscription. | Free trial unavailable | Ideal for small to mid-sized organizations |

Benefits

Payment Methods: Cash, check, money order, credit card, and ACH are accepted payment methods. The platform also allows auto-pay for scheduled withdrawals.

Maintenance and Updates: The native-cloud architecture ensures regular automatic updates and feature rollouts while requiring minimal maintenance.

Custom Invoices: The solution configures billing cycles and payment plans based on the needs of the policyholders.

Customer Experience: The policyholder portal allows customers to manage payments, bills, and other payment options.

Design: The interface is easy to use and intuitive for agents or business users. It is mobile-responsive, allowing access from different devices.

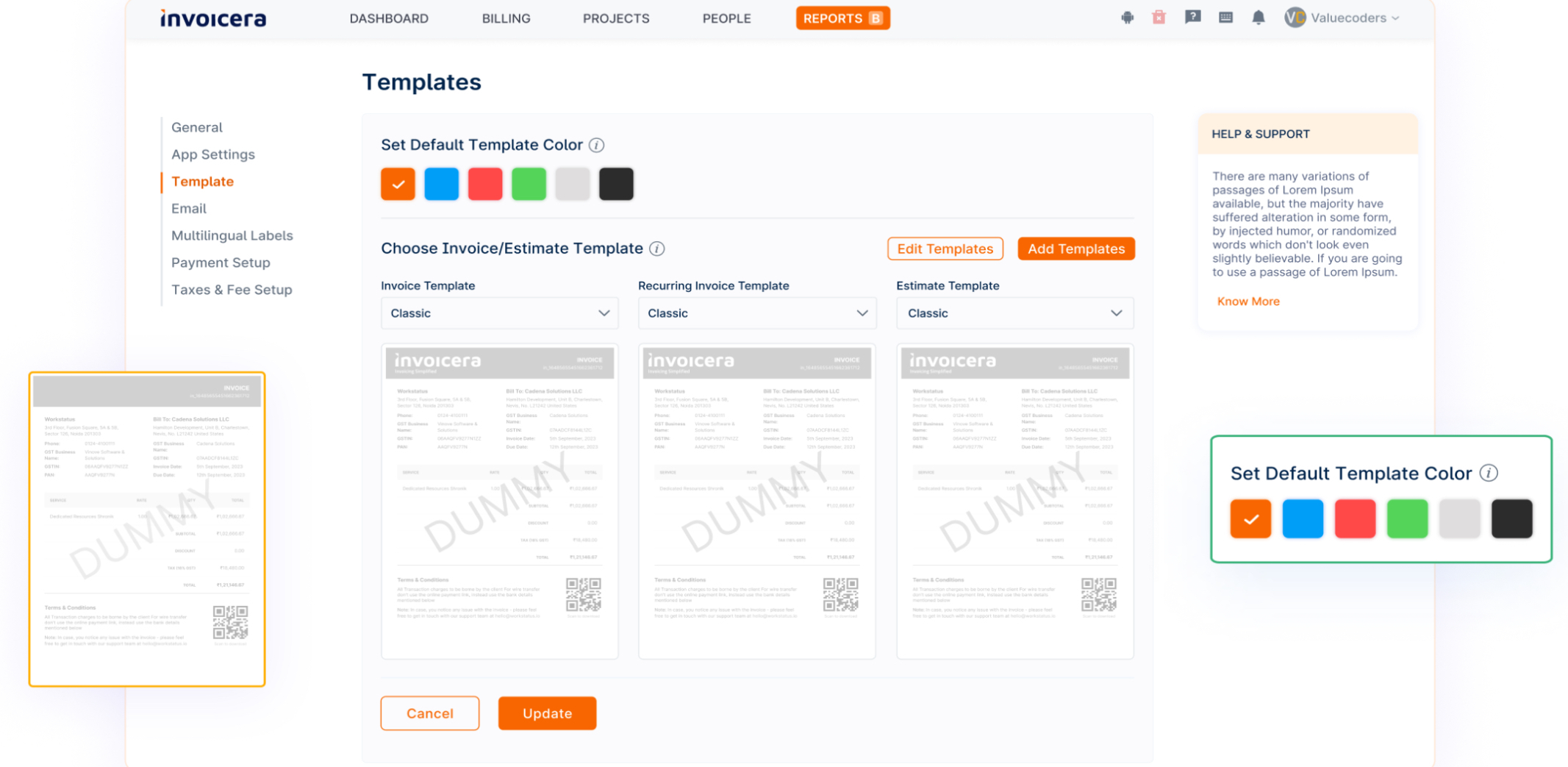

2. Invoicera

Invoicera is a cloud-based invoicing and billing software that offers various features to facilitate invoicing process, efficiently manage billing cycles, and enhance client interactions. It caters to businesses of all sizes helping them manage clients and financials in one platform.

Key Features

- The platform uses big data analytics to analyze past sales and business performance, making informed data-driven decisions.

- Invoicera’s core integrates with CRM tools to improve efficiency. It also integrates with over 14 payment gateways, including PayPal, for payment convenience.

- The customization extends not only to invoice templates but also to different subscriptions (recurring billing) for both customers and organizations, making it highly flexible and affordable. v

- The mobile application offers on-the-go service to users and is available for iOS and Android.

Use Case: The software is ideal for small to mid-sized organizations and agencies looking to streamline and improve financial management.

| Price | Free Trail | Users |

|---|---|---|

| Starts from $19.95 for the basic plan | Free trial available | Ideal for small to mid-sized organizations |

Benefits

Cost Effective: The system offers various plans tailored to different business sizes.

Support Services: Invoicera provides comprehensive support options, including phone and live chat, to assist organizations

Mobile Access: The cloud-based platform allows for easy access. The mobile application can be accessed on multiple devices, such as tablets and mobile phones.

Transactional Support: the platform enables clients to use multiple payment methods and supports multiple currencies and languages.

Customization: The platform allows for creating custom templates with branding options like logos or even specific company details. Invoicera offers customizable plans to meet organizations’ specific business needs.

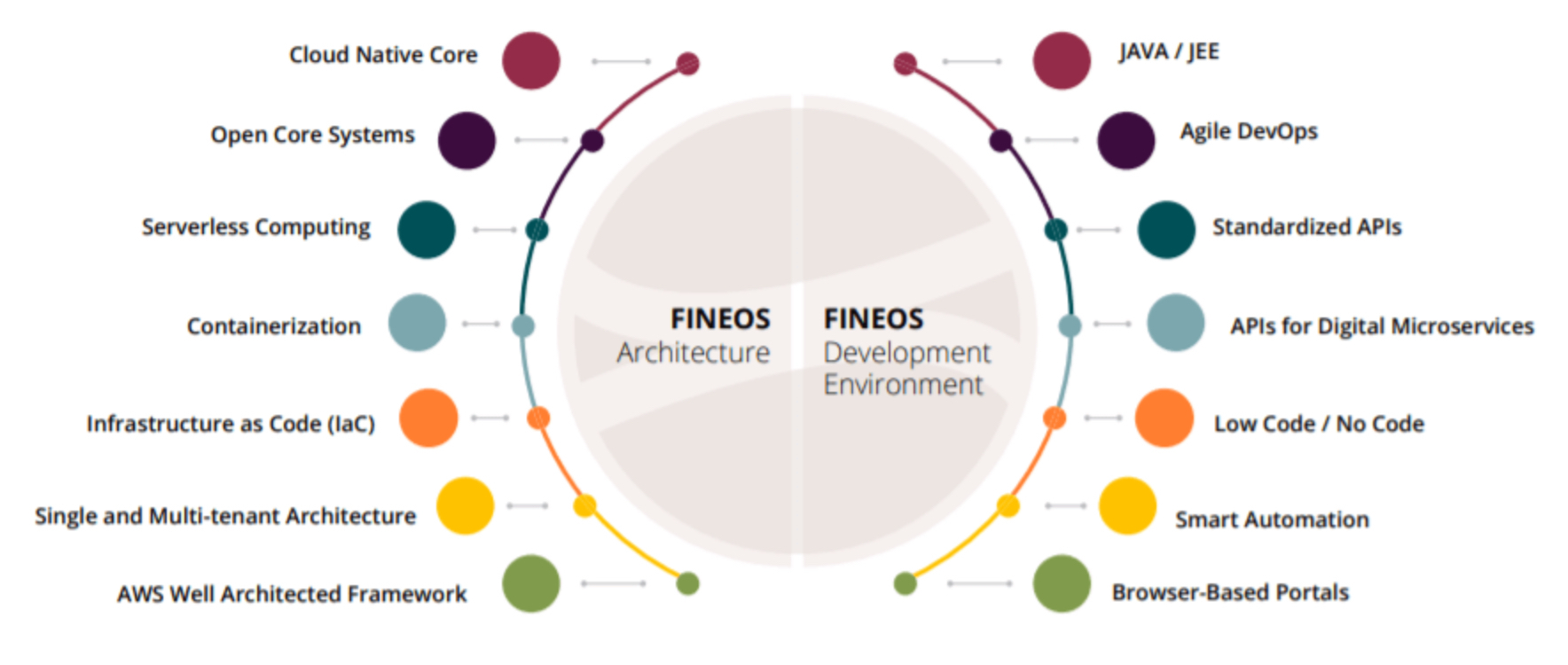

3. Fineos Billing

Fineos Billing is a billing management solution designed for Life, Accident, and Health Insurance needs, working as a standalone solution or part of a broader platform. It automates the entire billing lifecycle, aiming to streamline workflow, improve CX, and facilitate seamless operations. The platform provides real-time insights, collaborative tools, innovative features, and customer-centric design to reimagine the ease of the billing experience in the insurance sector.

Key Features

- The unified billing system consolidates all billing and reconciliation under one platform to eliminate redundancy and reduce operational expenses. It includes seasonal billing capacity and multi-pay point billing functionality.

- Accounts receivables are managed through the platform by determining estimates of billing periods beforehand. Combined with automatic updates and analsytical reporting, it minimizes premium leakage.

- The AI-driven workflow manages complex premium discrepancies by prioritizing billing discrepancies recognized through variance monitoring to resolve such issues.

- The system was built with advanced technological open architecture to accommodate APIs with pre-built accelerators for easy integration with existing system or third-party applications, leading to quick and convenient implementation.

- The platform has extensive search capabilities with real-time, 24/7 access. Additionally the platform is user-centric, presenting policy, billing, and payment information under one system.

Use Case: Ideal for small to mid-sized organizations seeking to grow and digitize their operations. Best suited for organizations that prioritize customer satisfaction and regulatory compliance.

| Price | Free Trail | Users |

|---|---|---|

| Contact Fineos for pricing details | Free trial available | Ideal for small to mid-sized organizations |

Benefits

Collaborative Tools: The shared dashboard and collaborative issue resolution across departments lead to timely reconciliation, enhanced service delivery and CX.

Support Services: Fineos offers comprehensive training, resources, and after-sale services to help organizations make optimum use of the platform.

Configuration Capabilities: The system supports various billing functions to adapt to different market demands.

Future Outlook of the Insurance Billing Software Market

The current outlook for the Insurance Billing Software market is sturdy, driven by the growing demand for automated billing solutions within the insurance industry. As technology advances and the need for efficient billing processes increases, the market is experiencing steady growth. Take a look at Guidewire’s post on “The Impact of Insurance Billing Software on Customer Experience” for valuable insights into how insurance billing software affects the customer experience. Looking ahead, this expansion is expected to continue as insurance companies increasingly seek ways to ease operations and improve customer experience. With a rising emphasis on digital transformation and data analytics, the Insurance Billing Software market is well-positioned for substantial growth in the coming years.

Key Takeaway: Innovation in Insurance Billing

The insurance billing software market is experiencing strong growth as insurers seek to increase efficiency and ease billing operations. With the rising demand for automated and accurate billing processes, this software is becoming a critical asset for insurance companies looking to improve customer satisfaction and stay competitive.

When it comes to document generation, Perfect Doc Studio offers an exceptional solution. It simplifies the creation of essential documents like policies, insurance quotes, and claim forms, allowing for easy customization and distribution across various channels. By integrating Perfect Doc Studio with your insurance billing software, you can ensure that your document workflows are as ideal and precise as your billing processes, setting your business up for long-term success.

Conclusion

Selecting the right business software requires extensive search and needs analysis. There are numerous software in the market each with its unique selling points. It is up to the organization to find a solution that meets their specific needs. However, a billing software system is a crucial aspect that businesses cannot avoid if they want to stay competitive in their industry. Moreover, the benefits that an insurance system brings far outweigh its cost.

FAQs

1. What Are the Key Features of Insurance Billing Software?

Key features of insurance billing software include automated invoicing, payment processing, premium collection, customizable billing templates, integration with existing software, real-time analytics, and compliance with legal requirements.

2. What Are the Benefits of Cloud-Based Insurance Billing Software?

Cloud-based insurance billing software offers scalability, security, and easy accessibility. It allows insurance companies to store and access billing information online without the need for on-site hardware, making it easier to manage increasing volumes of policies and customers.

3. How Does Insurance Billing Software Integrate with Other Software?

Insurance billing software integrates seamlessly with other insurance administration software, such as CRM and policy management tools. This integration ensures that billing processes are aligned with other business operations, improving overall efficiency.

4. Can Insurance Billing Software Handle Multiple Payment Methods?

Yes, most insurance billing software solutions support multiple payment methods, including direct billing, agency billing, installment plans, and online payments. This flexibility allows insurance companies to offer convenient payment options to their customers.