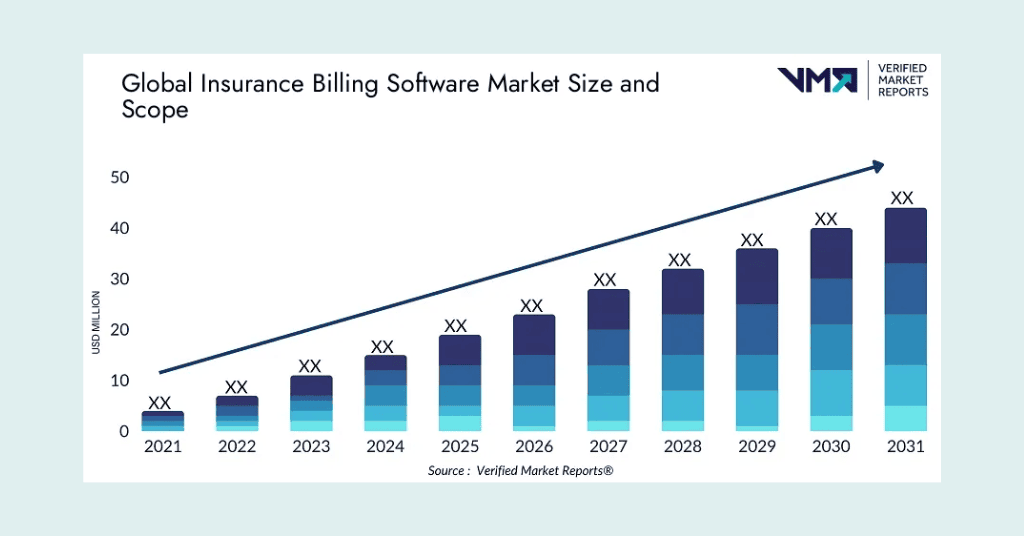

The Insurance Billing Software Market was valued at USD 20.1 billion in 2023 and is projected to grow to USD 35.2 billion by 2030, with a compound annual growth rate (CAGR) of 8.32% during the forecast period from 2024 to 2030.

At its core, billing insurance software enables insurance companies to efficiently manage their financial transactions with agents, third-party payers, and policyholders. It easily integrates with existing insurance administration software, ensuring accuracy, efficiency, and compliance with legal requirements.

The demand for insurance billing software is growing due to the industry’s increasing need for effective billing solutions, driven by regulatory changes, heightened competition, and evolving customer expectations. The market features both established software providers and specialized companies offering customized solutions for specific insurance market segments.

According to Verified market reports, here’s an overview of the global insurance billing software market size and scope

Before discussing how billing insurance software works, its future outlook, or the market segment analysis, let’s start with a basic overview of what insurance billing software is.

Want to Generate Documents in bulk ?

With Perfect Doc Studio, you can simplify bulk document generation in over 100 languages with its intuitive drag-and-drop interface. Our advanced features allow businesses to create, customize, and distribute personalized communications across global markets.

Table Of Content

- What is Insurance Billing Software?

- Why Does Your Organization Require Insurance Billing Software?

- Saxon Insurance: 25% Market Growth in One Year

- On-Premise, Cloud-Hosted, and True SaaS: What’s the Difference for Insurance Software?

- What to look out for in an Insurance Billing software?

- Commonalities Between Life, Commercial, and Medical Insurance Billing Software

- Best Insurance Billing Software Solutions for the Insurance Industry

- Small and Medium sized business

- Large sized business

- Future Outlook of Insurance Billing Software Market

- Key Takeaway: Innovation in Insurance Billing

- FAQs

What is Insurance Billing Software?

Insurance billing software assists insurers in setting up billing plans and invoicing clients. It enables insurance companies, healthcare providers, Insurance brokers, or related agents/organizations to generate reports such as customer bill summaries, detailing policy costs for both business and personal insurance lines, and more.

Whether you’re managing individual policies or multiple accounts, this software lets you set up direct policy bills, consolidated account bills, or automatically scheduled payments with ease.

Now, why does your organization require billing Insurance software?

Check out this Reddit post to see what people are saying about automating insurance billing.

Why Does Your Organization Require Insurance Billing Software?

From Broad Contents Coverage To Single-Item Coverage

Insurers can now use digital data and advanced analytics to customize property policies. Instead of offering broad coverage for all contents, they can focus on providing protection for specific high-value or important items that matter most to the customer.From Fixed 6- or 12-Month Billing To On-Demand, Parametric, And Usage-Based Billing

With advancements in digital data, analytics, and mobile technology, insurers can now offer more flexible billing options instead of the traditional 6 or 12 month policies. Coverage can be activated on-demand, based on customer usage rather than fixed schedules. Parametric insurance provides on/off coverage and automatic payouts triggered by specific events. Usage-based insurance (UBI) calculates billing based on factors like mileage or duration of use, using real-time data to set prices.From Standard Billing To Subscription Billing

Subscription billing has become popular in many industries, and insurance is beginning to adopt this approach. These models offer more than just recurring payments; they provide flexibility with payment schedules, free trial periods, and the option to use promotion codes. Insurance billing systems should also adapt to freemium or premium models, like popular apps, where basic services can be free (supported by ads) or enhanced with extra features.From Standard Billing To Seasonal Billing

Insurers have traditionally been reluctant to offer seasonal insurance products or flexible coverage that allows customers to turn policies on and off. This hesitation is often due to concerns about inconsistent revenue and the risk that customers might not reactivate their policies after deactivation. However, many consumers prefer to pay only for the coverage they need during specific seasons when they’re actively using the insured property. To meet these evolving consumer demands, billing and payment solutions must be designed for adaptability and responsiveness. Insurers require the ability to pivot quickly in response to changing market conditions, emerging products, and shifting customer expectations. This flexibility is essential for encouraging innovation, and ensuring rapid responsiveness to new opportunities in the market.Success Story: Medical Claims Billing Transforms Through Integration

Medical Claims Billing offers comprehensive medical billing, claims management, consulting, and credentialing services, supporting around 40 clients across diverse medical specialties. However, when Bob Trotta acquired the company in 2015, he faced significant operational challenges.

Challenges:

The company struggled with inadequate reporting, inefficient manual processes, and a lack of integrated systems. Without a modern EHR or practice management system, staff faced difficulties understanding their daily responsibilities and managing client accounts. This disorganization hindered the company’s ability to establish accurate pricing models, making it hard to assess costs per client effectively.

Solutions:

To address these issues, Bob implemented Kareo’s integrated EHR and practice management system. The transition was easy, allowing for the quick migration of thousands of patient records via a simple .CSV upload. With Kareo’s extensive training resources, Bob ensured that clients received the support they needed to navigate the new system confidently.

This transition allowed the company to provide more than just medical billing services, improving their clients’ processes and overall efficiency.

What to look out for in an Insurance Billing software?

Insurance carriers now need to offer different payment plans and methods for quoting, binding, and managing policies. A billing software’s ability to handle commission payments is key to maintaining good relationships with agencies. As payment methods have changed, billing software have also evolved to include features like electronic bill presentment and payment (EBPP).

Do features in Property and Casualty (P&C), commercial, medical, and life billing insurance software differ from each other?

Slightly! The features mentioned below can vary depending on the type of insurance being managed. For instance, here’s an overview of features to look out for in P&C insurance billing software:

Billing Methods

Direct, account, and agency billing methods are considered traditional options, and most billing platforms/products support these methods. However, selecting a billing product should not be based solely on the carrier’s current offerings. It is advisable to choose a billing solution that provides multiple billing methods, particularly “Deductible Recovery,” which allows carriers to bill insured parties for claim deductibles in third-party claims. For insurance carriers with a significant volume of mortgagee-billed business, it is wise to inquire about mortgagee billing support in the RFP/RFI process.Moratorium/Deferred Billing/Zip Code Freeze

A moratorium refers to the temporary suspension of the invoicing and non-payment cancellation processes, typically enacted during disaster situations. Moratorium orders can be issued by state authorities and the NAIC. During the COVID-19 pandemic, many insurance carriers deferred billing due to the adverse impact on the job market and insureds’ ability to pay. Different billing software products manage moratoriums in varying ways, so having the capability to implement moratoriums at the zip code or county level is highly desirable for targeted support. Additionally, features like automatic moratorium lifts on pre-selected dates are beneficial. It’s crucial to understand the speed and processes a product offers for establishing a moratorium.Automated Non-Pay Cancellation/Non-Reporting Cancellation Process

Tracking accounts receivable balances, due dates, and issuing non-pay cancellation transactions can be labor-intensive and prone to errors. To maintain account equity, it is essential for carriers to monitor receivable balances closely. In the case of reporting policies like workers’ compensation, carriers must ensure payroll is reported according to the agreed schedule. Billing products that automate the non-pay and non-reporting cancellation processes not only help maintain account equity but also save time and reduce costs by minimizing manual efforts.Interfaces

An ideal billing system should function autonomously. Key interfaces to consider include:➤ Automated Non-Sufficient Funds (NSF) Transactions: A returned payment from the carrier’s financial institution can be costly, as most institutions charge fees for returned checks. Consequently, accounting teams must manually locate bad cash receipts in the system and process NSF transactions. Given that financial institutions typically provide a daily list of returned payments, managing NSFs can become labor-intensive. Billing products that automate NSF processing can save time and automatically assess NSF fees to the insured.

➤ Commission Disbursement Hold: Commission disputes with agencies are common. For direct bill policies, it is advantageous to have the ability to place a commission disbursement hold on specific policies or all policies within an account.

➤ Automated Match of Suspense Payments: Accepting cash from insureds as a down payment or deposit before binding a policy is a common business scenario. In cases of new business or rollovers, the policy or account number is often unknown at the time of quoting or binding. Payments posted to the billing system without a known policy number typically hit a suspense account, requiring billing users to spend hours identifying the appropriate policies for these suspense payments. An automated matching capability that aligns payments with interfaced policies can significantly save time and enhance user productivity, as having unallocated cash in suspense accounts is undesirable.

➤ Configurable Cash Allocation Rules: Insurers should consider whether their chosen billing product provides configurable cash allocation rules based on receivable type and line of business.

➤ Configurable Billing Fees: Billing fees encompass various receivables generated by billing systems, including installment fees, late fees, reinstatement fees, and NSF fees. These fees contribute to revenue generation for insurers and should be configurable by state and writing company.

➤ Automated Collection Process and Automated Write-offs: Many insurers have internal and external collection processes. When a policy is canceled or expires with an unpaid balance, insurers typically send collection letters at regular intervals, depending on the balance threshold. Manual letter sending is time-consuming and may lead to legal issues if one insured receives different treatment than another. The external collection process involves providing information on policy balances for accounts that still have outstanding balances after internal collection efforts. Automating the collection and write-off processes can significantly reduce manual efforts and improve overall process efficiency.

Best Insurance Billing Software Solutions for the Insurance Industry

When selecting insurance billing software, it’s essential to consider the size of your organization to ensure the solution meets your specific needs. The best insurance billing software solutions are consolidated based on company size—small, medium, and large enterprises. Small businesses benefit from user-friendly and cost-effective options, while medium-sized companies can leverage more robust features for increased transaction volumes. Large enterprises require comprehensive platforms with advanced functionalities to manage complex billing processes efficiently. This categorization helps in choosing the right solution tailored to each organization’s needs.Small and Medium-Sized Businesses

ePayPolicy

Key Features:

Centralized dashboard, real-time transaction tracking, recurring payments, batch processing, custom branding, API integrations.| Starting Price | Free Version | Free Trail |

|---|---|---|

| $25.00 starting | Available | Available |

Invoicera

Key Features:

Automated billing, client portals, recurring payments, GST/e-invoicing, compliance, expense management, and multilingual support| Starting Price | Free Version | Free Trail |

|---|---|---|

| $15.00 starting | Available | Available |

BriteCore

Key Features:

End-to-end policy administration, billing, claims handling, agent and policyholder portals, multi-line and multi-location support, cloud-native deployment.| Starting Price | Free Version | Free Trail |

|---|---|---|

| Pricing is available upon request | Not Available | Not Available |

Riskonnect RMIS

Key Features:

Automated billing, claims management, certificate tracking, compliance monitoring, risk assessments.| Starting Price | Free Version | Free Trail |

|---|---|---|

| Pricing is available upon request | Not Available | Not Available |

Insuresoft Diamond Billing

Check out the video on how Splice Software improved customer communications with Diamond!

Key Features:

Real-time payment adjustments, customizable pay plans, automated cancellations/reinstatements, mobile/web payment options.| Starting Price | Free Version | Free Trail |

|---|---|---|

| Pricing is available upon request | Not Available | Not Available |

FINEOS Claims

Key Features:

Claims management, rehabilitation planning, API integration, ACORD compliance, HIPAA compliance.| Starting Price | Free Version | Free Trail |

|---|---|---|

| Pricing is available upon request | Not Available | Not Available |

Large Scale Businesses

Applied Epic

Key Features:

Policy administration, claims handling, insurer connectivity, CRM integration, document organization, market quoting.| Starting Price | Free Version | Free Trail |

|---|---|---|

| Starts from $1000 | Not Available | Not Available |

Insurity Billing

Key Features:

Scalable cloud-first platform, automated workflows, multi-line support, billing automation, commission calculations, regulatory reporting. Creek Technologies| Starting Price | Free Version | Free Trail |

|---|---|---|

| Pricing is available upon request. | Not Available | Not Available |

Duck Creek Billing

Duck Creek Billing is an all-encompassing insurance billing solution designed to optimize workflows, improve the customer experience, and strengthen financial management. The software automates critical tasks such as invoicing, premium collection, and payment processing, while offering adaptable billing options and configurations tailored to specific needs. With the integration of Duck Creek Clarity, users gain real-time access to vital financial insights, leading to better decision-making.

This solution enhances satisfaction among agents and brokers by providing customizable commission structures, maximizing receivables, and enabling easy setup through low-code tools and partner integrations. Duck Creek Billing facilitates modern insurance billing by incorporating features that simplify operations and enhance customer retention.

Supporting recurring payments through installment plans helps build customer trust and loyalty by maintaining a reliable payment schedule. To keep pace with digital transformation, the software includes a variety of electronic payment methods, with plans to integrate Payments Marketplace with Imburse in 2024 for increased flexibility.

Moreover, Duck Creek Billing simplifies cancellation and reinstatement processes through automated follow-up rules, ensuring customers remain informed and engaged throughout their journey. The platform also automates commission calculations and offers customizable plans for key producers, using incentives to elevate sales productivity and reinforce relationships with top producers.

Key Features:

Automated invoicing, commission management, recurring payments, low-code configuration, partner integrations, real-time financial data.

| Starting Price | Free Version | Free Trail |

|---|---|---|

| Pricing is available upon request. | Not Available | Not Available |

Fiserv

In addition to its insurance solutions, Fiserv (previously known as FirstData) specializes in payment processing for businesses managing online transactions. The platform is equipped with a suite of marketing tools that empower merchants to implement tailored loyalty programs, launch marketing initiatives, and provide discounts or rewards to enhance customer engagement. Furthermore, Fiserv emphasizes security with advanced fraud prevention features tailored for financial institutions. One of the standout features of Fiserv is its gift card functionality, which supports marketers in developing mobile gift card programs and tracking point balances while issuing store credits. This solution encompasses digital cards, receipt printing, purchase validation, promotional signage, eCommerce integration, and multiple payment methods. Additionally, businesses can accept payments through checks, smartphones, and ACH systems. Through analytics, Fiserv allows marketers to gain valuable insights into sales data, market trends, and customer spending habits. This data can be leveraged to improve customer interactions and optimize targeted marketing strategies. For pricing inquiries, interested parties are encouraged to contact Fiserv directly, with support available via phone, email, and online resources.Key Features:

Personalized billing, multiple payment options, multi-channel communication, risk management, regulatory compliance.| Starting Price | Free Version | Free Trail |

|---|---|---|

| Starts from $69 | Not Available | Not Available |